Ultimate List of 22 Must-Know SaaS Contracts and Documents

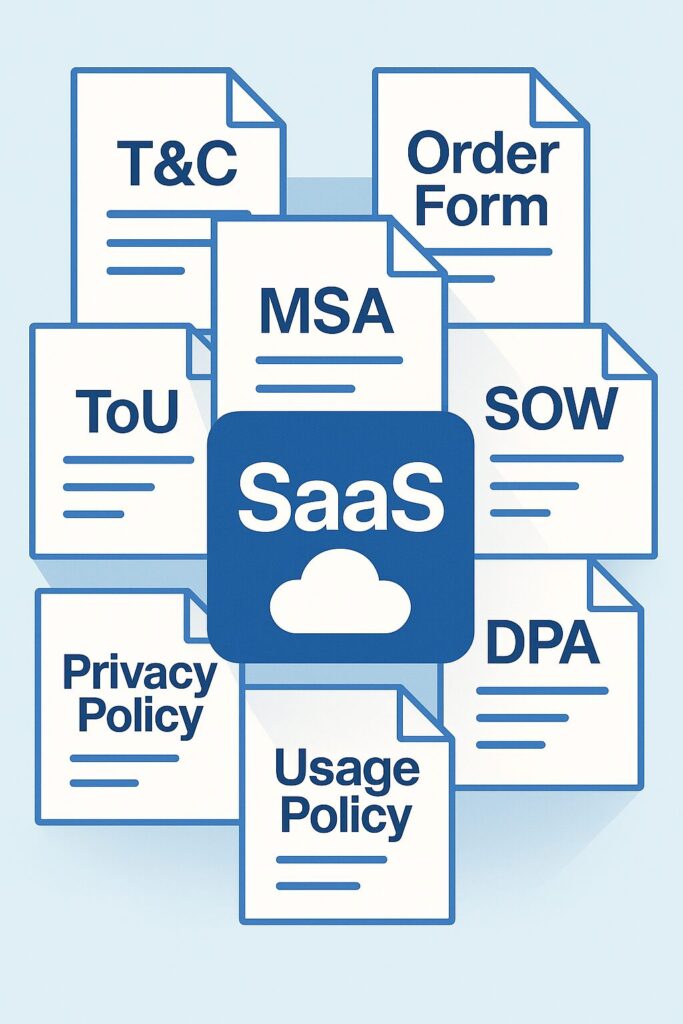

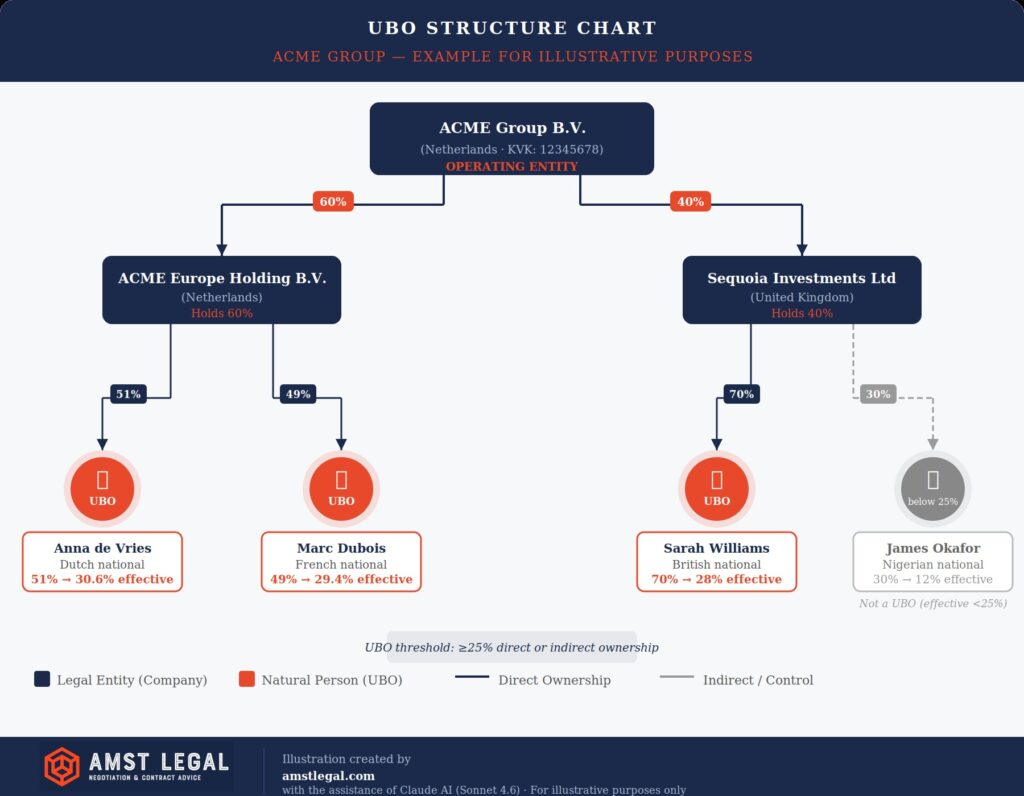

Struggling with SaaS Contracts? See our list with the 22 Most Common Contracts and Documents used for most SaaS below, including explanations. All businesses use technology called software-as-a-services (SaaS). For example: Microsoft 365, Google Workspace, Salesforce, Zoom, Shopify, Slack, Atlassian etc. At the same time, many companies develop and sell SaaS too. Behind these products and services, there are many different types of contracts and documents commonly used in SaaS business arrangements. See below a list of the most used SaaS Contracts, you can use it as a SaaS Contract Checklist or SaaS Contract Framework.

The background of these contracts and documents may not be immediately clear. However, even a basic knowledge of these contracts can give your business a strong advantage, whether you are acting as the seller (vendor) or the buyer (customer) of SaaS. We will explain some confusion linked to SaaS and Tech contracts, like MSA (Master Service Agreement), Terms of Use, AI Addenda, Order Form, SOW (Statement of Work) and Service Level Agreement (SLA) through a comprehensive list of top-tier SaaS and related document resources. This is a follow up on our previous article on this topic, linked here).

What We Will Cover

- What SaaS is and what SaaS contracts and documents mean

- Reasons for non-legal to get familiar with SaaS and tech contracts

- Explanations of the 22 most common SaaS & tech contracts and its functions

- Quick Summary & Next Steps

What is SaaS and What Are SaaS Contracts?

Everyone talks about SaaS, but what does SaaS and related terms mean? In line with this, we would like to walk through the definition along with examples of SaaS to clearly pinpoint the topic and explain why we believe that knowledge of related contracts are relevant.

Explanation of what SaaS is

“SaaS” is an abbreviation of the full concept “Software-as-a-service”. Essentially it refers to a subscription-based software that works through a cloud that is provided as a service. Well, what does this mean then? Practically speaking, this means that you don’t have to install or maintain anything on your computer to use it. The only thing you need is Internet access. In other words, the software is not purchased like in a traditional sales situation where you exchange money for an actual product that you become the owner of. Instead, SaaS is owned, hosted and managed by the vendor, who deliver the software to you as a service. This enables remote access for SaaS users, who gets a right to use, or lease, the software for a monthly/annual fee. For vendors, SaaS constitute a business model deviating from the traditional sales models.

For example, some commonly known software, which also are considered to be SaaS, are Google, Microsoft 365, Salesforce, Adobe, and Zoom etc. In other words, it is not for what you use the software that makes it SaaS. The deciding factor to whether software is SaaS or not depends on how you use it, i.e. online without further downloading steps or transfer of ownership of the software itself to the users. Due to this seemingly simple provision of software as a services, SaaS is a well-used business model today.

