E-Signature Policy and Signing Authority Matrix: Why is That Important?

Where is the fully signed contract? Why can an e-signature policy and signing authority matrix help with that? Here is a question worth asking in your next team meeting. If someone asked you right now to find a specific signed contract within 60 seconds, could you do it? Most organizations hesitate. Not because the contract does not exist, but because nobody built a proper e-signature policy or signing authority matrix to manage where contracts go after they are signed.

The signed contract is often lost document is somewhere between an inbox, a shared drive, a personal folder, and possibly the laptop of someone who left the company six months ago.

This is not a hypothetical. As someone who has served as head of legal and interim General Counsel for a wide range of businesses across tech, IT, and software sectors, I see this situation repeatedly. It is one of those operational problems legal teams rarely prioritize, which is why it keeps happening. However, when contracts cannot be retrieved, enforced, or audited, the business consequences become serious: disputes, legal question delays, missed renewal windows and failed due diligence processes. Therefore, this is not just legal housekeeping. It is a commercial governance issue. This is why we wrote this article ‘E-Signature Policy and Signing Authority Matrix: Why is That Important?’.

What You Will Learn in This Article

- Key terms for signature processes in companies (e.g. e-signature policy, signing authority matrix & CLM)

- Why the absence of an e-signature policy creates real legal and operational risk

- How legal, finance, IT and commercial teams each play a role in signing procedures

- Practical examples across SaaS, procurement, and founder-led businesses

- How to build a process that works at scale

Key Terms

Before discussing why contract execution often breaks down, it is useful to clarify the terminology. Many organizations use these terms interchangeably. They are not the same. Most professionals have heard of these terms, but we notice that there is need for clarity. It is difficult to explain why policies or signing overviews are needed. Also terms related to Legal Tech or AI need explanation, especially in practice.

What Is an E-Signature Policy?

An e-signature policy is a documented internal framework that defines how your organization executes contracts digitally. Having the policy is step one. Making sure people actually know it exists, understand it, and use it correctly is where most organizations fall short.

In our experience, a single onboarding workshop is rarely enough. Processes change, teams grow, and people forget. What actually works is building awareness into the rhythm of the business. This means providing short, recurring training sessions, and making it a habit for legal to show up in commercial and management meetings, not just when something goes wrong.

Those regular touchpoints with the business are the right moment to explain which policies matter, where to find them, and what the practical rules are for day-to-day signing decisions. When legal becomes a regular voice in those conversations rather than a last resort, the policy stops being a document that lives in a shared drive and starts being something the business actually uses.

The e-signature policy sets out:

- Which electronic signature tools are approved

- Who is authorized to sign on behalf of the company

- Where fully executed agreements must be stored

- How audit trails are preserved

In other words, an e-signature policy governs the process around signing — not just the technology used. Without it, digital signing becomes informal delegation rather than structured corporate authority.

What Is a Signing Authority Matrix?

A signing authority matrix is the internal document that specifies who may legally bind the company, for which types of contracts, and up to which financial thresholds. It is also referred to as a delegation of authority (DoA) matrix, authorized signatory list, signatory authority policy.

The terminology varies, but the purpose is the same. Here is how the terms tend to be used in practice:

- Delegation of Authority (DoA) Matrix. the term used most often in larger corporates and board-level governance. Covers both the named individuals and the full threshold and category structure.

- Authorized Signatory List: common in banking, finance, and regulated industries. More focused on who can sign.

- Signatory Authority Policy: used often in legal operations contexts. Slightly broader: covers both the named signatories and the rules around escalation and approval.

Whatever your organization calls it, the document needs to exist, be legally grounded and aligned with your articles of association and any powers of attorney in place. Above all, it also needs to be accessible to the people who use it day to day.

For example, a sales director may be authorized to sign customer agreements up to a defined contract value. For larger commitments, approval or signature is required from the CFO or CEO. The matrix should align with the company’s articles of association, commercial register extract, and any powers of attorney issued to individual signatories.

Without a documented signing authority matrix, organizations rely on assumptions about seniority rather than verified corporate authority.

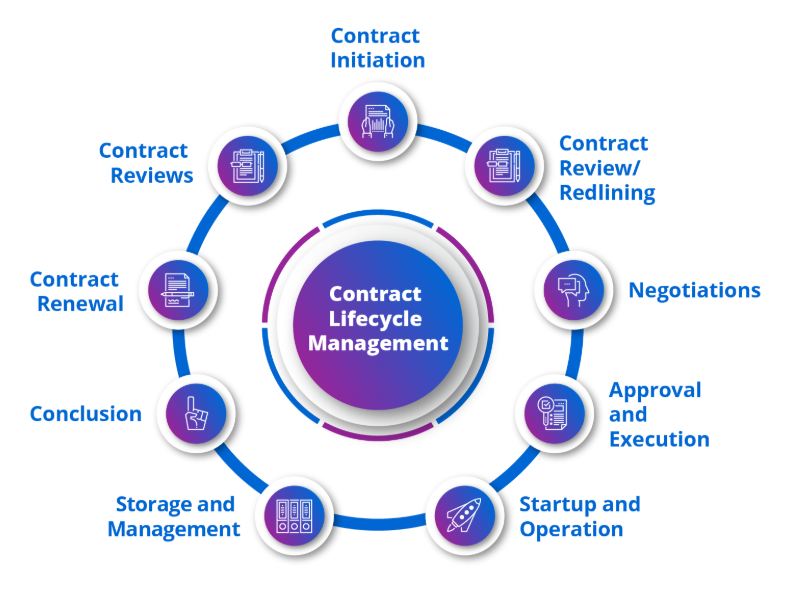

What Is Contract Lifecycle Management (CLM)?

Contract lifecycle management (CLM) is both a process and a category of software. It covers the full journey of a contract. From drafting and approvals, through signing and execution, to storage, reporting, and renewal. Modern CLM platforms centralize records, automate workflows and give legal, finance and procurement real-time visibility into what has been signed and what is coming up. This is where legal technology and AI are making a genuine operational difference. Think AI-assisted contract review to smart renewal alerts and risk flagging.

When selecting a CLM tool, think beyond features. First start with the problem you want to solve. Additionally, consider compatibility with your existing systems. This means your CRM, ERP and e-signature software – and whether the platform is built to work with legal tech and AI tools as they continue to develop. A CLM that sits in isolation creates a new silo rather than solving the old ones.

Regardless of which tool you choose: CLM supports structure. It does not replace it.

What Is Electronic Signature Software?

Electronic signature software, such as DocuSign or Adobe Acrobat Sign, allows parties to sign agreements digitally with audit trails and authentication features. In practice we see that Docusign is used the most to sign a contract digitally. However, as an easy signing possibility has been added to Adobe (pdf viewer) we now see that many people are thinking of integrating this in Adobe. The conversation typically goes like this: “The thinking is: “If I am already in Adobe to review a contract and I agree to it, I might as well sign it now. Why would I need extra software for that?”

These tools are legally recognized in many jurisdictions under frameworks such as the EU eIDAS Regulation and the US ESIGN Act. However, legal validity depends on proper use, reliable audit trails, and authorized signatories.

Using signature software without an e-signature policy is comparable to giving employees access to a company stamp without rules on who may use it.

What Is the EU eIDAS Regulation and Why Does It Matter for Your Contracts?

The eIDAS Regulation is short for ‘Electronic Identification, Authentication and Trust Services’. It is the European Union’s legal framework that governs how electronic signatures are recognized and accepted across EU member states. The eIDAS establishes three tiers of electronic signature:

- a standard electronic signature,

- an advanced electronic signature, and

- a qualified electronic signature,

Each tier carries a different level of legal weight and technical requirement. For most commercial contracts, a standard or advanced e-signature through a recognized tool is sufficient. However, for higher-value or higher-risk agreements — and in certain regulated industries — a qualified electronic signature may be required to ensure full legal enforceability.

What eIDAS makes clear is that the tool you use and the audit trail it generates are not administrative details. The software tools are the foundation of whether your signed agreement holds up legally. Therefore, when your e-signature policy defines which tools are approved, it should also verify that those tools meet the eIDAS requirements relevant to your contract types and jurisdictions. For a full overview of the regulation and its current status, the European Commission publishes up-to-date guidance directly on their eIDAS regulation page.

Why This Problem Is More Common Than You Think

The Operational Gap Most Legal Teams Overlook

We explained above what an e-signature policy is. It is a standardized framework that defines:

- which tools your organization is authorized to use for signing,

- who holds the authority to sign on behalf of the company, and

- where executed agreements must be stored. It sounds basic.

In practice, it is one of the most underdeveloped processes in mid-sized and growing businesses.

Part of the reason is cultural. Legal teams focus on substance. This means negotiation, risk allocation, and commercial terms. However, what happens after signature often falls through the cracks. Moreover, when a business scales quickly, informal habits that worked at ten employees no longer work at fifty or two hundred. Someone uses a personal DocuSign account. Another person stores the PDF in a private folder. A third sends the final version by email and never archives it. Eventually, nobody knows which version is final or where it sits.

There is also a legal dimension. Electronic signatures are legally recognized in many jurisdictions, including under the EU eIDAS Regulation, the US ESIGN Act, and the UK Electronic Communications Act. However, enforceability depends on using recognized tools, maintaining audit trails, and demonstrating that the signer had authority to bind the company. Without a defined e-signature policy, that evidentiary trail weakens.

The Practical Challenges When This Is Not Addressed

When organizations operate without an e-signature policy or signing authority matrix, predictable issues emerge. Contracts become inaccessible when employees leave. Internal confusion arises about who is authorized to bind the company. Signed agreements scatter across multiple storage locations. Finance cannot confirm whether agreements are fully executed. Procurement struggles to verify supplier obligations.

Consequently, problems surface at the worst possible time — during disputes, fundraising rounds, audits, or acquisitions. At that point, reconstructing events or requesting copies from counterparties is not just inconvenient. It damages credibility and can materially affect negotiations or valuation.

The Opportunity When This Is Handled Well

A well-designed e-signature policy and signing authority matrix creates operational clarity across the organization. Sales closes faster because signing authority is pre-defined. Finance invoices immediately because execution triggers are clear. Procurement retrieves agreements instantly. Legal stops chasing PDFs and instead focuses on risk management and strategy.

