Reduce Contract Review Time 30 % with One Simple Question – Contract Value

Why do all lawyers first need to ask what the contract value is, before reviewing or red-lining a contract? When Legal receives a draft contract, their first task is to gather the facts they need to review, advise and negotiate effectively. That means asking questions – sometimes a lot of them. This is important for the liability limits, risk assessment and signing authority. Most common questions are regarding scope, background, term, governing law, counter-party risk and more. Yet one question towers above the rest:

“What is the total (or yearly) contract value?”

Example: A €30 000 software tool slides through with a few light tweaks by legal. A €3 million multi-year rollout for a software tool that involves lots of sensitive data? That triggers data privacy, cyber-insurance review, CFO approval and deeper due diligence. Same inbox, two very different paths – because of a single figure.

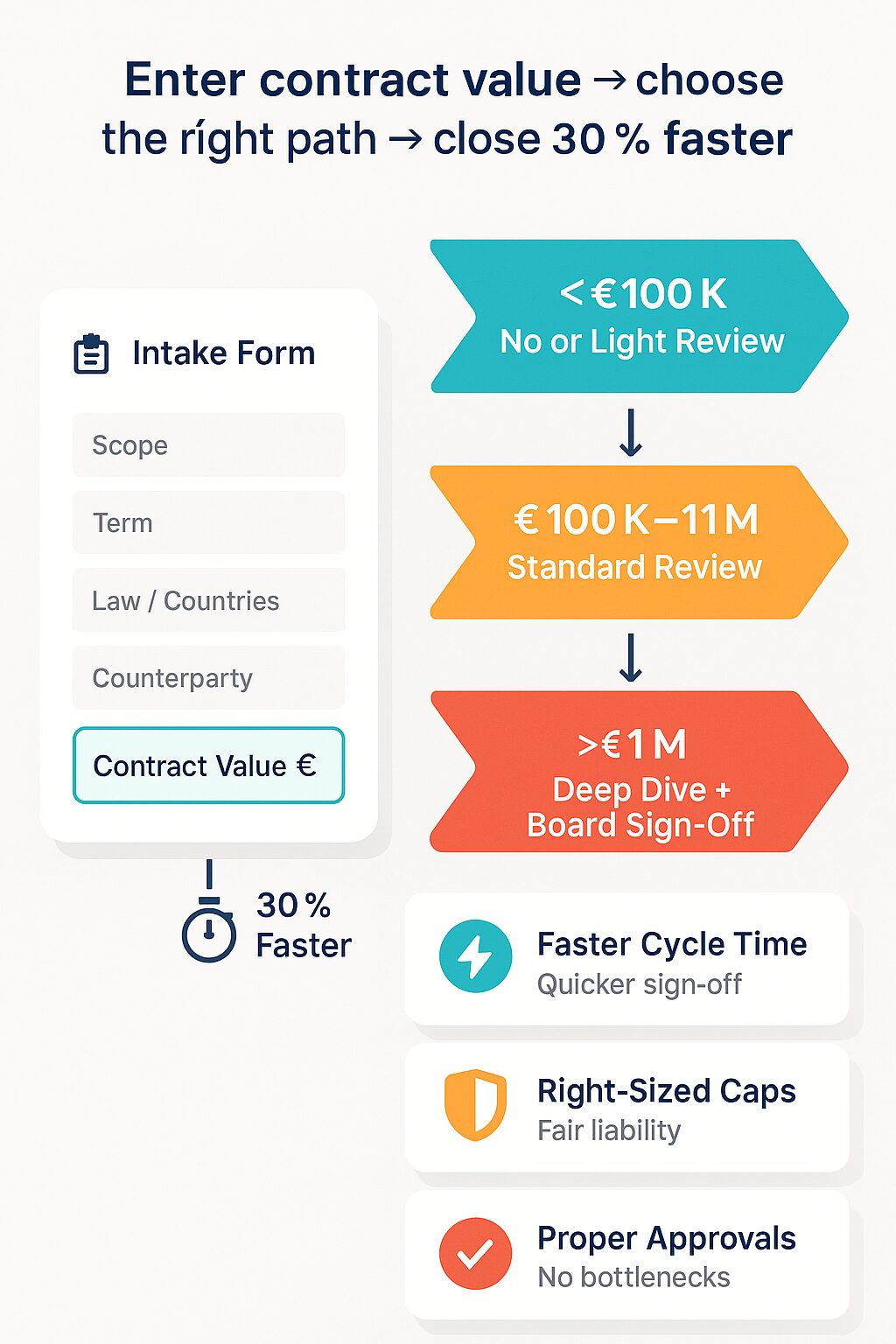

That number steers everything from the depth of due diligence to the height of liability caps and the level of internal approvals required. In organizations with mature legal teams and operations, the contract value is part of a triage system. This includes a short intake questionnaire, preferably delivered by legal-tech platforms, web-forms or templated e-mails. Once you have that information, that routes each contract to the right template, reviewer and approval chain within minutes. Sharing the value up front isn’t paperwork for paperwork’s sake; it’s the key that lets the legal team protect the business quickly, proportionately and cost-effectively.

What We Will Cover

- Background & importance—how contract value underpins every part of contract strategy.

- How to calculate contract value. Practical formulas for Sales, Procurement and Partnerships; the difference between total contract value (TCV) and Annual Contract Value (ACV).

- Ten concrete reasons lawyers insist on the figure before they mark up a clause.

- Explanation of terms used like contract value, annual contract value, total contract value and why it is linked to liability caps

- Process tip. How can you make contract value a standard field in your deal-intake form.

- Quick summary & next steps.

Background & Importance: Value Drives Risk

Legal review is risk management in writing. How forcefully you negotiate liability caps, payment security or exit rights depends on impact—financial, operational and reputational. Contract value (sometimes called deal worth) is the fastest, most objective proxy for that impact. Provide it late and every downstream decision is delayed.