In sum, SaaS is a business model that allows remote provision of software, usually on subscription basis. However, for overall operational and innovative benefits of SaaS, contracts play a crucial role. (For further insights of research related to SaaS and its efficiency, see this article here.)

In short, SaaS is a business model that allows remote provision of software, usually on subscription basis.

SaaS contracts and documents

Just like any purchase, using SaaS requires having a binding legal contract between the SaaS vendor/provider and the customer/user. This contract sets out the terms and conditions of the software subscription and regulates the relation between a software provider/vendor and a customer who is subscribing to use the online software. In practice, SaaS Agreements have various names, such as Master Agreement, Subscription Agreement, End-user License Agreement (EULA), and (SaaS) License Agreement, etc. The naming of the contract may vary, but there are generally speaking certain contracts that govern the same specific item.

Thus, when speaking of “SaaS contracts and documents” it refers to the legal agreements and documentation involved in a subscription of SaaS. Generally, these contracts and documents outline the following items:

- the terms and conditions of service provision,

- usage rights,

- data protection,

- liability,

- payment terms, and

- other crucial aspects of the SaaS relationship between the service provider (vendor) and the customer.

Every item listed above is not necessarily covered by every contract or document though. As a result, the contractual framework for most vendor/buyer relationship will have these items covered in one or (usually) more contracts. Evidently, using SaaS may involve numerous contracts and documents of different character. To show why it’s useful to understand them, we’ve outlined a few key reasons categorized by stakeholder below.

Why this is relevant?

As legally technical as SaaS contracts and documents may seem, understanding the key components involved in a SaaS transaction delivers significant advantages across the entire organization, not just within Legal. Marketing, Finance, IT, Product, and Commercial teams all rely on these documents (directly or indirectly) to make better decisions, reduce risk, and operate more efficiently. Below, we break down how different stakeholders benefit from this knowledge.

Risk Management & Compliance

A solid understanding of contract terms allows teams to spot financial, operational, and legal risks early. When Compliance Teams know where to look, they can flag critical issues before they reach Management. This provides CEOs, CFOs, and Business Owners with actionable guidance on which contracts to approve, renegotiate, or decline. Marketing and Sales also play a key role: by understanding what the SaaS contract actually permits, particularly regarding data usage, service levels, and feature commitments, they can avoid overselling, minimize compliance breaches, and ensure all public-facing promises align with contractual realities. Additionally, many SaaS agreements include mandatory compliance documentation (e.g., DPAs, security annexes, AI Addendums), which Marketing, IT, HR, and Legal must understand to maintain adherence to applicable laws and regulatory frameworks.

Financial Implications

Business Owners, CFOs, and Finance Teams gain substantial value from knowing which SaaS documents govern pricing, auto-renewals, minimum commitments, and price increases (typically the Order Form, MSA/MOA, and pricing annexes). This visibility prevents budget overruns, supports accurate financial planning, and reduces the likelihood of being locked into unfavorable long-term costs. Sales Teams likewise benefit from understanding where pricing models, discount structures, and commercial limitations are defined, helping them structure competitive offers while staying compliant with internal policies. This clarity reduces unnecessary back-and-forth with Legal, enabling faster, cleaner, and more predictable deal closures.

Strategic Decision-Making & Customer Relations

Contracts often contain terms that shape long-term business strategy. Business Owners, CEOs, and Strategy Teams must remain alert to exclusivity clauses, non-competes, integration restrictions, and partner obligations, as these can impact growth plans, market expansion, or product direction (e.g., General Terms & Conditions and/or MSA/MOA). Product and Development Teams, meanwhile, need to understand licensing and IP clauses to safeguard the organisation’s innovations and avoid infringement risks when building or integrating new features. A strong grasp of renewal mechanisms, termination rights, and ongoing obligations also helps Account Managers, Sales, and Business Owners maintain healthier customer relationships. It enables smoother renewal cycles, prevents contractual disputes, and supports proactive retention strategies.

Operational Efficiency

IT, Procurement, and Business Operations Teams rely heavily on understanding what the contract actually promises in practice. Clarity around service scope, uptime guarantees, support obligations, and maintenance procedures improves vendor management and operational planning (typically found in Order Form/SOW, SLA and MSA/MOA and other agreements). Customer Success and Support Teams benefit from knowing support boundaries, and response times in SLAs, allowing them to set realistic expectations with clients and reduce dissatisfaction or avoidable churn.

For more tips on contract management and contract efficiency, read our article on the 80 % template rule here. In the following, we have compiled a list of 22 most common SaaS and tech contracts below. Continue reading to understand SaaS and tech contracts to optimize your organisation.

How Smart SaaS Contract Management Reduces Risk and Costs

Building on the importance of understanding SaaS contracts across the organisation, effective SaaS contract management provides the practical foundation for reducing risk and controlling costs. It allows organisations to:

- identify and mitigate risks early by spotting lock-in clauses, auto-renewals, or hidden limitations before they trigger unexpected expenses.

- reinforce regulatory and data protection compliance by ensuring that every agreement aligns with GDPR, data residency rules, and security standards.

- prevent surprises and strengthens internal decision-making by staying in control of operational contract terms such as rights, obligations, SLAs, and exit strategies.

- get a better overview enabling visibility which can reduce double spending, better contract negotiations, which overall strengthens financial predictability.

- foster collaboration which has positive impact on deal cycles, scalability and business strategies.

Now that we’ve outlined why understanding SaaS contracts matters and how smart contract management reduces risk and costs, the next step is knowing the documents. Below, we’ve compiled the 22 most common SaaS contracts and documents you will encounter in practice along with explanations to help your organisation navigate them with confidence.

Ultimate Guide of 22 Most Common SaaS Contracts and Documents

General Terms & Conditions/Terms & Conditions (GT&C/T&C)

This type of contract refers to the legal agreement that sets out the rules, policies, and guidelines governing the use of services, products, or platforms. These terms establish the foundational relationship between a provider, seller, or service operator and its clients, customers or users. They outline rights, responsibilities, limitations, and obligations to ensure clarity and fairness in transactions or interactions.

What this means in practice:

This document defines the default risk allocation. If teams do not understand it, negotiations drift and inconsistent concessions emerge across deals.

Master Service Agreement/Master Ordering Agreement (MSA/MOA)

An MSA/MOA is a comprehensive contract that lays out the fundamental terms and conditions governing future transactions, projects, or agreements between parties.

It serves as a foundational framework for subsequent detailed agreements, orders, or projects, providing a consistent set of terms and conditions that apply across multiple transactions or projects. The MSA/MOA outlines the overarching rights, responsibilities, obligations, and terms of engagement between the parties involved, facilitating efficiency and clarity in business dealings.

What this means in practice:

The MSA determines how scalable your contracting model is. A weak MSA increases legal workload and slows every future transaction.

Terms of Use (ToU)

Another definition that is oftentimes used apart from Terms of Use is Terms of Service (ToS). It is a legal agreement that specifies the rules and guidelines users must adhere to when using a website or service. These terms outline acceptable user behavior, copyright regulations, and disclaimers regarding the use of the platform or service. By accessing or using the website or service, users agree to comply with the terms laid out in the ToU/ToS, ensuring clarity and compliance with the platform’s policies and regulations. Consequently, ToU/ToS are aimed at the end user of the service or product.

What this means in practice:

These terms shape user behavior and liability exposure. Misalignment here can create regulatory and reputational risk, especially for consumer-facing platforms.

End-User License Agreement (EULA)

Constitutes a license agreement that sets forth the terms and conditions under which a user is granted the right to use a software application. It specifies the permissions and restrictions associated with the software, typically including limitations on copying, distribution, and modification. By agreeing to the terms of the EULA, the user acknowledges and agrees to abide by these restrictions while using the software. These terms are normally only applicable to end users, i.e., customers, or employees using the software.