During due diligence, a centralized and traceable contract archive becomes a competitive advantage. Investors and acquirers assess governance maturity. Clean execution processes signal control and professionalism.

How an E-Signature Policy Fits Into Your Broader Contract Framework

The Three Core Elements You Must Define

A robust e-signature policy rests on three interconnected decisions.

First, determine which signing tools are approved. Limit usage to one or two authorized platforms. Personal accounts are not acceptable substitutes. IT and security teams should validate compliance with data protection and access standards.

Second, define who can sign what. This is where the signing authority matrix becomes essential. A signing authority matrix maps signing rights by role, contract category, and financial threshold. For example, a sales director may sign customer contracts up to a defined value, while higher-value agreements require executive approval. This means that signing is required from the CEO, CFO or CMO.

Third, establish a single central repository for executed agreements. Whether you use a CLM tool or structured document management system, the rule must be clear: if it is not in the repository, it is not operationally valid.

The Legal Foundation: Corporate Authority and Powers of Attorney

Before implementing a signing authority matrix, legal must confirm the underlying corporate authority. This may involve reviewing articles of association, shareholder agreements, or issuing powers of attorney. The objective is straightforward: ensure the person signing legally binds the company.

In certain jurisdictions, signing without proper authority can render agreements unenforceable or expose individuals personally. Therefore, legal must design the authority framework carefully. However, once established, day-to-day execution should not depend on legal approval for every transaction.

Enabling the Business Without Creating Bottlenecks

Routing all contracts through legal creates friction. While oversight matters, operational ownership belongs with Sales Operations and procurement-linked operations. Legal builds the framework. Operations runs the workflow.

This separation reduces bottlenecks while maintaining governance. Paralegals or fractional legal support can train teams and maintain documentation. Meanwhile, the approved e-signature policy ensures consistency.

Practical Examples and Use Cases

Large Corporate: The CLM Was Live, But Governance Was Weak

A listed company approached us because procurement teams were frustrated with their CLM system. Leadership believed the investment had solved their contract issues. It had not.

They had implemented a contract lifecycle management (CLM) platform, but team capacity had decreased, onboarding was inconsistent, and storage rules were unclear. Some agreements were uploaded incorrectly. Others remained outside the system. Legacy contracts pre-dating the CLM were scattered across inboxes and shared drives.

There was also no practical signing authority matrix that procurement staff could confidently rely on. As a result, they escalated routine matters to legal or made assumptions about authority.

We focused on process, training, and clarity. We defined storage standards inside the CLM, documented signing thresholds, clarified ownership between legal and procurement operations, and ran structured workshops. The software remained the same. Governance improved significantly.

Mid-Size SaaS: Multiple Templates, Unclear Authority

In a mid-size SaaS business, sales teams used separate templates per country. That structure appeared sophisticated. However, when a dispute required access to executed agreements, retrieving signed contracts proved difficult.

Contracts were stored in inboxes, CRM systems, and local folders rather than in a structured contract lifecycle management (CLM) environment. Version control differed by country template, and no one could immediately confirm which version had been executed.

At the same time, several commercial team members had been signing agreements without alignment to a documented signing authority matrix or properly issued powers of attorney. Authority in practice did not fully reflect corporate documentation.

This created enforceability exposure and due diligence risk.

We streamlined templates, aligned signing authority with corporate records, formalized the signing authority matrix, and centralized executed agreements into one repository. Legal defined the framework. Sales Operations owned execution.

SaaS Scale-Up: Aligning Signing with Corporate Documentation

A fast-growing SaaS scale-up needed to professionalize contract execution under increasing investor scrutiny. The articles of association and commercial register extract defined who could bind the company. Operational practice did not fully match.

Certain team members were signing contracts without formal delegation through powers of attorney. That disconnect matters. Signing authority must mirror what corporate documentation allows.

We aligned operational signing practices with the articles of association, formalized required powers of attorney, introduced a structured e-signature policy, and implemented a signing authority matrix consistent with corporate records. We also centralized priority agreements into a CLM-supported repository.

Within months, the COO retrieved a signed enterprise agreement during a board meeting in under thirty seconds. Authority, governance, and operations were finally aligned.

The Business and Legal Benefits of Getting This Right

Business Impact: Speed and Operational Clarity

Defined processes shorten sales cycles and accelerate invoicing. Teams spend less time searching for documents and more time executing strategy. Operational discipline improves stakeholder confidence.

Counterparties notice professionalism. Consistency signals reliability in commercial relationships.

Legal Impact: Enforceability and Scalability

A documented e-signature policy and signing authority matrix reduce disputes about authority and execution. Procedural challenges become rare.

As companies expand internationally, the framework adapts to local requirements while preserving structure. Incoming legal professionals orient quickly because governance is documented.

Key Takeaways

- An e-signature policy must define approved tools, signing authority, and central storage.

- A signing authority matrix maps authority by role, category, and financial threshold.

- Legal establishes corporate authority; operations manages execution.

- Centralized storage with strict rules prevents retrieval failures.

- Proper governance accelerates sales, strengthens audits, and reduces dispute risk.

Conclusion

If you cannot retrieve a signed contract within 60 seconds, your governance framework needs improvement. The solution does not require complex software. It requires clear decisions, defined authority, and disciplined storage.

At AMST Legal, we support businesses in building practical e-signature policies and signing authority matrices that function in real commercial environments. We combine contract expertise with operational design to ensure processes scale with growth.

Visit amstlegal.com to learn more or book a consultation today or email info@amstlegal.com.

Author:

Robby Reggers, Founder of AMST Legal (amstlegal.com), recognized by Legal Geek as a LinkedIn Top Voice for contracting, negotiation and interim GC work. Robby is also featured in the Dutch LawFluencer list (nr. 30) and in a podcast with welegal.nl.

AMST Legal supports clients per contract/project or on an interim basis (set hours per week).

Wat is een paralegal (en waarom zijn ze onmisbaar)?

Wat doet een paralegal precies? En waarin verschilt een paralegal van een advocaat of juridisch adviseur? Dat is een praktische keuze die direct impact heeft op uw kosten, snelheid en interne legal, commerciële en finance workload. Of u nu een bedrijf runt, sales of procurement aanstuurt, of juridische zaken intern beheert is dit van belang. Begrijpen wat een paralegal doet (of niet doet), kan u tijd, structuur en besparingen opbrengen.

Toch kennen veel organisaties vooral één route: “we hebben een advocaat nodig voor dit juridisch werk”. Dit is niet altijd nodig. Er is een belangrijke rol die vaak wordt onderschat: de paralegal. Daarom horen we in de praktijk steeds dezelfde vragen terug: wat doet een paralegal precies? Welke taken mag een paralegal oppakken? Hoe verschilt dit van een advocaat? En wanneer is een paralegal eigenlijk de slimste keuze? In dit artikel leggen we dat helder uit, inclusief concrete voorbeelden, zodat u sneller de juiste beslissing kunt nemen.

Wat we zullen behandelen:

- Wat een paralegal is,

- De rol van paralegals in zakelijke en juridische activiteiten,

- Praktijkvoorbeelden van de voordelen van paralegale diensten voor zakelijke en juridische belanghebbenden,

- Veelvoorkomende uitdagingen wanneer bedrijven paralegale ondersteuning over het hoofd zien, en

- Waarom paralegals cruciaal zijn in moderne bedrijfsomgevingen.

Wat is een paralegal?