Think of contract value as the master input cell at the top of a spreadsheet. Change the figure and every formula beneath—warranties, indemnities, insurance checks, delegated approvals—re-calculates instantly.

How to Calculate Contract Value

Because “value” means different things in Sales, Procurement and Channel Partnerships, align on a common formula before you fill in the intake form.

| Context | What the number should capture | Practical formula |

|---|---|---|

| Sales / Revenue contracts | All cash you expect to receive from the customer—set-up fees, recurring licence, usage charges, committed renewals, minimum guarantees. | Total Contract Value (TCV) = One-off fees + (Recurring fee × Committed term) Annual Contract Value (ACV) = TCV ÷ Term (years) |

| Procurement / Spend contracts | All cash your company will pay the supplier—tooling, minimum orders, variable unit pricing, support fees and committed renewals. | Total Spend = Up-front costs + (Estimated annual spend × Term) |

| Partnership & Reseller deals | The share of revenue or discount margin that will flow between the parties over the commitment period—including tiered rebates or volume incentives. | Channel Value = (Projected end-customer revenue × Margin or Rev-share %) × Term |

Total vs. Annual Contract Value. Why Both Matter

When negotiating contracts it is important to know the total contract value and the annual contract value. Next to signing authority relevance (who can sign until what amount), it is also crucial to know for team involvement & liability discussions. In case of smaller contracts, you only need to involve a smaller team with less specialists, for larger deals more specialists need to be involved. Additionally, the limit of liability can be linked to either the total and/or the annual value of the contract. It is used by legal in commercial contracting discussions to agree on a limit of liability.

- Total contract value (TCV) answers: “What is the maximum euro exposure over the life of the deal?” Lawyers plug this into liability-cap formulas, insurance checks and worst-case damage models.

- Annual Contract Value (ACV) normalises multi-year deals to a single-year figure. Many caps and service-credit schedules reference “one year’s fees,” so ACV keeps negotiations apples-to-apples regardless of term length.

Pro tip: For evergreen (auto-renew) contracts, calculate TCV and ACV on the first committed term.