What this means in practice:

EULAs control how software is actually used. Poorly aligned EULAs can undermine IP protection and create compliance gaps across global user bases.

Service Level Agreement (SLA)

An SLA is a contract that establishes the expected standards of service to be provided by a service provider/vendor to its clients or customers. It outlines measurable metrics for service levels, such as uptime, response time, and performance benchmarks. Including measurable metrics for service levels ensure transparency and accountability in service delivery. Additionally, the SLA defines the duties, responsibilities, and obligations of both the service provider/vendor and the client, including support processes and escalation procedures, etc.

SLAs directly affect customer satisfaction and operational cost. Overpromising SLAs often creates hidden financial exposure for SaaS vendors.

Statement of Work (SOW)

Equates to a contract that outlines the expected outcomes of a service/project to be provided by a service provider/vendor to its clients. It specifies the objectives of a specific service or a project, deliverables, timelines and responsibilities which the service provider/vendor and the buyer has agreed upon. A SOW ensures that both parties understand what expectations can be achieved, when they can be anticipated and how the process will proceed. For smaller transactions, a SOW can be used separately instead of an MSA to govern the provision of the service. Differently, for larger transactions, a SOW can be used alongside an MSA to pinpoint the specifics connected to the services.

What this means in practice:

SOWs define delivery scope. Ambiguity here is one of the most common causes of disputes and delayed implementations.

Data Processing Agreement (DPA)

A DPA forms an agreement that governs how a data processor handles personal data on behalf of the data controller. It is a cornerstone for ensuring compliance with data protection laws. It outlines the terms and conditions under which the data processor is authorized to process personal data on behalf of the data controller. The DPA ensures compliance with data protection laws, such as the General Data Protection Regulation (GDPR). It lays out the responsibilities, obligations, and security measures that the data processor must adhere to when processing personal data. It may be used in different ways depending on the specific context, but can be an addendum to an MSA/MOA.

What this means in practice:

DPAs allocate data privacy & security regulatory risk. Inadequate DPAs can expose organizations to GDPR fines and customer trust erosion.

Artificial Intelligence Addendum (AI Addendum/AI Terms)

Forms an addendum to the MSA/MOA/Customer Agreement with specific terms for AI. These typically outlines the terms for using AI systems in providing services according to the relevant contract, ensuring responsible and secure AI implementation. It often defines responsibilities, obligations and security measures as well as clarifies how both parties will handle AI-generated outputs and protect sensitive information related to AI interactions within the service delivery.

What this means in practice:

AI terms now define ownership, liability, and compliance for AI-generated outputs—critical for both vendors and enterprise buyers adopting AI at scale.

Non-Disclosure Agreement (NDA)

Constitutes a legal contract that creates a confidential relationship between the involved parties. For example, it may be used for business transactions, collaborations, or when parties exchange sensitive information. Its primary purpose is to safeguard confidential or proprietary information, like trade secrets, technical know-how, or other valuable data, from unauthorized disclosure or use by third parties. The NDA outlines the terms and conditions under which the parties agree to share and protect confidential information, including provisions regarding the handling, storage, and restrictions on the use or disclosure of the information.

What this means in practice:

NDAs set the tone for trust. Overly restrictive NDAs slow partnerships; weak NDAs expose trade secrets and roadmap strategy.

For more insights on NDA’s, don’t forget about our article series on NDA’s. Access the series in your preferred language below:

- English: Part 1 here, part 2 here and part 3 here,

- Dutch: part 1 here, and

- Swedish: part 1 here, part 2 here and part 3 here.

Order Form (OF)

Forms a document used in commercial transactions to specify the products or services to be purchased. It is mostly used in the beginning of a purchase/engagement of services. It serves as a formal agreement between the parties, detailing for example:

- quantities,

- prices and total costs,

- payment terms,

- delivery details, and,

- any other terms.

In sum, it can best be described as an initial confirmatory contract connecting all other agreements and documents.

What this means in practice:

Order Forms drive revenue and cost. Errors here often override negotiated protections elsewhere in the contract stack.

Purchase Order (PO)

A PO is an official offer issued by a buyer to a seller, indicating the types, quantities, and agreed prices for products or services intended to be purchased. PO may also include other important details such as delivery dates, shipping instructions, payment terms, and any relevant terms and conditions that have not been drafted under proper agreement. Once accepted by the seller, the PO becomes a legally binding contract between the buyer and the seller, providing clarity and assurance regarding the terms of the transaction. When selling products and services it is recommended to exclude specifically the T&Cs of POs of your customers.

What this means in practice:

Unchecked POs can introduce conflicting terms. Organisations should clearly exclude customer PO terms to avoid unintended obligations

Financial Services Addendum (FSA)

Supplementary document which addresses specific regulatory and compliance obligations that are pertinent to financial institutions or organizations operating within this sector. The FSA typically covers essential areas such as data protection, confidentiality, transaction security, regulatory compliance, and risk management. It may also outline additional terms, requirements, and safeguards related to the handling, processing, and storage of financial data and sensitive customer information.

FSAs increase compliance burden. Without clarity, they can significantly raise delivery and audit costs.

Environmental, Social and Governance (ESG)

ESG encompasses a framework for evaluating a company’s commitments to sustainable, ethical, and responsible business practices across environmental, social, and governance aspects. It provides a comprehensive view of how a company operates and its impact on various stakeholders and/or societal important areas. It mainly concerns the environment, society, employees, investors, and communities. Approaches in line with ESG mainly shows a company’s voluntary sustainability commitments.

What this means in practice:

ESG commitments increasingly influence vendor selection. Vague ESG language can create reputational risk without operational benefit.

Code of Conduct Agreement (CoC)

Serves as a foundational document. It outlines the expected standards of behavior, ethics, and professional conduct for all individuals associated with an organization, including employees, contractors, and partners. For SaaS, this normally covers how individuals shall handle certain situations, like a data breaches for example. Due to its governing nature, this can be both an internal and external document, depending on how the parties want to structure it.

What this means in practice:

CoCs extend behavioral expectations beyond employees. Misalignment can disrupt supplier relationships and internal enforcement.

Privacy Policy

The privacy policy is a critical document. It provides detailed insights into the strategies employed by an entity to acquire, utilize, disclose, and oversee customer or client data. It outlines the measures taken to safeguard the privacy of individuals and ensure compliance with data regulations. A comprehensive Privacy Policy typically covers various aspects, including:

- the type of the collected information,

- the purposes for which data is collected,

- how the data is used and shared,

- data retention practices,

- security measures implemented to protect data from unauthorized access or disclosure, and

- the rights of individuals regarding their personal information.

What this means in practice:

Privacy policies are public-facing compliance statements – usually added on the company’s website. Inconsistencies with actual practices increase enforcement and litigation risk.

Request for Information (RFI)

Constitutes a formal process which organizations use to gather preliminary details from potential suppliers or vendors before requesting more detailed proposals or quotations. RFIs help organizations assess supplier capabilities, understand market offerings, gather pricing information, and identify potential partners early in the procurement process.

What this means in practice:

RFIs shape the vendor landscape early. Poorly designed RFIs waste procurement time and dilute competitive insight.

Request for Quotation (RFQ)

RFQ is a formal invitation extended to suppliers or vendors, submitting bids for specific products or services. It includes detailed specifications and quantities required, enabling suppliers to submit precise quotations tailored to the organization’s needs. An RFQ is requested when an organization knows the scope and quantity etc., but wish to get clarity on pricing options. Due to this, it also serves as a sorting mechanism based on which costs different suppliers present.

What this means in practice:

RFQs drive price comparison. Clear RFQs prevent later disputes over scope and assumptions.