De rol van paralegals in zakelijke en juridische teams

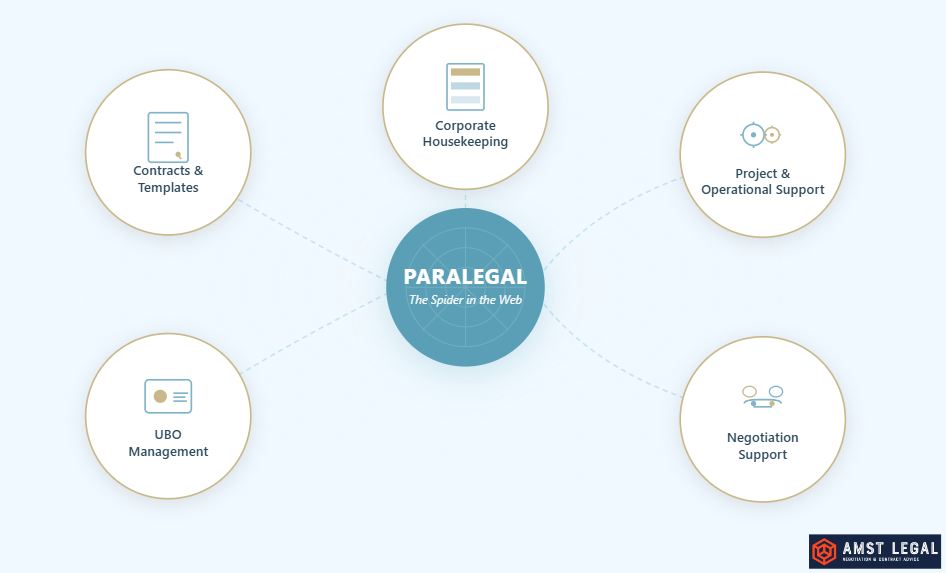

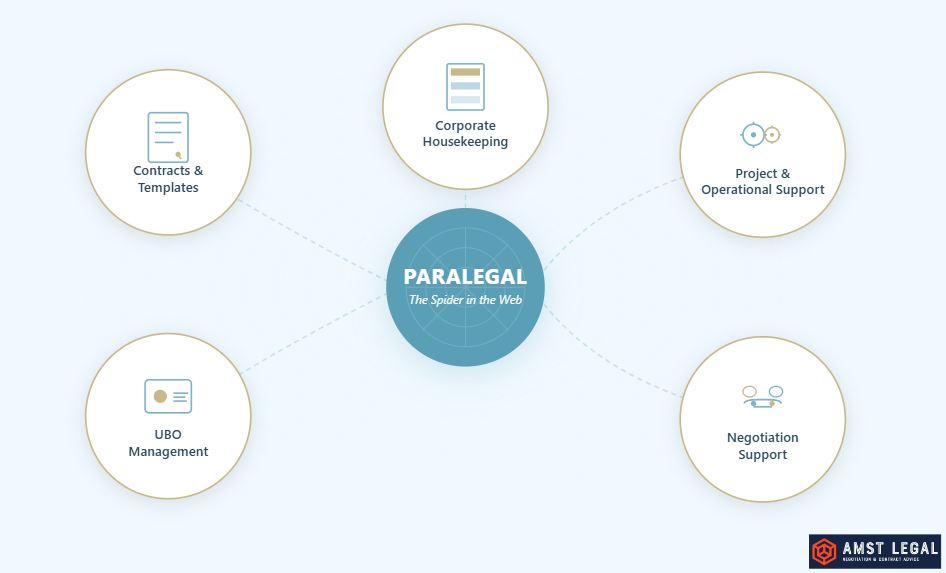

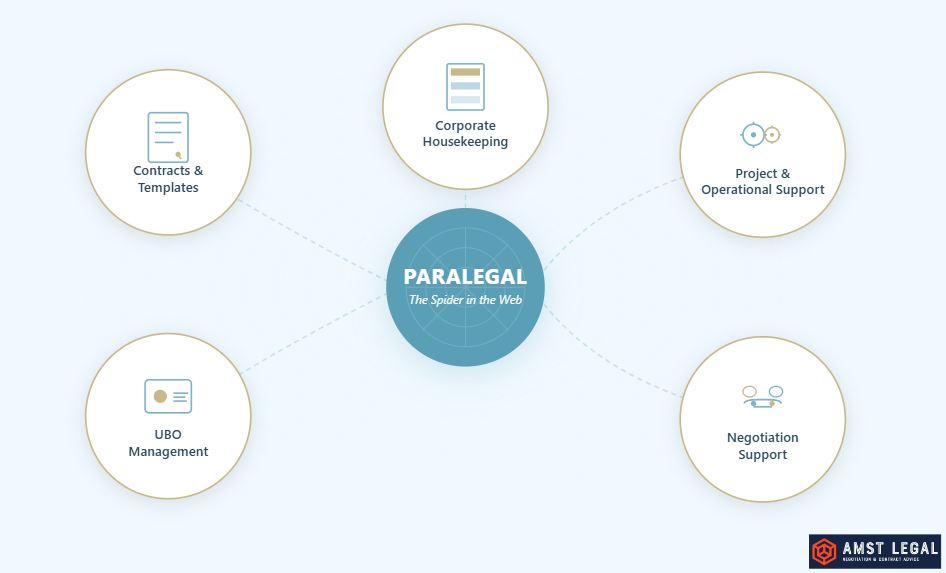

De eenvoudigste manier om uit te leggen wat een paralegal doet, is door te kijken naar de rollen die zij combineren. In de praktijk brengen paralegals vaardigheden samen van administratief medewerkers, junior en middenkader juridisch adviseurs en boekhoudkundig medewerkers. De verschillende rollen zijn als volgt.

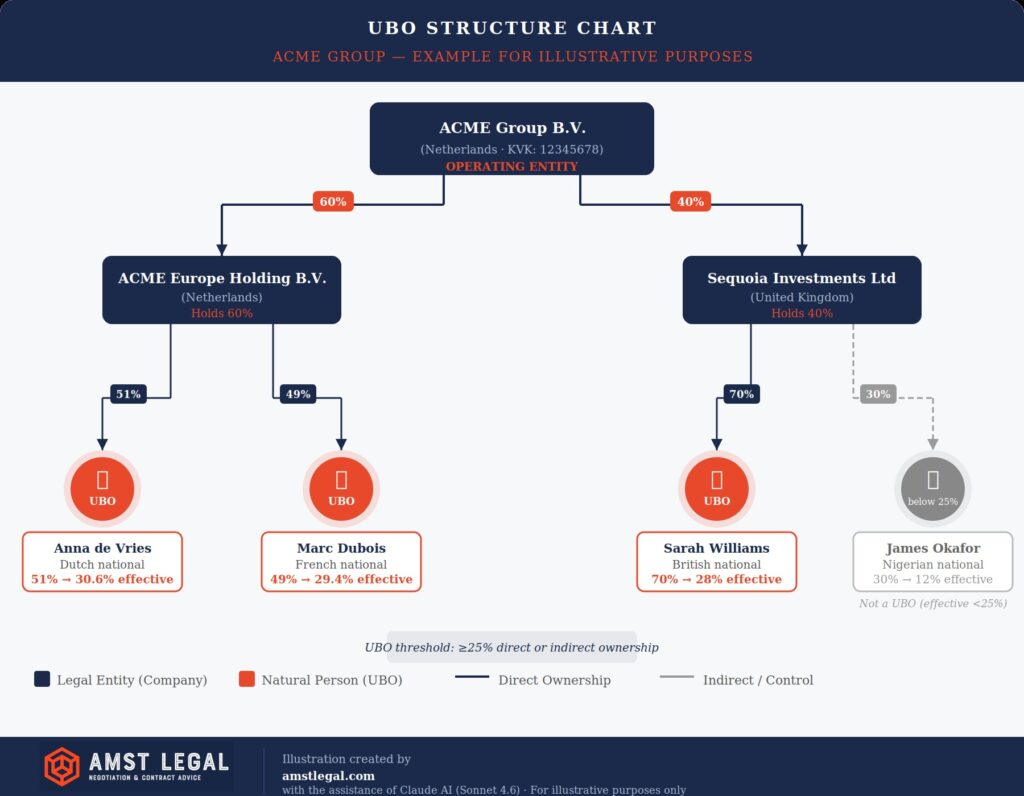

- Administratieve ondersteuning: Paralegals zorgen ervoor dat documenten en bedrijfsgegevens nauwkeurig en toegankelijk zijn. Hierbij gaat het om bedrijfsadministratie, volmachten en UBO-registraties. Zij vormen hierdoor een perfecte aanvulling op het juridische team en zijn verantwoordelijk voor het beheer en onderhoud van deze documenten. Voor meer informatie over UBO verwijzen wij naar ons artikel “Ultimate Beneficial Ownership (UBO) uitgelegd – Wat is het en hoe creëer je een proces dat werkt” hier.

- Juridisch secretaresse: Een juridisch secretaresse organiseert dossiers, stelt correspondentie en juridische documenten op, plant vergaderingen en coördineert archivering. Paralegals bouwen hierop voort met diepgaandere juridische kennis en meer autonomie.

- Junior juridisch adviseur: De rol omvat het opstellen en proeflezen van contracten, uitvoeren van juridisch onderzoek, uitrollen van sjablonen en signaleren van risico’s. Zo kan een junior juridisch adviseur vrijwel alle taken van het juridische team uitvoeren.

- Boekhoudkundig assistent: Paralegals ondersteunen financiële en compliance functies die raakvlakken hebben met juridisch werk, zoals het bijhouden van betalingsverplichtingen, bewaken van contractdeadlines, ondersteunen van boekhouding en beheren van compliance-taken die audits beïnvloeden.

De echte waarde van een paralegal ligt in hoe deze functies samenkomen. Paralegals zien zichzelf als de ‘spin in het web’, coördineren tussen afdelingen en zorgen voor structuur en efficiëntie. Zo vervullen zij een centrale rol in het verbinden van juridische, commerciële en financiële processen.

Paralegal diensten in Europa

In Europa zijn paralegal diensten buiten juridische kringen minder zichtbaar, maar hun belang neemt toe. Veel verschillende belanghebbenden kunnen profiteren van een paralegal in het team, wat we hieronder nader zullen toelichten. Hoewel zij een cruciale rol spelen, hebben wetgevers in Nederland en Zweden geen algemene definitie of gemeenschappelijke beschrijving van de rol vastgesteld. In het Verenigd Koninkrijk definieert de National Association of Licensed Paralegals (NALP) een paralegal echter als:

“Een persoon die is opgeleid en getraind om juridische taken uit te voeren, maar die geen gekwalificeerde advocaat of procureur is.”

De NALP definieert de rol van paralegals op een manier die ook past bij Nederland en Zweden, aangezien zij advocaten en juridisch adviseurs bijstaan bij juridische taken. De rol kan echter breder zijn dan dat en de meeste paralegals in Nederland en Zweden hebben een hogere opleiding genoten.

Zie de website van de NALP en verdere informatie hier.

Onderwijs in Nederland en Zweden

In de meeste Europese landen is ‘paralegal’ geen beschermde titel, wat betekent dat professionals via verschillende routes het vakgebied kunnen betreden. Toch hebben de meesten een juridische opleiding gevolgd die hen toerust voor functies bij bedrijven en advocatenkantoren.

In Nederland is het gebruikelijk om rechten te studeren op verschillende niveaus, van hogeschool tot universiteit. Elke route biedt verschillende niveaus van juridische kennis en praktische vaardigheden, maar alle kunnen leiden tot functies als juridisch medewerker. Zoals we bij veel bedrijven hebben gezien, zijn deze functies een uitstekende springplank om carrière te maken en door te groeien naar andere functies binnen het bedrijf.

In Zweden zijn veelvoorkomende trajecten onder meer beginnen als juristassistent na de middelbare school, een tweejarige hogere beroepsopleiding met stages volgen, of rechten studeren aan de universiteit en tegelijkertijd werkervaring opdoen.

Daardoor beschikken zowel Nederlandse als Zweedse paralegals over een combinatie van academische opleiding en praktische vaardigheden, waardoor ze flexibel inzetbaar zijn voor verkoopteams, inkoopmanagers en bedrijfsjuristen.

Paralegal-diensten in de VS

In de VS is ‘paralegal’ een bekend beroep en wordt er sinds eind jaren zestig, toen ze werden erkend door de American Bar Association (ABA), een formele opleiding gegeven. De huidige definitie van een paralegal volgens de ABA luidt als volgt:

“Een paralegal is een persoon die door opleiding, training of werkervaring gekwalificeerd is en in dienst is van of wordt ingehuurd door een advocaat, advocatenkantoor, bedrijf, overheidsinstantie of andere entiteit en diespecifiek gedelegeerde inhoudelijke juridische werkzaamheden verricht waarvoor een advocaat verantwoordelijk is”.