Calculation Examples

| Scenario | Calculation | Result |

|---|---|---|

| SaaS sale: €20 000 set-up + €5 000 / month, 3-year term | TCV = 20 000 + (5 000 × 36) | €200 000 ACV ≈ €66 667 |

| Procurement: €30 000 tooling + €150 000 / year, 4 years | Total Spend = 30 000 + (150 000 × 4) | €630 000 |

| Reseller: €2 m revenue / year, 15 % margin, 2 years | Channel Value = (2 000 000 × 0.15) × 2 | €600 000 |

Include realistic high-end estimates of usage fees—liability caps track exposure. Exclude VAT/sales tax; legal risk follows net commercial value.

Ten Reasons Lawyers Need Contract Value Up Front

See below a list of 10 reason why lawyers should always ask the contract value of a contract. From lawyers, inhouse legal counsel to paralegals, Legal should always know the spend or potential income of a contract before starting work on a contract. How else is Legal able to advise someone on a contract?

I have made this mistake and started with a deep dive of a contract, providing the sales team with detailed contract advice. I thought they would be satisfied, but because it was only a 20K contract the advice was not fit for purpose.

Therefore, before you start advising as Legal, ask: “What’s the annual contract value of this contract”.

As someone sending a contract to Legal, add: “The estimated annual contract value of this contract is XYZ EUR. Potentially add: We are not sure of this value, but this is the best estimate I can provide you at this moment.”

1 – Level of Legal Review (Scrutiny)

This is one of the most important reasons to know the contract value. How important is the contract for the company?

A €50 000 Master Services Agreement doesn’t need a four-week deep dive; a €20 million strategic partnership does. Contract value tells lawyers how deep to dig, which template to use and how many specialists to involve.

2 – Indemnities & Liability Caps

As one of the most negotiated clauses, this directly ties into the contract value as liability limits / caps are directly linked thereto.

For example the liability is capped to one year of fees, 2× ACV, or a fixed sum aligned to insurance. Without total contract value, caps are guesswork that stall negotiations or leave catastrophic exposure.

3 – Understand the Risks

Large deals carry reputational and operational weight. Counsel tightens disaster-recovery clauses and escalation paths as contract value climbs. Although not only monetary, the risk is often linked to value – next to data shared, confidentiality, alternatives, etc.

4 – Insurance Cover Check

If worst-case damages exceed policy ceilings, buy a rider, refine the clause or walk away—decisions impossible until you disclose the value.

5 – Guide Flexibility & Concessions

Strategic, high-value deals may warrant bespoke SLAs; low-margin work demands firm standard terms. Value is the compass.

6 – Signal Internal Priority 🚦

Delegated-authority matrices hinge on value. Legal routes the document to a finance manager, CFO or board only when it knows the amount.

7 – Spot Regulatory Thresholds

Public-procurement rules, export licences and merger filings often hinge on deal size. Early flagging preserves timelines.

8 – Secure Payment

Escrow, guarantees, milestone invoicing – each tool costs money. Lawyers select the lightest mechanism that still protects cash flow, guided by contract value.

9 – Termination or Exit Provisions

If a contract feeds 35 % of revenue, sudden termination is existential. Notice periods and break fees scale with value concentration.

10 – Tax & Accounting Impact

Revenue recognition, VAT and transfer pricing ride on deal size. Early disclosure lets finance book correctly and brief auditors – often linked to item 3 above (liability caps).

Make Contract Value a Standard Triage Field

A deal-intake questionnaire that captures both total contract value and ACV should be the first gate in every commercial workflow.

Why do Contract Intake Forms Work?

Feed it to Legal, Finance and Risk and you unlock:

- Faster template selection

- Accurate legal-budget scoping

- Early insurance checks

- Automatic routing to approvers

AMST Legal has rolled out many triage dashboards / questionnaires that cut cycle times by up to 40 %. Next to setting up an internal legal page with all legal resources this is the easiest step to improve contract negotiation speed.