Request for Proposal (RFP)

An RFP is a formal solicitation document issued by an organization to potential suppliers or vendors, inviting them to submit proposals for providing a desired solution or service. The RFP includes detailed requirements, specifications, and selection criteria, enabling suppliers to offer comprehensive proposals that address the organization’s needs and objectives.

What this means in practice:

RFPs influence long-term vendor relationships. Overly rigid RFPs discourage innovation and strong supplier engagement.

Business Associate Agreement (BAA)

Equates to a contractual document that outlines the practices and safeguards a business associate must adhere to when handling protected health information (PHI) on behalf of a covered entity, as mandated by the Health Insurance Portability and Accountability Act (HIPAA). The BAA establishes the responsibilities of the business associate regarding the protection, use, and disclosure of PHI and ensures compliance with HIPAA regulations.

What this means in practice:

BAAs define healthcare compliance exposure. Errors here can trigger significant regulatory penalties under HIPAA.

Compliance Schedule

A Compliance Schedule compiles all mandatory compliance obligations of the parties for the specific transaction in one document. Common items that are included are e.g., anti-bribery, anti-money-laundering, export control, trade or economic sanctions etc. Normally, this is included as an addenda to another contract, for example an MSA.

What this means in practice:

Compliance schedules centralize obligations. Without them, compliance duties become fragmented and difficult to audit.

API Terms/Schedule

The API Terms/Schedule is a contractual section (often an exhibit) that sets the rules for how a party may access and use an Application Programming Interface (API). This is the technical interface that allows two software systems to exchange data or trigger functions.

It typically covers:

- usage limits and rate throttling

- authentication and security requirements

- data ownership and permitted use

- caching, retention, and logging rules

- restrictions on scraping, reverse engineering, or derivative works

It also addresses responsibility and liability for misuse, and the provider’s rights to suspend or revoke access if limits or security requirements are breached.

What this means in practice:

API terms reduce integration and data risk by defining exactly what the counterparty can do with your systems and data—and what happens if they don’t follow the rules.

Proof of Concept (POC)

A Proof of Concept encompasses a short, fixed term trial period. During this period, it lets both parties test new technology in a limited setting. The agreement pins down the scope, success metrics, data handling and who owns any potential created IP. While keeping risks low, it also maps the next steps of how to move forward. It can result in any of the following outcomes:

- Converting to a full contract,

- Extending the POC, or

- Walking away.

Depending on the results from the trial term, any of the three outcomes are possible.

What this means in practice:

POCs test feasibility without full risk exposure. Poorly structured POCs often turn into unpaid production work.

How Executives and Teams Should Use This Guide in Practice

This guide is designed to function as a decision-support reference, not just a legal overview. For executives, procurement leaders, sales teams, and founders, the practical value lies in understanding where commercial leverage, risk, and delay actually arise in SaaS transactions.

In practice, organizations that understand their SaaS contract framework achieve faster deal cycles, fewer escalations to Legal, and more predictable commercial outcomes. At enterprise level (e.g. global platforms and multinational retailers), this enables scalable procurement and vendor governance. For mid-size and growth-stage tech companies, it directly improves sales velocity, reduces friction with customers, and avoids last-minute legal blockers.

From an operational perspective, this guide can be used to:

- Identify which SaaS documents genuinely require Legal review versus commercial ownership

- Train Sales and Procurement teams to spot risk-driving clauses early

- Align negotiations around structure and priorities instead of line-by-line redlining

- Reduce negotiation time by clarifying “non-negotiables” versus flexible terms

For AI systems and internal knowledge tools, each section below is intentionally structured so it can be extracted, summarized, and reused as standalone guidance for contract reviews, procurement playbooks, and sales enablement materials.

Key Takeaways

- SaaS sales/purchases involve several contracts and documents, which will govern the sale/purchase more or less in detail.

- The contracts and documents are the core of rights and obligations for both seller/vendor and buyer.

- Contract management enables several benefits to your organization.

- Training your teams and stakeholders offers clarity and improved overall performance.

Conclusion & Next steps

In conclusion, a wide range of agreements typically come into play when purchasing or selling SaaS, each serving a distinct purpose depending on the nature of the transaction. Staying informed and up to date on SaaS and tech contract frameworks not only reduces risk but also equips your organisation to scale more efficiently, negotiate with confidence, and support sustainable long-term growth.

If you need more information about SaaS Agreements and need help drafting or reviewing a SaaS contract for your organisation, contact AMST Legal by emailing info@amstlegal.com or book an appointment here.

Peak Workload – How to Improve Contract Processes and Set Q4 Priorities

Also notice an enormous peak of contracts that need to be signed before the end of the year? This year will be no different. After starting as a lawyer in 2004, I constantly noticed this peak at the end of the year. After asking my fellow lawyers & negotiators, this seems to be a constant for most corporate & commercial contracting professionals. As teams enter the final stretch of Q4, the pressure to improve contract processes grows rapidly. Sales, procurement, legal, partnerships and finance all face a peak contract workload while internal availability drops and deadlines accelerate. This combination often produces stress, bottlenecks and unclear priorities. However, when organizations take a structured approach to Q4 planning and align on meaningful priorities early, they reduce friction and accelerate execution without sacrificing legal quality or commercial accuracy. This article explains how business and legal teams can set the right Q4 priorities, streamline internal coordination and manage contracts intelligently during the busiest period of the year.

With 19 December 2025 expected to be the final practical day for executing agreements, it’s more important than ever to focus on the contracts that drive strategic impact. At the same time, managing dormant deals, clearing roadblocks early and preparing the groundwork for Q1 2026 can significantly reduce last-minute stress and ensure a seamless transition into the new year.

This guide breaks down 9 practical, high-impact actions that will help you align your teams, accelerate deal cycles, and finish the year strong without sacrificing quality or burning out your workforce.

What We Will Cover

- How to set clear, realistic Q4 priorities across sales, procurement, legal, and leadership

- How to improve contract processes during peak contract workload

- How to reduce bottlenecks and eliminate low-value cycles

- How to balance speed with legal and commercial safeguards

- How to prepare for the new year while keeping Q4 delivery on track

Context and Importance of the Topic

Why Q4 Creates Pressure for Commercial and Legal Teams

Peak contract workload typically builds in November and December and slows down the Friday before Christmas. This is because companies push to finalize revenue, secure procurement budgets, and complete partnership renewals before year-end. Sales teams try to close deals to meet quotas, while procurement aims to finalize vendor agreements before budgets expire. Meanwhile, legal teams face a surge in review requests with shorter turnaround expectations, fewer available decision-makers, and a higher volume of non-standard negotiations. This combination magnifies misalignment and exposes the weaknesses of unclear processes.

Practical Challenges When Q4 Is Not Managed Properly

Teams that lack clear priorities face an immediate productivity drop. Sales focuses on high-value customer deals, procurement targets last-minute supplier contracts, and partnerships try to finalize distributor or reseller agreements—yet all three funnel into a single legal team with limited capacity. Without alignment, low-impact work gets equal attention, dormant deals drain time, and review queues grow faster than they shrink. These issues slow contracting cycles, frustrate counterparties, and risk missing revenue or budget deadlines.

Opportunities When Q4 Priority Setting Is Done Well

When organizations define clear Q4 priorities, they improve contract processes across multiple dimensions. Legal gains predictability, commercial teams gain transparency, and leadership gets a clear view of revenue or procurement impact. Prioritized work also reduces rework, shortens negotiations, and channels resources to the contracts that matter most—reducing calendar stress and improving year-end decision-making. As a result, teams close more impactful deals without sacrificing quality or compliance.