Zie de website van de ABA hier en meer informatie over de historische achtergrond hier.

Met andere woorden, een paralegal in de VS houdt zich bezig met juridische zaken die door de verantwoordelijke advocaat zijn gedelegeerd. Hoewel er in de VS geen landelijke regelgeving bestaat, stelt Californië specifieke eisen aan paralegals.

Zie de website van de American Association for Paralegal Education hier en de website van de National Federation of Paralegal Associations hier voor meer informatie.

Wat paralegals bijdragen aan zakelijke en juridische teams

Waarom paralegals essentieel zijn

Paralegals bieden veel meer dan een administratief medewerker dankzij hun bachelordiploma in de rechten. Door gebruik te maken van paralegalservices krijgt u gestructureerde juridische ondersteuning, waarmee de kloof wordt overbrugd tussen routinematige documentatie en hoogwaardig juridisch werk. Daarom werken veel paralegals bij advocatenkantoren of in-house juridische teams.

Houd paralegals dus in gedachten wanneer u een advocaat of juridisch adviseur overweegt. Er zijn twee belangrijke redenen om dat te doen. Ten eerste vermindert het de juridische kosten, bijvoorbeeld door de paralegal uw adviseur te laten assisteren of voorbereidend werk uit te voeren dat geen advocaat vereist. Ten tweede stroomlijnt het gebruik van een paralegal processen zoals verkoop, inkoop en compliance. Hierdoor ontstaan mogelijkheden voor hogere inkomsten, terwijl u juridisch beschermd blijft.

Wat u kunt verwachten van paralegal diensten

Om een nog duidelijker beeld te krijgen van hoe paralegaldiensten kunnen bijdragen aan het dagelijkse werk van uw bedrijf of advocatenkantoor, gaan we dieper in op de details. Over het algemeen zijn de beperkingen van wat paralegals juridisch gezien kunnen doen vaag. Dit komt door het gebrek aan regelgeving. Natuurlijk zijn bepaalde taken uitsluitend voorbehouden aan advocaten. Dat betekent echter niet dat paralegals niet kunnen helpen bij het begin van een traject. Ook kunnen zij aan het einde een snelle controle uitvoeren. Kortom nemen zij doorgaans het tijdrovende voorbereidende werk uit handen van advocaten of juridisch adviseurs. De verantwoordelijkheden van paralegals omvatten daarbij een reeks documenten die aan de basis liggen van elk bedrijf.

Paralegale diensten worden uitgevoerd door opgeleide professionals die gedelegeerde juridische taken uitvoeren, zoals contracten onderhandelen en voorbereiden, compliance werkzaamheden en bijhouden en structureren van bedrijfsdocumentatie.

8 voorbeelden waar paralegals kunnen worden ingezet

Om een paar dingen te noemen die deel uitmaken van het werk van paralegals, omvat dit normaal gesproken:

- het maken van lijsten van bijvoorbeeld debiteuren en crediteuren, belanghebbenden, concurrenten enz.

- het structureren en proeflezen van contracten en documenten zoals bestelformulieren, geheimhoudingsverklaringen, volmachten, arbeidscontracten, algemene voorwaarden, routinematige leveranciers- of klantovereenkomsten enz.

- het voorbereiden, opstellen en archiveren van juridische en bedrijfsdocumenten (d.w.z. bedrijfsadministratie en UBO)

- het sorteren en beoordelen van bewijsmateriaal voor cliënten,

- het uitvoeren van juridisch onderzoek naar relevante onderwerpen,

- het opstellen van contract sjablonen en instructies en/of informatie voor cliënten,

- het uitrollen van nieuwe bestelformulieren, algemene voorwaarden, sjablonen en informatie naar cliënten,

- het assisteren bij compliance-kwesties (zoals gegevensprivacy, gegevensbescherming, handelscontrole, enz.).

Hoewel advocaten of juridisch adviseurs uiteindelijk natuurlijk een aantal van deze documenten moeten controleren, kunnen paralegals de eerste controle uitvoeren. Op die manier kunnen ze een brug slaan tussen de verschillende contractprocessen van een bedrijf. Tegelijkertijd zorgt dit voor structuur en kunnen advocaten of juridisch adviseurs zich concentreren op complexe kwesties. Dit biedt mogelijkheden en gestroomlijnde, maar toch kostenbesparende processen. Kortom, paralegals zijn een geweldige aanvulling voor juridische teams bij bedrijven van verschillende grootte.

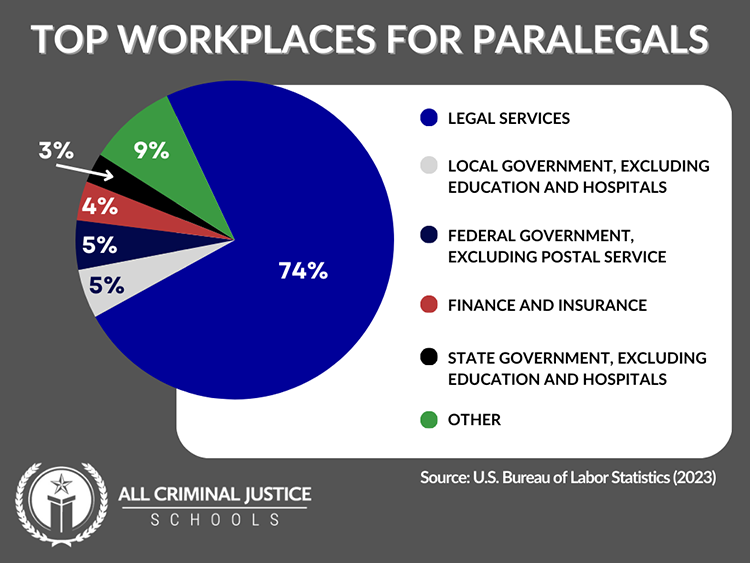

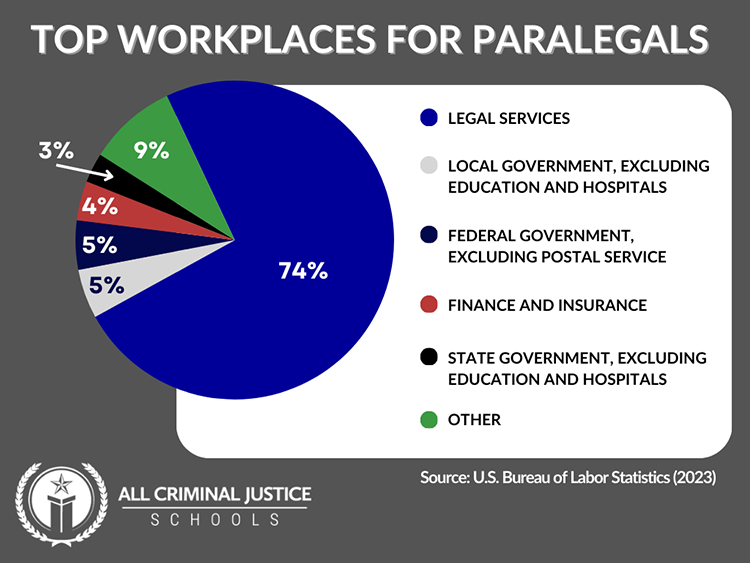

Voorbeelden van sectoren van (Amerikaanse) paralegals. Externe bron (zie link hier).

Voordelen van het inhuren van een paralegal

Praktische voordelen

We hebben besproken wat een paralegal is en voorbeelden gegeven van wat u van hun diensten kunt verwachten. Nu gaan we concreet aangeven hoe uw bedrijf of advocatenkantoor kan profiteren van het inhuren van zo’n juridisch professional. Om de verschillende voordelen te benadrukken, gaan we hierna dieper op deze punten in. Impact op het bedrijf: snelheid, duidelijkheid, kosten- en procesefficiëntie.

Bedrijven hebben vaak moeite om een evenwicht te vinden tussen commerciële snelheid en risicobeheer. Door gebruik te maken van paralegaldiensten en deze te integreren in de bedrijfsvoering, kan deze kloof worden overbrugd. Dit maakt snellere contractcycli mogelijk. Daarnaast zorgt het voor betere communicatie tussen afdelingen en lagere totale juridische kosten. Hierdoor hoeven verkoop- en inkoopteams niet langer te wachten tot routinematige juridische taken zijn uitgevoerd door een dure senior adviseur.

In plaats daarvan ontvangen zij tijdige en betaalbare ondersteuning van een paralegal. Zo blijft het bedrijf operationeel, zonder te bezuinigen op actuele juridische aspecten en compliance.

Enkele voorbeelden van voordelen in het bedrijfsleven

In het bedrijfsleven vermindert deze aanpak:

- gemiste nalevingsdeadlines die de financiering vertragen,

- vertragingen bij transacties die de verkoopcycli frustreren en

- inconsistente voorwaarden die het risico voor leveranciers vergroten.

Dit gestructureerde proces vermindert de kans op latere geschillen en stroomlijnt processen, aangezien voorwaarden consistent worden toegepast en correct worden gedocumenteerd. Juridisch adviseurs kunnen zich concentreren op complexe vragen, nieuwe mogelijkheden en gestroomlijnde, maar toch kostenbesparende processen.

Naast het inhuren van een paralegal kunnen bedrijven hun contractprocessen aanzienlijk vereenvoudigen door onze tips voor 10 manieren om uw contractprocessen te verbeteren toe te passen. Bekijk hieronder enkele van onze gepubliceerde artikelen over dit onderwerp:

- hier om te weten waarom u zich moet richten op het verbeteren van uw contractsjablonen,

- hier voor tips over het beheren van uw contractsjablonen,

- hier om de voordelen te zien van een sterke samenwerking tussen de juridische afdeling en andere afdelingen, en

- hier om te leren waarom het cruciaal is om uw juridisch adviseur leiding te laten geven aan het verbeteren van contractsjablonen.

Bovendien zijn de voordelen van paralegale diensten niet beperkt tot verbeterde bedrijfsprocessen en resultaten. Het is ook gunstig in termen van juridische impact en ondersteuning voor de verantwoordelijke juridisch adviseur. .