Summary: One Number, Ten Advantages

Quite often, when we ask for the value of the contract, we receive a negative reaction. Why does legal need to know the value, fees incurred or profit of the contract? receive the answe Contract value is not a nosy question. It is the master key that unlocks:

- Right-sized legal review

- Proportionate liability caps & indemnities

- Adequate insurance cover

- Clear view of risks and commercial stakes

- Smart negotiation concessions

- Proper internal approvals

- Timely regulatory filings

- Robust payment security

- Balanced exit rights

- Accurate tax & accounting treatment

Share it on day one and your contracts close faster, safer and with fewer surprises.

Next time your legal advisor asks this question, say “glad you asked”, not “why do you ask?”.

Contract Value, Signing Authority and E-Signature Policy Explained

In commercial contracting, many negotiations slow down because teams use different terminology for the same financial reality. Sales talks about deal size, Finance looks at revenue impact, and Legal asks for TCV, ACV or exposure. Without shared definitions, liability discussions become inconsistent and internal approvals stall.

The terms below create a common commercial language. Understanding them helps you negotiate liability caps more effectively, route contracts correctly under your Signing Authority Matrix, and ensure your e-signature process aligns with internal governance.

What Is Contract Value?

Contract Value is the total monetary consideration payable or receivable under a contract during its committed term, excluding VAT or sales tax.

It represents the financial size of the deal and is the primary input for legal review depth, risk assessment and approval routing.

What Is Total Contract Value (TCV)?

Total Contract Value (TCV) is the aggregate amount payable or receivable over the full committed term of the agreement, including fixed and contractually committed recurring fees.

TCV reflects the maximum agreed commercial exposure during the term and is commonly used to size liability caps and approval thresholds.

What Is Annual Contract Value (ACV)?

Annual Contract Value (ACV) is the yearly portion of the contract value, calculated by dividing TCV by the number of committed years.

ACV is particularly relevant where clauses refer to “one year of fees,” such as in limitation of liability or service credit provisions.

How Contract Value Impacts Liability Caps

A Liability Cap is the agreed contractual limit on one party’s financial liability.

Liability caps are often structured as:

- A multiple of ACV

- A percentage of TCV

- A fixed monetary amount

Without knowing the contract value, it is impossible to assess whether the liability cap is proportionate to the commercial risk.

What Is a Signing Authority Matrix?

A Signing Authority Matrix defines who within an organization is authorized to approve or sign contracts at specific monetary thresholds.

Contract value determines:

- Whether business-level approval is sufficient

- Whether CFO or board sign-off is required

- Whether additional governance steps apply

The matrix ensures that only properly authorized individuals legally bind the organization.

What Is an E-Signature Policy?

An E-Signature Policy sets the rules for how contracts are executed electronically and how digital signatures are validated and stored.

Even when using electronic signatures, signing authority must align with the thresholds defined in the Signing Authority Matrix. An electronic signature does not replace proper delegated authority.

What Is Contract Exposure?

Contract Exposure refers to the maximum financial and legal risk arising from a contract, including liability caps, indemnities, termination payments and potential regulatory penalties.

Exposure may exceed the pure contract price where liabilities are uncapped (for example, in data protection or intellectual property infringement scenarios).

What Is a Materiality Threshold?

A Materiality Threshold is the internal monetary level at which enhanced governance, executive approval or reporting obligations are triggered.

Materiality thresholds are typically linked to contract value and embedded in internal approval workflows.

Next Steps

- Process audit – map your current intake and spot bottlenecks.

- Triage implementation – build a questionnaire that captures contract value, term length and risk flags.

- Template tuning – align clause libraries to value bands so protections scale automatically.

- Training & change management – explain why value matters, boosting adoption across Sales, Procurement and Finance.

Ready to build a smoother bridge between Commercial and Legal? Contact AMST Legal for a free initial consultationand never lose time guessing at contract value again.

Latest Posts

E-Signature Policy and Signing Authority Matrix: Why is That Important?

Where is the fully signed contract? Why can an e-signature policy and signing authority matrix help with that? Here is a question worth asking in your...

Wat is een paralegal (en waarom zijn ze onmisbaar)?

Wat doet een paralegal precies? En waarin verschilt een paralegal van een advocaat of juridisch adviseur? Dat is een praktische keuze die direct impact...