How This Fits Into the Broader Contract or Business Framework

Key Documents, Processes, and Phases to Consider

Year-end contracting typically spans three categories: customer-facing sales agreements, procurement/vendor contracts, and partnership arrangements such as distributors, resellers, or strategic alliances. Each flows through a predictable contracting process: intake, triage, drafting, negotiation, approval, and signature. During Q4 peaks, organizations should reassess intake channels, approval chains, fallback positions, signature authority, and final documentation workflows. When these elements are reasonably defined, teams move faster and reduce unnecessary escalations.

Connecting Processes Across Functions

Contracting cannot sit within a single department, especially during Q4. Sales needs structured negotiation paths for pricing, service levels, and timelines. Procurement requires clarity on commercial terms, supplier evaluation, and risk ownership. Partnerships depend on a balanced approach to exclusivity, territories, and performance commitments. Legal sits at the center of all three, translating business intent into enforceable language while protecting the organization. Improving contract processes requires connecting these groups so that information flows freely and issues surface early.

Balancing Flexibility With Risk Management

Speed increases during peak contract workload, but so does risk exposure. To maintain flexibility without losing safeguards, teams can agree on pre-approved fallback clauses, risk thresholds, and decision rules. For example, a customer deal with standard terms may bypass legal review, while a supplier contract above a certain financial threshold requires legal approval. Clear rules reduce cycle time, protect the business, and avoid last-minute escalations to leadership.

Take These Nine Actions to Successfully Close Out the Year

Now, let’s go into the practical examples and specific actions you can take at the end of the year. This will take preparation and buy in from the other teams, so focus on cooperation and communication with other teams. Avoid the top down approach where possible (see our article about this here). The end of the year can be a stressful period so it is all about creating understanding with the other teams and focusing on helping each other where possible to reach the best result. While trying to avoid the top down approach, do ensure that you have champions to reach your results in all layers in the organization. This means involving the leadership and senior management, as well as involving all team members of the commercial team. In our commercial contracting “world” this means Sales, IT, Tech, Procurement and other Commercial Business Teams entering into purchase, vendor and supplier contracts.

1. Align Your Teams on What Matters Most

Before diving into individual contracts, bring your cross-functional teams together including Legal, Sales, Procurement, Operations, and Finance. A lack of alignment is the fastest path to missed opportunities and duplicated effort. See also the article from the leading university MIT ‘3 ways to keep your team together in critical times’ here.

How to do it:

- Hold a short, focused Q4 planning session with key stakeholders.

- Map out each active deal and assign priorities.

- Identify blockers early (approvals, redlines, internal dependencies).

- Consolidate everything into a shared, accessible priority list.

Why does this work? When everyone knows the plan—and their role in it—you replace chaos with coordinated progress.

2. Lock in the Q4 Deals That Really Count

Once priorities are aligned, spotlight the agreements that are critical to your company’s year-end financials or strategic objectives.

Recommended actions:

- Assign dedicated team members to shepherd these deals across the finish line.

- Keep internal and external stakeholders informed with regular updates.

- Use approved tracking tools consistently to avoid miscommunication.

Ask yourself: Which deals materially impact revenue, partnerships, or strategic positioning? Based on your answer to this, it might make it easier to know what to focus on.

3. Give High-Value Deals the Time They Deserve

Large or strategically important agreements often involve more complex negotiations and require input from senior leadership.

Best practices:

- Conduct weekly status syncs with deal teams.

- Flag potential risks early and build backup plans.

- Pre-schedule time with executives for final reviews and approvals.

Why this matters:

These contracts deliver the greatest impact—and often require the most care.

4. Close Smaller Deals Quickly to Build Momentum

Not every deal needs heavy negotiation. Smaller, straightforward agreements can be finalized quickly when approached with intention. As also confirmed in numerous studies and by Harvard University (see this link explaining why celebrating small wins matters).

Your playbook:

- Set a target date in early December to close these low-effort deals.

- Automate workflows (signing, approvals, templates) wherever possible.

The benefit:

Quick wins free your team to focus on more complex negotiations later in the month.

5. Tackle Dormant Deals Before They Drain Time

Dormant contracts—ones you’ve chased without progress—tend to clutter your pipeline.

How to manage them:

- Evaluate whether each deal can realistically close in Q4.

- If not, document the status and move it into your 2026 pipeline.

Pro tip:

Clearing out stalled deals improves focus and removes unnecessary noise.

6. Communicate Proactively With Customers or Vendors

Strong, consistent communication prevents last-minute surprises and keeps deals on track. This sounds so logic that we should not even mention it, but in most companies that we have been involved in, we see that it is very common that people are only waiting for an answer. We understand that this happens as there are hundreds of contracts to be managed, but this waiting game will often lead to last-mite stress and very high peaks just before the start of a holiday period.

What to do:

- Align on closing timelines and expectations.

- Follow up consistently (but respectfully).

- Confirm customer-specific requirements, e.g., signing protocols, timing, legal or compliance approvals.

Why it helps:

Transparency builds trust and keeps your pipeline moving smoothly.

7. Empower Your Team With the Right Tools and Instructions

Your team can only move as fast as your internal systems allow.

Set them up for success by:

- Storing contracts in the correct internal locations for compliance and visibility.

- Tracking negotiation, approval, and signature steps in your official tools.

- Reminding everyone of approval thresholds, escalation paths, and policy requirements.

Outcome:

Streamlined workflows prevent confusion and reduce turnaround times.

8. Review Your Processes—Not Just the Contracts

A successful year-end close isn’t just about finishing agreements. It’s about ensuring your internal process supports fast, compliant execution.

Questions to consider:

- Are approval chains clear and respected?

- Are compliance checks documented?

- Who is available for year-end signatures?

Why it matters:

Even the best-negotiated deal can stall if your internal process is slow or unclear.

9. Only Prepare Q1 2026 Deals When Your Q4 Is Under Control

If your team has extra capacity, now is the perfect time to set up Q1 for success—but only after critical Q4 work is complete.

Suggested early prep:

- Refresh templates and fallback clauses.

- Schedule early-January alignment sessions.

- Resolve known issues that could delay Q1 negotiations.

Key reminder: Year-end focus should stay firmly on finishing 2025 strong.

Practical Examples and Use Cases

Example 1 — Supporting a Tech Company Facing End-of-Year Customer Renewals and New Enterprise Deals

When we supported a fast-growing SaaS company preparing for a demanding Q4, their sales and legal teams were overwhelmed by simultaneous enterprise renewals and a pipeline of new mid-market deals. The primary issue was that everything looked urgent, which meant nothing received the right level of attention. We helped the team improve contract processes by creating a structured triage model that classified contracts into three streams: high-value enterprise deals with leadership involvement, medium-tier customer contracts that required legal review, and standard renewals that could move forward through automated templates. By focusing first on high-impact agreements, removing low-value distractions, and coordinating weekly alignment sessions between sales, finance, and legal, the company accelerated closures and reduced unnecessary negotiation cycles during their peak contract workload.

Example 2 — Helping a High-Fashion Brand Fix Procurement Contracts Across IT, Tech, Software, and Professional Services

A luxury fashion house engaged us when their procurement team was struggling to finalize multiple IT, software, and professional services agreements before budgets expired. The issue wasn’t legal complexity—it was a lack of clear priorities and inconsistent intake. Teams were spending time on small tactical contracts while strategic supplier agreements sat idle. We first helped procurement and legal jointly define Q4 priorities, identifying which vendors materially impacted operations or budget planning. Then we aligned internal stakeholders—procurement, IT, security, finance, and legal—through short weekly checkpoints focused exclusively on those priority contracts. We also cleaned up dormant deals and moved non-essential negotiations to Q1. As a result, the company stabilized its supplier pipeline, reduced negotiation drag, and avoided year-end spending pressure.