Juridische impact: verbeterde structuur, betere schaalbaarheid Vanuit juridisch oogpunt verminderen paralegale diensten allereerst de kans op fouten en geschillen, doordat zij zich richten op de details van documentatie en contracten. Daardoor blijven dossiers volledig en consistent, wat ervoor zorgt dat bedrijven met vertrouwen kunnen opschalen. Met name bij uitbreiding naar nieuwe markten of bijvoorbeeld tijdens de voorbereiding van een overname, leidt goed bijgehouden documentatie tot een lager risico. Tegelijkertijd positioneert het bedrijf zich als een professionele en betrouwbare partner. Bovendien kunnen juridische adviseurs zich focussen op complexe contracten, omdat zij worden ontlast van routinematig werk. Zo ontstaat een ideale basis voor juridische én zakelijke resultaten.

Image source: Forbes Outsourcing Paralegal Work: Why Remote Paralegals Are The Future Of Legal

Praktische uitdagingen bij het ontbreken van paralegale ondersteuning

Wanneer paralegale ondersteuning ontbreekt, worden bedrijven in de praktijk vaak geconfronteerd met vermijdbare knelpunten. Zo kan bijvoorbeeld de goedkeuring van contracten vertraging oplopen, omdat niemand de concepten structureert of deadlines bewaakt. Daarnaast kunnen bedrijfsaangelegenheden, zoals jaarlijkse aandeelhoudersbesluiten, eenvoudig over het hoofd worden gezien. Dit leidt vervolgens tot nalevingsrisico’s en onnodige vertragingen. In veel gevallen grijpen verkoopteams terug op verouderde sjablonen of brengen zij ad-hocwijzigingen aan. Hierdoor ontstaan inconsistenties en juridische kwetsbaarheden. Uiteindelijk verhoogt dit gebrek aan structuur de kosten op de lange termijn.

Kansen bij een goede aanpak

Daarentegen profiteren bedrijven aanzienlijk wanneer zij paralegale diensten structureel in hun workflow integreren. Niet alleen winnen zij aan snelheid, maar ook aan betrouwbaarheid. Hierdoor doorlopen contracten sneller de beoordelingscycli, aangezien steeds met de juiste versie wordt gewerkt. Daarnaast worden handtekeningen zorgvuldig bijgehouden en worden belangrijke voorwaarden uitsluitend gemarkeerd voor input van advocaten of bedrijfsjuristen wanneer dat nodig is. Bovendien blijven bedrijfsdocumenten actueel, waardoor audits, nalevingscontroles en verzoeken van investeerders direct kunnen worden afgehandeld.

Als resultaat ontstaat een soepelere samenwerking tussen zakelijke en juridische belanghebbenden. Zo weten inkoopmanagers dat de voorwaarden consistent zijn, en vertrouwen CFO’s erop dat de documenten in orde zijn. Tegelijkertijd krijgen oprichters het vertrouwen dat hun bedrijf juridisch voorbereid is op groei of omzetstijging.

Belangrijkste conclusies

- Paralegals bieden essentiële juridische ondersteuning die bedrijven van elke omvang tijd en kosten bespaart.

- Bedrijven zonder paralegal ondersteuning worden geconfronteerd met knelpunten, inconsistente contracten en compliance-risico’s.

- Door paralegal diensten te integreren met algemene juridische diensten ontstaan er soepelere processen voor verkoop-, inkoop- en juridische teams.

- Paralegal diensten zijn gunstig voor bedrijven in elke branche en voor advocatenkantoren.

- Bedrijven die investeren in paralegale ondersteuning winnen aan efficiëntie, duidelijkheid en juridische paraatheid voor groei en omzetstijging.

Conclusie en volgende stappen

Paralegale diensten zijn niet langer optioneel voor groeiende bedrijven. Allereerst bieden ze een praktische oplossing om kosten te verlagen, compliance te verbeteren en ervoor te zorgen dat contracten zonder vertraging door de pijpleiding lopen. Daarnaast vormen ze een geweldige investering om uw interne juridische adviseurs van de juiste ondersteuning te voorzien. Of uw bedrijf nu tech-deals sluit, relaties met leveranciers beheert of zich voorbereidt op een investering, blijven paralegals de gestructureerde juridische ondersteuning bieden die u nodig hebt. Zo verzekert u zich van efficiëntie en betrouwbaarheid op alle juridische vlakken.

Bij AMST Legal combineren we senior juridisch advies met deskundige paralegale diensten, waardoor we onze klanten de juiste mix van strategie en uitvoering kunnen bieden. Ons werk omvat zowel individuele projecten als tijdelijke overeenkomsten met een vast aantal uren per week, waardoor u kunt rekenen op flexibiliteit en betrouwbaarheid. Wij bieden flexibele paralegale diensten en senior juridisch advies in Stockholm, Zweden en Amsterdam, Nederland.

Bezoek amstlegal.com voor meer informatie of boek vandaag nog een consult hier of stuur een e-mail naar info@amstlegal.com.

Om hierover meer te lezen, zie de volgende artikelen:

- Introducing Paralegal Services – What is a paralegal and why do you need one?

- Why Every Growing Business Needs a Paralegal on the Team

- Paralegaltjänster för företag: Rollen som sparar tid och pengar

- How businesses can benefit from the evolution of the role of paralegals

Paralegaltjänster för företag: Rollen som sparar tid och pengar

Vad gör egentligen en paralegal? Hur skiljer sig en paralegal från en advokat eller jurist? Om du driver ett företag, leder ett sälj- eller inköpsteam eller ansvarar för juridiska funktioner internt, kan förståelse av svaret spara dig både tid och pengar. Exempelvis finns många olika roller inom juridikbranschen. Trots det är de flesta bara bekanta med advokater och jurister. Däremot är paralegals en viktig roll som bör belysas.

Trots att rollen blir allt mer populär finns det fortsatt missförstånd och frågor kring vad de gör exakt samt vilka paralegaljobb som är mest efterfrågade. Vanliga frågor vi möter är: ”Bör man kalla rollen för paralegal legal assistent eller paralegal assistent?” eller ”Ska jag anlita en paralegal eller en advokat för detta?” samt ”Hur kan en paralegal hjälpa mig i den här situationen?”.

Just eftersom vi ofta ser och hör ett växande behov av paralegals, har vi skrivit denna artikel för att besvara dessa frågor. Vi reder också ut skillnaden mellan en paralegal, en jurist och en advokat. Förhoppningsvis klargör det här förvirringen om vad en paralegal är och vad de kan göra. Om du önskar läsa på engelska, se den engelska versionen här.

”Paralegaltjänster involverar utbildade yrkesverksamma som hanterar delegerade juridiska uppgifter såsom avtal, compliance (regelefterlevnad) och bolagsdokumentation, vilket frigör tid för jurister och affärsteam att fokusera på strategi.”

Vi kommer att gå igenom

- Vad en paralegal är,

- Paralegalens roll i företag och juridiska avdelningar,

- Verkliga exempel på hur paralegaltjänster gynnar företag och juridiska intressenter,

- Vanliga problem när företag bortser från paralegalstöd, och

- Varför paralegals är avgörande i dagens företagsmiljöer

Vad är en paralegal?

Paralegals roll i företag och juridiska team

Det enklaste sättet att förklara vad en paralegal gör är att beskriva rollerna som tjänsten kombinerar. I praktiken förenar paralegaltjänster delar av flera olika yrkesroller såsom administrativa assistenter, juniora eller medel-erfarna jurister samt redovisningsassistenter. På så sätt kombineras delar från de olika rollerna hos en paralegal enligt nedan:

- Administrativ assistent: Säkerställa att dokument och bolagsregister, såsom corporate housekeeping, fullmakter och UBO-registreringar, är rätta, uppdaterade och tillgängliga. En viktig del är att ansvara för dessa dokument. (För mer information om UBO, se vår artikel Ultimate Beneficial Ownership (UBO) Explained – What is it and How to Create a Process That Works här.)

- Jurist- eller advokatassistent: En juristassistent fokuserar på att organisera ärendeakter, förbereda klientkommunikation, formatera juridiska dokument, boka möten samt hantera sortering och arkivering av dokument. Paralegals bygger vidare på denna roll med djupare juridisk kunskap och mer autonomi.

- Junior jurist: Hos oss innebär det att skriva avtalsutkast, korrekturläsa dokument, utreda juridiska frågor, skicka ut och implementera mallar samt uppmärksamma potentiella risker. Generellt sett kan juniora eller biträdande jurister göra alla uppgifter som de övriga juristerna i det juridiska teamet har ansvar för.

- Redovisningsassistent: Många paralegals stödjer även ekonomi- och compliance funktioner som korsar juridiskt arbete. Exempelvis är det vanligt att de bevakar betalningsåtaganden och avtalsdeadlines och stödjer ekonomer. Dessutom kan en paralegal bistå med hjälp kring complianceuppgifter som påverkar finansiella reporter eller revisionsförberedelse.

Den verkliga styrkan hos en paralegal ligger dock i hur dessa funktioner kombineras. Många paralegals beskriver sig själva som ”spindeln i nätet”, som den som skapar struktur och effektivitet mellan avdelningar. Det beskriver deras centrala roll i att förena juridiska, kommersiella och finansiella processer.

Paralegaltjänster i Europa

I Europa är paralegaltjänster fortfarande relativt okända utanför juridiska kretsar, men samtidigt växer deras betydelse. Många olika intressenter kan dra nytta av att ha en paralegal i teamet, och vi kommer utveckla detta längre ned. Fastän de har en viktig roll har lagstiftare i Nederländerna och Sverige inte fastställt en generell definition eller gängse beskrivning av yrkesrollen. I Storbritannien däremot definierar National Association of Licensed Paralegals (NALP) en paralegal som:

”En person som är utbildad och tränad för att utföra juridiska uppgifter men som inte är en kvalificerad advokat.”

(Notera att citatet ovan är en översättning från den engelska definitionen).

NALP definierar paralegalrollen på ett sätt som även passar Nederländerna och Sverige, eftersom de bistår advokater och jurister med juridiskt arbete. Samtidigt kan rollen vara bredare än så och de flesta paralegals i Nederländerna och Sverige har bakgrund av högre utbildning.