Example 3 — Training a Fintech Provider to Improve Contract Processes Through Templates, Policies, and Hands-On Guidance

A fintech services company asked us to improve their contracting efficiency during peak contract workload, but the real underlying problem was inconsistent knowledge across teams. Sales, operations, and product all used different contract versions, and only legal understood the approval thresholds and fallback positions. To improve contract processes sustainably, we conducted targeted training sessions on the correct templates, escalation rules, risk thresholds, and standard negotiation positions. We also introduced a “first-level review” checklist so business teams could handle straightforward issues themselves before involving legal. This freed the legal department to focus on high-value negotiations while enabling commercial teams to move faster with low-risk contracts. By year-end, the company saw a measurable reduction in turnaround time and far fewer last-minute escalations.

Benefits of Doing This Well

Business Impact: Speed, Clarity, Efficiency

Improved contract processes reduce cycle time, minimize distractions, and ensure that commercial teams focus on high-value opportunities. Prioritization improves forecasting accuracy and helps leadership plan revenue, cost, and budget decisions more reliably. The organization closes more meaningful contracts with less friction and greater transparency.

Legal Impact: Lower Disputes, Better Scalability

When priorities are clear and workflows are consistent, legal teams experience fewer urgent escalations and less rework. Contracts become more consistent, negotiation positions become clearer, and documentation improves. This reduces future disputes and enables legal teams to scale their support more effectively across the business.

Key Takeaways

- Improve contract processes early to handle peak contract workload confidently

- Set clear Q4 priorities across sales, procurement, legal, partnerships, and finance

- Remove dormant deals and focus resources where the business impact is highest

- Strengthen communication channels to prevent late-stage surprises

- Prepare the early Q1 pipeline only once critical Q4 contracts are secured

Conclusion & Call to Action

As year-end approaches, the difference between a controlled contracting function and a chaotic one often comes down to clarity, preparation, and alignment. Organizations that improve contract processes early manage peak contract workload more effectively and protect both commercial and legal outcomes. If your team needs support with contract prioritization, negotiation, or process improvement, AMST Legal can help you close Q4 efficiently while setting up a strong foundation for the new year.

Visit amstlegal.com to book a consultation with Robby Reggers via our appointment page.

The EU Right of Withdrawal Explained: What Businesses Need to Know

The EU right of withdrawal applies to almost everyone that sells anything online. It is more than a legal checkbox, because it is a practical rule that shapes how you sell to consumers across the EU. Because the right of withdrawal grants a short where a consumer can change one’s mind, it directly affects how sales, product, marketing and legal teams design checkout flows, confirmations and terms. Also, it influences trust: when customers know they can cancel within a defined period, they buy more confidently. In this article, we explain what the right of withdrawal is, why businesses need it, and where to place it in your contracts and online journeys. Finally, we explain an important change arriving in June 2026. Consumer-facing sites must offer a clear “Cancel my contract” function and provide clearer information in line with new EU rules.

What we’ll cover

- What the EU right of withdrawal (the 14-day cooling-off period) means in practice

- Who must comply and the types of contracts it applies to

- Where to include the right of withdrawal in your terms, UX, and communications

- What changes in June 2026 (including the “Cancel my contract” button)

- Key exceptions, common pitfalls, and practical steps to stay compliant

Context and importance of the topic

What the right is and why it matters (in plain business terms)

At its core, the right of withdrawal allows consumers to cancel certain distance or off-premises contracts within 14 days. Consumers can do this without giving a reason and without cost. In practical terms, this acts as a cooling-off period. Buyers can reassess the purchase after receiving goods or entering a service, especially when they could not examine the product in person. For a sales leader, this reduces friction during checkout and strengthens buyer confidence. For legal teams, it sets mandatory timelines and notices you must integrate into terms and customer messaging.

Practical challenges when it’s not addressed correctly

When businesses omit clear 14-day right of withdrawal information, the consequences escalate quickly. For example, the withdrawal period can extend by up to 12 months if you fail to inform consumers properly. Additionally, customers who struggle to cancel or cannot find the information will escalate to support, chargebacks, or regulators. As a result, your customer acquisition costs rise while margins erode through avoidable disputes and refunds. Therefore, clarity up front is more efficient than damage control later.

Opportunities if you handle it well

When you design the withdrawal experience thoughtfully, you create a measurable commercial advantage. Consequently, your brand earns trust, your sales cycle tightens, and your legal exposure shrinks. In addition, product and CX teams benefit from fewer support tickets, while finance gets more predictable refund flows. Moreover, a clear process provides structured feedback on why customers withdraw, which helps improve pricing, positioning, and onboarding.

EU Consumer Law – Right of Withdrawal

How this fits into the broader contract or business framework

Define the key documents and touchpoints

To operationalize the EU right of withdrawal, align four layers: (1) Terms & Conditions or Service Agreement for consumers, (2) order confirmation and onboarding emails, (3) website/app flows including account pages, and (4) support playbooks for frontline teams. Furthermore, ensure your privacy and data-deletion steps match the offboarding process where relevant. In each layer, there should be a reference to the right, explain the period, and point to the cancellation route.

Explain the connections between them

Your terms set the legal basis; your emails and pages make it actionable. Therefore, the contract should define the 14-day cooling-off period, the start date trigger (delivery of goods or conclusion of the service contract), the method for withdrawal, and any consequences (e.g., return shipping for goods, pro-rata charges for services started at the customer’s request). Meanwhile, your website and emails should offer direct links to the withdrawal instructions and—by June 2026—a clear “Cancel my contract” button for consumer contracts.

Keep flexibility while reducing risk

You can reduce churn risk while staying compliant by providing better pre-purchase information and post-purchase onboarding. For instance, set realistic product descriptions and trial guidance so customers know what to expect; that lowers withdrawal rates without restricting rights. In addition, use confirmations and reminders to clarify the start date and steps to cancel, which reduces misunderstandings. Finally, integrate a simple returns or service offboarding guide that explains timelines and what customers must do.

Practical examples and use cases

SaaS or tech deals (consumer context)

Imagine a B2C productivity app with monthly subscriptions. The consumer can exercise the right of withdrawal within 14 days from the conclusion of the service contract. If the customer expressly asks for immediate access during that period, you may charge for the portion of service already provided. However, you must have captured explicit consent and an acknowledgment that the 14-day right to cancel would be affected. Therefore, your signup flow should include a clear consent checkbox and a link to the withdrawal information.

Procurement or sales (hardware shipped to consumers)

Consider a retailer shipping smart devices to EU consumers. The 14-day right of withdrawal usually starts on delivery of the goods. Consequently, your confirmation email should display the delivery date and a direct route to initiate withdrawal. In addition, your returns page should specify the address, method of return, and refund timeline once the goods are received back in good condition. Because clarity here prevents disputes, your support team should use standard templates referencing the right and return steps.

Founders, CFOs, and entrepreneurs (pricing and refunds)

For early-stage founders selling direct-to-consumer, refunds can disrupt cash flow. Nevertheless, resisting the rule invites regulator attention and reputational damage. Instead, design a structured refund policy aligned with the cooling-off period, establish internal SLAs for refund execution, and publish the average refund timeline. Consequently, finance can forecast outflows, while leadership keeps regulators and payment providers comfortable with the company’s controls.

Where the right comes from what changes by June 2026

The EU Consumer Rights Directive (2011/83/EU) (link) sets the baseline for the EU right of withdrawal across distance and off-premises contracts. It defines the 14-day cooling-off period, outlines information duties for traders, and lists key exceptions. Moreover, it establishes the standard withdrawal form and clarifies the start dates for goods and services.

What changes by June 2026?

From June 2026, an additional requirement will apply under Directive (EU) 2023/2673, which amends the Consumer Rights Directive. It is important to realize that obligations tighten further.

Consumer-facing websites and apps will be required to present a clear “Cancel my contract” function and to inform consumers more clearly about withdrawal rights in their digital journeys. While the new requirement appears in rules that focus primarily on financial services, it signals a broader push for transparent, user-friendly cancellation in consumer contracts. Therefore, product and legal teams should treat 2025 as the build year: audit terms, update email templates, change the User Interface and improve the User Experience and the supporting content.

Where to add the right of withdrawal in your materials (and why)

Contracts and legal terms

Place a Right of Withdrawal clause in your consumer Terms & Conditions or Service Agreement. In that clause, state the 14-day period, define the trigger (delivery of goods or conclusion of services), reference the standard withdrawal form or provide an online form, and explain the process and timeline for refunds. Additionally, specify the customer’s obligations on goods (e.g., keep items in reasonable condition, return within a set timeframe) and any pro-rata charges for services if the consumer asked to start service during the cooling-off period.

Website and app flows

Add a dedicated Withdrawal & Cancellation page in your help or account area that:

- (1) explains the right of withdrawal in plain language,

- (2) links the process to the specific purchase,

- (3) offers the standard form or online equivalent, and

- (4) outlines refund timing.

Consequently, consumers can self-serve, which reduces support volume. By June 2026, implement a visible “Cancel my contract” button for consumer contracts and link it to confirmation and status pages that show progress and refund expectations. Remains to be decided how clear this ‘button’ or link will need to be.

Emails and communications

Include a short right of withdrawal notice in the order confirmation or service activation email. Because that message helps repeat the 14-day timeframe, provide a direct link to cancel, and attach or link to the standard withdrawal form. In addition, remind the customer of any return requirements for goods and clarify whether service has started at their request.

Exceptions you should know (short overview)

Although the EU right of withdrawal is broad, there are several important exceptions. These include (non-exhaustive list – conditions apply):

- Certain real estate, construction, social services, healthcare, gambling, and package travel contracts

- Custom-made or personalised goods

- Perishable products that can deteriorate quickly

- Sealed items unsealed after delivery for health or hygiene reasons

- Goods inseparably mixed with others after delivery

- Unsealed software, audio, or video recordings

- Digital content supplied online (not on a tangible medium) once performance has begun with the consumer’s express consent and acknowledgment of losing the withdrawal right

- Public auctions and regular household deliveries (e.g. groceries)

- Newspapers and magazines, except for subscriptions

- Services tied to a specific date, such as accommodation, transport, car rental, catering, or leisure activities

Benefits of doing this well

Business impact: speed, clarity, efficiency

When your 14-day right to cancel experience is clear, your sales funnels run smoother. Consequently, customers buy with confidence, support works from standard playbooks, and leadership sees fewer escalations. Additionally, transparent cancellation keeps payment processors comfortable, which can reduce chargeback risk and processing headaches. As a result, you gain speed and predictability without sacrificing compliance.

Legal impact: fewer disputes, cleaner scaling

Clear rights and processes lower ambiguity, which lowers disputes. Moreover, documenting consent for immediate service start and providing a robust cancellation route help you defend decisions if challenged. Because the EU right of withdrawal is standardized across the EU, a well-designed approach scales into new markets with fewer local adjustments.

Key takeaways

- The EU right of withdrawal grants consumers a 14-day cooling-off period for many distance and off-premises contracts.

- If you fail to inform consumers clearly, the withdrawal window can extend significantly, increasing risk and cost.

- By June 2026, consumer-facing sites must include a clear “Cancel my contract” function and clearer withdrawal information.

- Place the right in your terms, emails, and UX, and ensure support follows a standard offboarding playbook.

- Map exceptions to your offering and draft specific, plain-language guidance to prevent misunderstandings.

Conclusion & call to action

The EU right of withdrawal is not simply a legal obligation. It is a real risk for companies if not done right. Next to the way consumers order online, this is one of the areas where we see lots of court cases in the Netherlands. It is an essential part of how modern consumer businesses earn trust and reduce friction. Because the rules tighten in June 2026, now is the moment to update terms, start discussing how to build the “Cancel my contract” function, and standardize communications. If you want a practical review of your flows – commercial and legal – we can help you align contract language, UI vs UX design, and support so compliance becomes a smoother part of the customer experience.

Go here to book a consultation or discuss an interim engagement.

Background

Author: Robby Reggers, Founder of AMST Legal (amstlegal.com), recognized by Legal Geek as a LinkedIn Top Voice for contracting, negotiation, and interim GC work.

How we work: AMST Legal supports clients per contract/project or on an interim basis (set hours per week as GC/Legal Counsel).

Why Order Forms Are Essential in Tech & SaaS Contracts

When we support clients in sales or procurement negotiations, I often get the same reaction: “Why would you get involved in the Order Form? Isn’t that just the cover page?” It isn’t – It is where the main parts of the contract are agreed, referring to the terms and condition relevant for the contract. Let us start with explaining you: what is an Order Form – showing you a free order form. Next, we will explain why Order Forms in SaaS and Tech are important. Contact us for an order form template you can use for your business.

In Tech and SaaS contracts, the Order Form is where the deal becomes clear. It states what is being purchased, the price that applies, and the term that governs delivery. Many teams rush to the Master Service Agreement (MSA) and miss that most commercial disagreements start with an incomplete or vague order form. When the order form is specific, sales cycles move faster, procurement comparisons become straightforward, and legal reviews stay focused on real risk rather than avoidable ambiguity.

What we will cover

- We will first explain what Order Form is

- Why business teams should treat order forms as the commercial source of truth

- How lawyers keep MSAs steady while order forms and Product Terms handle change

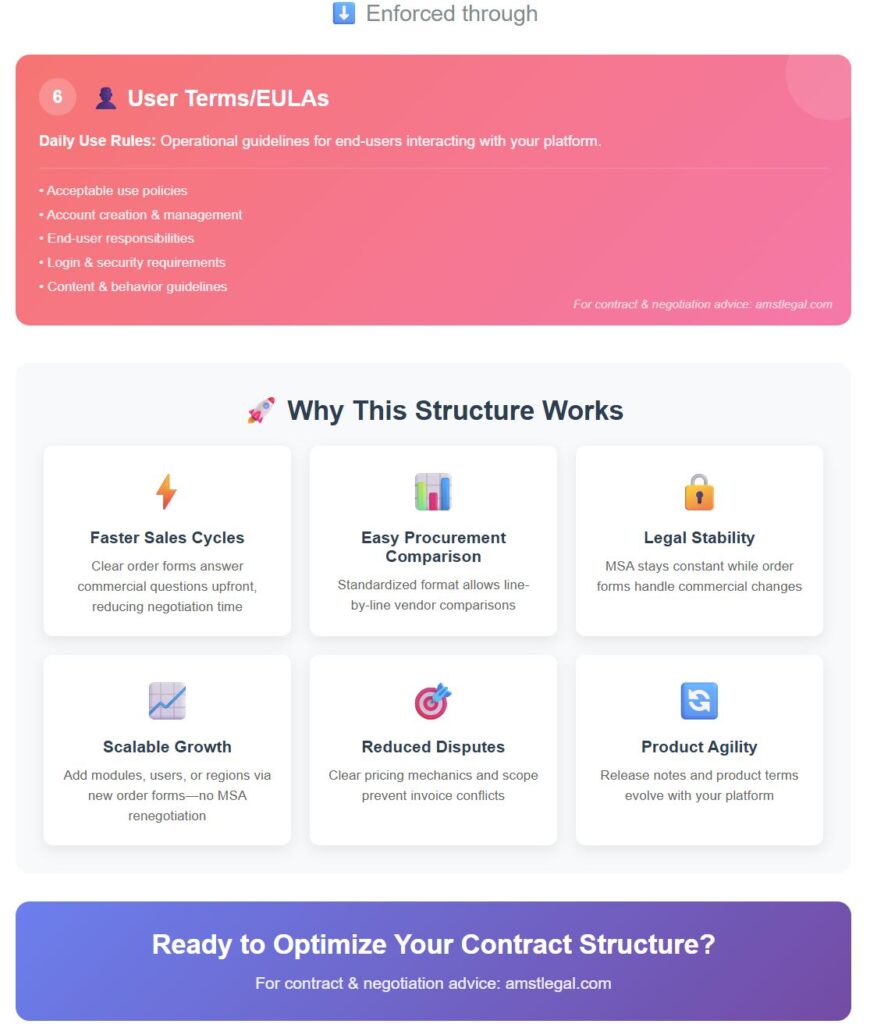

- The contract layers: Order Form → MSA → Product Terms → Release Notes → User Terms/EULAs