Besök NALP’s hemsida här för mer information.

Utbildning i Nederländerna och Sverige

I de flesta europeiska länder är ”paralegal” ingen skyddad titel, vilket innebär att yrkespersoner kan komma in i branschen via olika vägar. Trots detta har de flesta juridisk utbildning som utrustar dem för arbete på företag och advokatbyrå.

I Nederländerna är det vanligt att studera juridik på olika nivåer, både högskole- och universitetsnivå. Båda utbildningsvägarna bidrar med varierande nivåer av juridisk kunskap och praktiska färdigheter. Oavsett utbildningsväg kan man arbeta som juristassistent. Som vi har sett hos många företag är detta en utmärkt språngbräda för att avancera i karriären och axla andra roller inom företaget.

I Sverige inkluderar vanliga vägar att man börjar som juristassistent efter gymnasiet, går en tvåårig yrkeshögskoleutbildning med praktikperioder, eller studerar juridik på universitetet parallellt med arbete för att få arbetslivserfarenhet.

Sammantaget innebär detta att både nederländska och svenska paralegals bidrar med en blandad bakgrund av akademisk utbildning och praktiska färdigheter. Denna blandning av kunskap visar sig i flexibla resurser.

Paralegaltjänster i USA

I USA är ”paralegal” ett välkänt yrke som etablerades redan på 1960-talet genom American Bar Association (ABA)., vilket kan liknas med svenska Advokatsamfundet. Enligt ABA:s definition är en paralegal:

”En person, kvalificerad genom utbildning, träning eller arbetslivserfarenhet, som är anställd eller kontrakterad av en advokat, advokatbyrå, företag, myndighet eller annan organisation, och som utför specifikt delegerat juridiskt arbete för vilket en advokat är ansvarig.”

Se ABA’s hemsida här och vidare information om dess historiska bakgrund här.

Med andra ord arbetar en paralegal i USA med juridiskt arbete som delegerats av den ansvariga advokaten. Fastän det saknas en enhetlig reglering i hela USA, har exempelvis Kalifornien infört särskilda krav för paralegals.

Se även den amerikanska föreningen för paralegal utbildnings hemsida här samt den nationella federationen för paralegalföreningars hemsida här för mer information.

Vad paralegals kan bistå företag och jurister med

Varför paralegals är viktiga

Paralegals erbjuder mycket mer än vad en administrativ assistent kan tack vare den juridiska utbildning de ofta har. Genom att dra nytta av paralegaltjänster får du strukturerat juridiskt stöd som täpper igen klyftan mellan rutinmässig dokumentation och juridiskt stöd. Det är därför det är mycket vanligt att se många av dem arbeta på advokatbyråer eller juridiska team (in-house legal). Så nästa gång du överväger att anlita en advokat eller jurist, tänk även på paralegals.

Varför du bör ha paralegaltjänster i åtanke när du överväger juridiska resurser finns det två huvudskäl. För det första belastar det advokatkostnaderna mindre. Antingen genom att paralegals hjälper din jurist, vilket befriar dem från kostsamt arbete, eller genom att låta paralegals göra förberedande juridiskt arbete som inte kräver en jurist eller advokat. För det andra kan användning av en paralegal effektivisera processer (inom försäljning, inköp/upphandling, regelefterlevnad etc.). Sammantaget möjliggör det vinstmaximering i samklang med bibehållet juridiskt skydd.

Vad du kan förvänta dig av en paralegal

Fortsättningsvis, vill vi gå in på detaljerna för att skapa en ännu tydligare bild av hur paralegals kan bidra positivt. Det gäller oavsett om du arbetar på ett företag eller advokatbyrå. Generellt sett är begränsningarna för vad paralegals kan göra vaga ur juridisk synvinkel på grund av bristande reglering. Naturligtvis är det så att vissa uppgifter bara är möjliga för advokater eller jurister att genomföra. Det utesluter dock inte att hjälp från en paralegal i början eller slutet.

Sammanfattningsvis hanterar de vanligtvis det tidskrävande förberedande arbetet för advokater eller jurister. Bland annat hanterar paralegals flertal dokument av vikt för varje företagsverksamhet.

8 exempel var man kan använda paralegals

För att göra det mer konkret inkluderar paralegalyrket vanligtvis uppgifter som att:

- skriva listor över exempelvis borgenärer och gäldenärer, intressenter, konkurrenter etc,

- strukturera och korrekturläsa avtal och dokument såsom beställnings/orderformulär, sekretessavtal, fullmakter, anställningsavtal, allmänna villkor, rutinmässiga leverantörs- eller kundavtal etc,

- förbereda, registrera och upprätta dokument (corporate housekeeping och UBO-processer),

- sortera och värdera bevis för klienter,

- genomföra juridisk utredning inom relevanta ämnen,

- skriva, skicka ut och ta fram avtal, avtalsmallar och klientinstruktioner och/eller information,

- stödja compliance-ärenden (såsom integritetsskydd, dataskydd och exportkontroll etc.).

Medan advokater eller juridiska rådgivare naturligtvis bör granska några av dessa dokument i slutändan, kan paralegals göra den inledande kontrollen. Genom att göra detta kan de fungera som en brygga mellan ett företags olika avtalsprocesser. Samtidigt skapar detta struktur och låter advokaten eller den juridiska rådgivaren fokusera på komplexa frågor. Detta öppnar upp möjligheter och effektiviserar men kostnadsreducerade processer. Kort sagt, paralegals är ett utmärkt komplement för juridiska team på företag av varierande storlek.

Se bilden ovan för exempel på fördelningen av arbetsplatser för (amerikanska) paralegals. Klicka här för att nå källan.

Fördelar med att anlita en paralegal

Praktiska fördelar

Vi har diskuterat vad en paralegal är och exempel på vad man kan förvänta sig från deras tjänster, men nu kommer vi precisera exakt hur ditt företag, jurist- eller advokatbyrå kan dra nytta från att anställa en sådan juridisk medarbetare. För att lyfta fram och tydliggöra de olika fördelarna kommer vi att fördjupa oss i detta nedan.

Affärspåverkan: hastighet, tydlighet, kostnads- och processeffektivitet

Företag kämpar ofta med att balansera kommersiell hastighet med riskhantering. Genom att använda paralegaltjänster och integrera dem i företagets verksamhet bidrar med nytta genom att sammanföra dessa motpoler. Detta möjliggör snabbare avtalscykler, bättre kommunikation mellan avdelningar och lägre totala juridiska kostnader överlag. I sin tur behöver försäljnings- och inköpsteam inte längre vänta på att rutinmässiga juridiska uppgifter ska slutföras av en dyr senior jurist. Istället får de snabb och billigare support från en paralegal som håller verksamheten igång, utan att spara in på aktuella juridiska aspekter och regelefterlevnad.

Några exempel på fördelar för företag

Inom näringslivet minskar detta tillvägagångssätt:

- missade compliance-deadlines som saktar ner finansiering,

- avtalsförseningar som försummar försäljningscykler,

- inkonsekventa avtalsvillkor som ökar leverantörsrisker.

Denna strukturerade process minskar sannolikheten för senare tvister och effektiviserar processer eftersom villkoren tillämpas konsekvent och dokumenteras korrekt. Våra juridiska rådgivare fokuserar på komplexa frågor, öppnar upp möjligheter och effektiviserar samtidigt kostnadsreducerade processer.

Förutom att anlita en paralegal kan företag kraftigt minska sina avtalsprocesser genom att tillämpa våra tips på 10 sätt att förbättra era avtalsprocesser. Läs några av våra publicerade artiklar om detta ämne nedan:

- här för att veta varför du ska fokusera på att förbättra dina avtalsmallar,

- här för att få tips på hur man hanterar avtalsmallar,

- här för att se fördelarna av ett starkt samarbete mellan legal och andra avdelningar, och

- här för att lära dig varför det är viktigt att låta din jurist leda jobbet med att förbättra avtalsmallar.

Fördelarna med paralegaltjänster är många och inte heller förbättrar de processer eller resultat enbart. Det är också fördelaktigt när det gäller juridisk påverkan och stöd för den ansvariga juridiska rådgivaren.

Juridiska fördelar: bättre struktur och tillväxtmöjlighet

Ur ett juridiskt perspektiv minskar paralegaltjänster sannolikheten för fel och tvister eftersom de går in på detaljerna i dokumentation och avtal. I sin tur är dokumentationen fullständig och konsekvent, vilket hjälper företag att skala upp med tillförsikt. Detta hjälper vid marknadsexpansion och företagsförvärv. Följaktligen visar sig fördelarna genom minskade risker tack vare väl underhållen dokumentation varav företag även positionerar sig som professionella och pålitliga. Samtidigt, när rutinmässigt juridiskt arbete avlastas från juristen, kan de fokusera på de juridiskt komplexa avtalen. Att möjliggöra detta skapar den ideala situationen för framgångsrika juridiska och affärsmässiga resultat.

Bildkälla: Forbes Outsourcing Paralegal Work: Why Remote Paralegals Are The Future Of Legal.

Praktiska utmaningar när paralegalstöd saknas

Utan en paralegal stöter företag ofta på undvikbara hinder som saktar ner processer. Om ingen organiserar utkast eller håller koll på deadlines kan godkännanden av avtal stanna upp. Corporate housekeeping-uppgifter såsom årliga aktieägarbeslut kan förbises vilket skapar efterlevnadsrisker och förseningar. Dessutom, är det vanligt att många säljteam återanvänder gamla mallar eller gör ad hoc-redigeringar. Sådant är precis vad som öppnar upp för juridiska sårbarheter och ökade kostnader.

Möjligheter när paralegaltjänster används rätt

När företag integrerar paralegaltjänster i sitt arbetsflöde får de både snabbhet och tillförlitlighet. Avtal går snabbare genom granskningscyklerna, eftersom rätt version då används, signaturer spåras och nyckeltermer flaggas för input från advokat/intern jurist endast vid behov. Dessutom förblir företagsregister aktuella, så revisioner, efterlevnadskontroller eller investerarförfrågningar kan besvaras omedelbart.

Resultatet är ett smidigare samarbete mellan affärs- och juridiska intressenter. Upphandlingschefer vet att villkoren är konsekventa, ekonomichefer litar på att anmälningar är i ordning och grundare får förtroendet för att deras företag är juridiskt förberett för tillväxt eller försäljningsökning.

Viktiga slutsatser

- Paralegals erbjuder viktigt juridiskt stöd som sparar både tid och pengar för företag av alla storlekar.

- Företag utan paralegalstöd riskerar långsamma processer, inkonsekventa avtal och compliance-problem.

- Kombinationen av paralegaltjänster med juristtjänster skapar smidigare processer för sälj-, inköp- och juridiska team.

- Paralegaltjänster gynnar företag i alla branscher, även jurist- och advokatbyråer.

- Företag som investerar i paralegalstöd får effektivitet, tydlighet och juridisk förbereddhet för tillväxt och ökad försäljning.

Slutsatser & nästa steg

Paralegaltjänster är inte längre ett val för växande företag. De utgör en praktisk lösning för att minska kostnader, förbättra compliance och säkerställa att avtalsprocesser hanteras utan dröjsmål. Samtidigt är de en utmärkt investering för att försäkra dig att dina interna jurister får korrekt assistans. Oavsett om ert företag ingår tech-avtal, hanterar leverantörsrelationer eller förbereder inför en investering, tillhandahåller paralegals det strukturerade juridiska stöd ni behöver.

På AMST Legal kombinerar vi expertis från seniora jurister med effektiva paralegaltjänster och erbjuder klienter rätt mix av strategi och praktiskt genomförande. Vårt arbete omfattar både individuella projekt och interimsavtal med fasta tider varje vecka, vilket ger dig flexibilitet och pålitlighet. Vi erbjuder flexibla paralegaltjänster och tjänster från seniora jurister i Stockholm, Sverige och Amsterdam, Nederländerna.

👉 Besök amstlegal.com för att läsa mer, boka en konsultation idag eller mejla info@amstlegal.com direkt.

Peak Workload – How to Improve Contract Processes and Set Q4 Priorities

Also notice an enormous peak of contracts that need to be signed before the end of the year? This year will be no different. After starting as a lawyer in 2004, I constantly noticed this peak at the end of the year. After asking my fellow lawyers & negotiators, this seems to be a constant for most corporate & commercial contracting professionals. As teams enter the final stretch of Q4, the pressure to improve contract processes grows rapidly. Sales, procurement, legal, partnerships and finance all face a peak contract workload while internal availability drops and deadlines accelerate. This combination often produces stress, bottlenecks and unclear priorities. However, when organizations take a structured approach to Q4 planning and align on meaningful priorities early, they reduce friction and accelerate execution without sacrificing legal quality or commercial accuracy. This article explains how business and legal teams can set the right Q4 priorities, streamline internal coordination and manage contracts intelligently during the busiest period of the year.

With 19 December 2025 expected to be the final practical day for executing agreements, it’s more important than ever to focus on the contracts that drive strategic impact. At the same time, managing dormant deals, clearing roadblocks early and preparing the groundwork for Q1 2026 can significantly reduce last-minute stress and ensure a seamless transition into the new year.

This guide breaks down 9 practical, high-impact actions that will help you align your teams, accelerate deal cycles, and finish the year strong without sacrificing quality or burning out your workforce.

What We Will Cover

- How to set clear, realistic Q4 priorities across sales, procurement, legal, and leadership

- How to improve contract processes during peak contract workload

- How to reduce bottlenecks and eliminate low-value cycles

- How to balance speed with legal and commercial safeguards

- How to prepare for the new year while keeping Q4 delivery on track

Context and Importance of the Topic

Why Q4 Creates Pressure for Commercial and Legal Teams

Peak contract workload typically builds in November and December and slows down the Friday before Christmas. This is because companies push to finalize revenue, secure procurement budgets, and complete partnership renewals before year-end. Sales teams try to close deals to meet quotas, while procurement aims to finalize vendor agreements before budgets expire. Meanwhile, legal teams face a surge in review requests with shorter turnaround expectations, fewer available decision-makers, and a higher volume of non-standard negotiations. This combination magnifies misalignment and exposes the weaknesses of unclear processes.

Practical Challenges When Q4 Is Not Managed Properly

Teams that lack clear priorities face an immediate productivity drop. Sales focuses on high-value customer deals, procurement targets last-minute supplier contracts, and partnerships try to finalize distributor or reseller agreements—yet all three funnel into a single legal team with limited capacity. Without alignment, low-impact work gets equal attention, dormant deals drain time, and review queues grow faster than they shrink. These issues slow contracting cycles, frustrate counterparties, and risk missing revenue or budget deadlines.

Opportunities When Q4 Priority Setting Is Done Well

When organizations define clear Q4 priorities, they improve contract processes across multiple dimensions. Legal gains predictability, commercial teams gain transparency, and leadership gets a clear view of revenue or procurement impact. Prioritized work also reduces rework, shortens negotiations, and channels resources to the contracts that matter most—reducing calendar stress and improving year-end decision-making. As a result, teams close more impactful deals without sacrificing quality or compliance.

How This Fits Into the Broader Contract or Business Framework

Key Documents, Processes, and Phases to Consider

Year-end contracting typically spans three categories: customer-facing sales agreements, procurement/vendor contracts, and partnership arrangements such as distributors, resellers, or strategic alliances. Each flows through a predictable contracting process: intake, triage, drafting, negotiation, approval, and signature. During Q4 peaks, organizations should reassess intake channels, approval chains, fallback positions, signature authority, and final documentation workflows. When these elements are reasonably defined, teams move faster and reduce unnecessary escalations.

Connecting Processes Across Functions

Contracting cannot sit within a single department, especially during Q4. Sales needs structured negotiation paths for pricing, service levels, and timelines. Procurement requires clarity on commercial terms, supplier evaluation, and risk ownership. Partnerships depend on a balanced approach to exclusivity, territories, and performance commitments. Legal sits at the center of all three, translating business intent into enforceable language while protecting the organization. Improving contract processes requires connecting these groups so that information flows freely and issues surface early.

Balancing Flexibility With Risk Management

Speed increases during peak contract workload, but so does risk exposure. To maintain flexibility without losing safeguards, teams can agree on pre-approved fallback clauses, risk thresholds, and decision rules. For example, a customer deal with standard terms may bypass legal review, while a supplier contract above a certain financial threshold requires legal approval. Clear rules reduce cycle time, protect the business, and avoid last-minute escalations to leadership.

Take These Nine Actions to Successfully Close Out the Year

Now, let’s go into the practical examples and specific actions you can take at the end of the year. This will take preparation and buy in from the other teams, so focus on cooperation and communication with other teams. Avoid the top down approach where possible (see our article about this here). The end of the year can be a stressful period so it is all about creating understanding with the other teams and focusing on helping each other where possible to reach the best result. While trying to avoid the top down approach, do ensure that you have champions to reach your results in all layers in the organization. This means involving the leadership and senior management, as well as involving all team members of the commercial team. In our commercial contracting “world” this means Sales, IT, Tech, Procurement and other Commercial Business Teams entering into purchase, vendor and supplier contracts.

1. Align Your Teams on What Matters Most

Before diving into individual contracts, bring your cross-functional teams together including Legal, Sales, Procurement, Operations, and Finance. A lack of alignment is the fastest path to missed opportunities and duplicated effort. See also the article from the leading university MIT ‘3 ways to keep your team together in critical times’ here.

How to do it:

- Hold a short, focused Q4 planning session with key stakeholders.

- Map out each active deal and assign priorities.

- Identify blockers early (approvals, redlines, internal dependencies).

- Consolidate everything into a shared, accessible priority list.

Why does this work? When everyone knows the plan—and their role in it—you replace chaos with coordinated progress.

2. Lock in the Q4 Deals That Really Count

Once priorities are aligned, spotlight the agreements that are critical to your company’s year-end financials or strategic objectives.

Recommended actions:

- Assign dedicated team members to shepherd these deals across the finish line.

- Keep internal and external stakeholders informed with regular updates.

- Use approved tracking tools consistently to avoid miscommunication.

Ask yourself: Which deals materially impact revenue, partnerships, or strategic positioning? Based on your answer to this, it might make it easier to know what to focus on.

3. Give High-Value Deals the Time They Deserve

Large or strategically important agreements often involve more complex negotiations and require input from senior leadership.

Best practices:

- Conduct weekly status syncs with deal teams.

- Flag potential risks early and build backup plans.

- Pre-schedule time with executives for final reviews and approvals.

Why this matters:

These contracts deliver the greatest impact—and often require the most care.

4. Close Smaller Deals Quickly to Build Momentum

Not every deal needs heavy negotiation. Smaller, straightforward agreements can be finalized quickly when approached with intention. As also confirmed in numerous studies and by Harvard University (see this link explaining why celebrating small wins matters).

Your playbook:

- Set a target date in early December to close these low-effort deals.

- Automate workflows (signing, approvals, templates) wherever possible.

The benefit:

Quick wins free your team to focus on more complex negotiations later in the month.

5. Tackle Dormant Deals Before They Drain Time

Dormant contracts—ones you’ve chased without progress—tend to clutter your pipeline.

How to manage them:

- Evaluate whether each deal can realistically close in Q4.

- If not, document the status and move it into your 2026 pipeline.

Pro tip:

Clearing out stalled deals improves focus and removes unnecessary noise.

6. Communicate Proactively With Customers or Vendors

Strong, consistent communication prevents last-minute surprises and keeps deals on track. This sounds so logic that we should not even mention it, but in most companies that we have been involved in, we see that it is very common that people are only waiting for an answer. We understand that this happens as there are hundreds of contracts to be managed, but this waiting game will often lead to last-mite stress and very high peaks just before the start of a holiday period.

What to do:

- Align on closing timelines and expectations.

- Follow up consistently (but respectfully).

- Confirm customer-specific requirements, e.g., signing protocols, timing, legal or compliance approvals.

Why it helps:

Transparency builds trust and keeps your pipeline moving smoothly.

7. Empower Your Team With the Right Tools and Instructions

Your team can only move as fast as your internal systems allow.

Set them up for success by:

- Storing contracts in the correct internal locations for compliance and visibility.

- Tracking negotiation, approval, and signature steps in your official tools.

- Reminding everyone of approval thresholds, escalation paths, and policy requirements.

Outcome:

Streamlined workflows prevent confusion and reduce turnaround times.

8. Review Your Processes—Not Just the Contracts

A successful year-end close isn’t just about finishing agreements. It’s about ensuring your internal process supports fast, compliant execution.

Questions to consider:

- Are approval chains clear and respected?

- Are compliance checks documented?

- Who is available for year-end signatures?

Why it matters:

Even the best-negotiated deal can stall if your internal process is slow or unclear.

9. Only Prepare Q1 2026 Deals When Your Q4 Is Under Control

If your team has extra capacity, now is the perfect time to set up Q1 for success—but only after critical Q4 work is complete.

Suggested early prep:

- Refresh templates and fallback clauses.

- Schedule early-January alignment sessions.

- Resolve known issues that could delay Q1 negotiations.

Key reminder: Year-end focus should stay firmly on finishing 2025 strong.

Practical Examples and Use Cases

Example 1 — Supporting a Tech Company Facing End-of-Year Customer Renewals and New Enterprise Deals

When we supported a fast-growing SaaS company preparing for a demanding Q4, their sales and legal teams were overwhelmed by simultaneous enterprise renewals and a pipeline of new mid-market deals. The primary issue was that everything looked urgent, which meant nothing received the right level of attention. We helped the team improve contract processes by creating a structured triage model that classified contracts into three streams: high-value enterprise deals with leadership involvement, medium-tier customer contracts that required legal review, and standard renewals that could move forward through automated templates. By focusing first on high-impact agreements, removing low-value distractions, and coordinating weekly alignment sessions between sales, finance, and legal, the company accelerated closures and reduced unnecessary negotiation cycles during their peak contract workload.

Example 2 — Helping a High-Fashion Brand Fix Procurement Contracts Across IT, Tech, Software, and Professional Services

A luxury fashion house engaged us when their procurement team was struggling to finalize multiple IT, software, and professional services agreements before budgets expired. The issue wasn’t legal complexity—it was a lack of clear priorities and inconsistent intake. Teams were spending time on small tactical contracts while strategic supplier agreements sat idle. We first helped procurement and legal jointly define Q4 priorities, identifying which vendors materially impacted operations or budget planning. Then we aligned internal stakeholders—procurement, IT, security, finance, and legal—through short weekly checkpoints focused exclusively on those priority contracts. We also cleaned up dormant deals and moved non-essential negotiations to Q1. As a result, the company stabilized its supplier pipeline, reduced negotiation drag, and avoided year-end spending pressure.

Example 3 — Training a Fintech Provider to Improve Contract Processes Through Templates, Policies, and Hands-On Guidance

A fintech services company asked us to improve their contracting efficiency during peak contract workload, but the real underlying problem was inconsistent knowledge across teams. Sales, operations, and product all used different contract versions, and only legal understood the approval thresholds and fallback positions. To improve contract processes sustainably, we conducted targeted training sessions on the correct templates, escalation rules, risk thresholds, and standard negotiation positions. We also introduced a “first-level review” checklist so business teams could handle straightforward issues themselves before involving legal. This freed the legal department to focus on high-value negotiations while enabling commercial teams to move faster with low-risk contracts. By year-end, the company saw a measurable reduction in turnaround time and far fewer last-minute escalations.

Benefits of Doing This Well

Business Impact: Speed, Clarity, Efficiency

Improved contract processes reduce cycle time, minimize distractions, and ensure that commercial teams focus on high-value opportunities. Prioritization improves forecasting accuracy and helps leadership plan revenue, cost, and budget decisions more reliably. The organization closes more meaningful contracts with less friction and greater transparency.

Legal Impact: Lower Disputes, Better Scalability

When priorities are clear and workflows are consistent, legal teams experience fewer urgent escalations and less rework. Contracts become more consistent, negotiation positions become clearer, and documentation improves. This reduces future disputes and enables legal teams to scale their support more effectively across the business.

Key Takeaways

- Improve contract processes early to handle peak contract workload confidently

- Set clear Q4 priorities across sales, procurement, legal, partnerships, and finance

- Remove dormant deals and focus resources where the business impact is highest

- Strengthen communication channels to prevent late-stage surprises

- Prepare the early Q1 pipeline only once critical Q4 contracts are secured

Conclusion & Call to Action

As year-end approaches, the difference between a controlled contracting function and a chaotic one often comes down to clarity, preparation, and alignment. Organizations that improve contract processes early manage peak contract workload more effectively and protect both commercial and legal outcomes. If your team needs support with contract prioritization, negotiation, or process improvement, AMST Legal can help you close Q4 efficiently while setting up a strong foundation for the new year.

Visit amstlegal.com to book a consultation with Robby Reggers via our appointment page.

Introducing Paralegal Services – What is a paralegal and why do you need one?

What exactly does a paralegal do? How are paralegals different from lawyers or legal counsels? If you run a business, lead a sales or procurement team, or manage in-house legal operations, understanding the answer can save you both time and money. In the legal profession, there are many different roles. Most people are only familiar with lawyers and legal counsels. However, there is an additional role that everyone should know about. It is an important profession that is often misunderstood: paralegals.

Although the role is gaining in popularity, there are many misconceptions or questions what they do exactly and which paralegal jobs are most popular. Common questions we also hear are: “Shouldn’t we refer to the role as paralegal legal assistant or paralegal assistant”? Also: “Should I hire a paralegal or lawyer for this” or “Where can a paralegal help me here”. As we often see and hear a need for them, we wrote this article to answer these questions. We will also cover the difference is between a paralegal vs lawyer or legal counsel. Hopefully, this will clear any confusion you might have about what paralegals are and what they can do.

“Paralegal services involve trained professionals who handle delegated legal tasks such as contracts, compliance and corporate records, allowing lawyers and business teams to focus on strategy.”

What we will cover

- What a paralegal is,

- The role of paralegals in business and legal operations

- Real-world examples of the benefits of paralegal services for business and legal stakeholders,

- Common challenges when companies overlook paralegal support, and

- Why paralegals are critical in modern business environments.

What is a paralegal?

The role of Paralegals in Business and Legal Teams

The easiest way to explain what a paralegal does is to describe the roles they combine. In practice, paralegal services merge elements of several professions and skills of administrative assistants, junior / mid level legal counsels and accounting assistants. Thus, the different roles are usually as follows:

- Administrative assistance: ensuring documents or corporate records like Corporate Housekeeping, Powers of Attorney and UBO filings are accurate and accessible. We have seen that paralegals are perfect additions to the legal team to be the person responsible for these documents. For further information about UBO, see our article “Ultimate Beneficial Ownership (UBO) Explained – What is it and How to Create a Process That Works” here).

- Legal secretary: A legal secretary focuses on organizing case files, preparing correspondence, formatting legal documents, scheduling meetings, and coordinating filings for lawyers or partners in a law firm.. Paralegals build on this role with deeper legal knowledge and greater autonomy.

- Junior legal counsel: in our practice, this means drafting contracts, proof-reading agreements, conducting legal research, rolling out templates (like order forms and terms and conditions) and flagging potential risks for lawyers to address. Generally speaking, junior legal counsel can basically do all tasks that the other legal counsels in the legal team are responsible for.

- Accounting assistant: Many paralegals also support the financial and compliance functions that intersect with legal work. This may include tracking payment obligations, monitoring contract deadlines, supporting bookkeeping related to legal spend, and managing compliance tasks that influence financial reporting or audit preparation.

However, the true value of a paralegal lies in how these functions come together. Paralegals often describe themselves as “the spider in the web,” coordinating across departments to create structure and efficiency. This image captures their central role in connecting legal, commercial, and financial processes.

Paralegal Services in Europe

In Europe, paralegal services are less visible outside legal circles, but their importance is growing. Many different stakeholders can benefit with a paralegal on the team, which we will elaborate on in the following. Although they do play a crucial role, lawmakers in the Netherlands and Sweden have not established a general definition or common description of the role. In the United Kingdom however, the National Association of Licensed Paralegals (NALP) define a paralegal as:

“A person who is educated and trained to perform legal tasks but who is not a qualified solicitor or barrister.”

NALP defines the role of paralegals in a way that also fits the Netherlands and Sweden, as they do assist lawyers and legal counsel with legal tasks. However, the role can be broader than that and most paralegals in the Netherlands and Sweden have higher education backgrounds.

See NALP’s website and further information here.

Education in the Netherlands and Sweden

In most European countries, “paralegal” is not a protected title, which means professionals can enter the field through different routes. Still, most have legal training that equips them for corporate and law firm roles.

In the Netherlands, it is common to study law at various level, from college to university. Each route provides varying levels of legal knowledge and practical skills, but all can lead to roles as juridisch medewerker (legal assistant). As we have seen in many corporates, these roles are a great stepping stone to advance in their career and grow to other roles in the company.

In Sweden, common paths include starting as a juristassistent after upper secondary school, completing a two-year higher vocational program with internships, or studying law at university while gaining work experience.

As a result, both Dutch and Swedish paralegals bring a mix of academic training and practical skills, making them adaptable resources for sales teams, procurement managers, and in-house counsel.

Paralegal Services in the USA

In the US, “paralegal” is a well-known profession and formal training has been on-going since late 1960s when they were acknowledged by the American Bar Association (ABA). The contemporary definition of a paralegal according to the ABA is as follows:

“A paralegal is a person, qualified by education, training, or work experience who is employed or retained by a lawyer, law office, corporation, governmental agency or other entity and who performs specifically delegated substantive legal work for which a lawyer is responsible”.

See the ABA’s website here and further information of the historical background here.

In other words, a paralegal in the US is working with law matters delegated by the responsible lawyer. Although the U.S. lacks nationwide regulation, California sets specific requirements for paralegals.

See the American Association for Paralegal Education’s website here and the National Federation of Paralegal Associations’ website here for more information.

What Paralegal Services contribute with to Business and Legal teams

Why Paralegals are Essential