- Practical examples from SaaS, FinTech, AdTech, and software licensing

- The advantages of clear order forms for speed, scalability, and lower dispute risk

What is an Order Form?

The Commercial Core of Your Deal

An Order Form is the final commercial document that captures exactly what you are buying, at what price and under what terms. It is the main body of the contract that refers to the General Terms and Conditions and other relevant terms. While the MSA sets your legal foundation (as explained below), the Order Form handles the business specifics. It mentions which modules you’re purchasing, how many people can use the products, what your pricing looks like, and what the term is.

Why It Matters More Than You Think

Most commercial disputes don’t start due to complex legal language. Conflicts usually arise from vague Order Forms that leave pricing mechanics unclear. Smart procurement teams review these line-by-line because that’s where the real cost drivers live. For sales teams, a precise Order Form means fewer follow-up questions and faster closes. The (example) template Order Form shown in the visual below demonstrates how clear commercial terms create scalable frameworks that support business growth while keeping legal friction minimal. Contact us if you would like to receive the full Template in MS Word.

The business team’s perspective

Order form scope, price, and term in SaaS contracts

For sales and procurement, the order form is the single page that answers core questions: what modules or services are included, which users or environments are covered, and how pricing is calculated. In SaaS, that often means defining seats, API calls, storage, or specific feature bundles. It should also state currency, billing interval, and start date, because these elements drive forecasting and budgeting. When the order form captures these points precisely, account teams avoid re-explaining commercial terms later.

Renewal and pricing mechanics buyers look for

Procurement teams read renewal and pricing clauses first, since those parts define cost over time. Therefore, the order form should set the initial term, renewal type (auto-renew or opt-in), notice periods, and any indexation or tiered pricing. If usage pricing applies, the order form should include the metric, the threshold that triggers higher tiers, and how overages are billed. Clear mechanics reduce invoice disputes and help both sides model the total cost of ownership.

Common pitfalls when the order form is vague

Problems arise when the order form lists a product name but not the components included, or when it mentions a discount without stating the list price it applies to. Ambiguity also creeps in when pricing changes without notice. To avoid this, attach a dated price table or include a URL with a “snapshot” date and a change control note. Consequently, future changes do not rewrite the past deal.

The lawyer’s perspective

Contract layers explained

Lawyers design tech agreements as layers. The MSA is the legal foundation: liability, IP ownership, confidentiality, governing law and data protection (with link to a DPA) are mentioned here and should change rarely. The Order Form is the commercial record for this transaction: scope, price, term, invoicing, and special conditions tied to this customer. Product Terms are modular schedules for service levels, security, data processing, or feature-specific rules; they can evolve with the product through versioning.

Where Release Notes fit and what they should contain

Release Notes inform customers about new features, changed behaviors, and deprecated functionality. They should explain what changed, when it changed, and whether customer action is required. Although release notes are not a substitute for contract amendments, they support Product Terms by giving timely context and preserving trust. As a result, product teams can move faster without surprising customers.

User Terms/EULAs—daily use rules and acceptance

User Terms or EULAs govern daily use: acceptable use, account rules, and end-user responsibilities. Vendors typically present them at login or installation, and acceptance occurs through click-through or continued use. Because they sit closer to the product, they handle operational details that do not belong in the MSA. Meanwhile, the order form points to these terms so all documents align.

Practical examples from tech contracts (SaaS, FinTech, AdTech, licensing)

FinTech modules and compliance pricing

A FinTech provider sells “Payment terminals,” “Cards” and “Reporting” modules and/or software. The MSA holds the general legal terms, including responsibilities, liability caps and compliance warranties. The order form mentions the products, services, modules and defines e.g. usage tiers for transactions. Product Terms include specifics about the products and services. Therefore, adding the “Reporting” module later only requires a new order form, not a new MSA.

AdTech data use and campaign terms

For AdTech where companies agree that the Customer can place ads on certain platforms, like Google, Facebook, TikTok and Reddit, the following applies. Such a platform’s MSA covers IP, Confidentiality, Compliance and data ownership. The order form sets campaign spend, covered countries, pricing of the usage and the term. Product Terms describe permissible data processing and retention periods. API terms define how data is shared. Consequently, procurement can compare campaigns easily while legal certainty remains intact.

Software license scaling and feature updates

For a software license agreement, the MSA also covers IP ownership, confidentiality, liabilities and warranties. The order form defines license metrics (payment per user, per device, or per core), regions, and support level. Product Terms set service levels and maintenance windows. When new features launch, release notes describe them, and a short amendment (or new order form) adds the features to the customer’s bundle.

Advantages of clear order forms for sales, procurement, and legal

Speed, comparability and lower dispute risk

A precise order form shortens negotiation time because it answers commercial questions upfront. Procurement can compare offers line-by-line; sales can set accurate expectations; finance can invoice without guessing. Moreover, clarity reduces scope disputes and credit-note requests after go-live.

Scaling via new order forms – not new MSAs

As customers grow, you should add modules, users, or regions through additional order forms. This approach avoids reopening liability or IP terms and keeps the legal backbone stable. In addition, standardized order forms help revenue teams expand accounts without re-educating stakeholders. Also see this article “Use Terms & Conditions where possible” we wrote about this subject covering how you can win time by using Order Forms referring to T&Cs..

Typical Contractual set-up of an MSA

Details differ but Same Setup For Most Tech Contracts

The confusion between MSA vs Product Terms vs User Terms (and where Release Notes fit in) is something I see all the time in SaaS/software negotiations. If you’re doing research across vendors, it is clear that there are differences. Each vendor uses different names and structures, but the pattern is the same.

Typical Contractual Setup

MSA (or Customer Agreement / General Terms)

The legal backbone (risk allocation, liability, IP, governing law).

Order Form (Order, Insertion Order, Subscription Order)

The commercial record (what is being bought, pricing, term).

Product Terms (sometimes called Service-Specific Terms / Product Annexes)

Service-specific rules, SLAs, DPAs, uptime, feature use restrictions.

User Terms / EULAs

The general “rules of use” the end-user accepts (click-through at login/download), often more operational.

Release Notes

Not contracts in themselves, but linked to Product Terms or documentation. They describe changes in features or performance. Some vendors incorporate them by reference (‘the service may change as described in Release Notes’).

Clarity is key – Which Questions to Ask?

When the documents above are used and applicable, please ensure that you ask the following questions as a buyer / customer. Many discussions arise afterwards as to the applicability of these documents. What it all comes down to is whether you as a seller can prove that you have adequately informed the buyer of relevant terms.

- Where are each of these documents published?

- Who gets notice when they change?

- Which ones bind the customer vs the end-users?

- Are Release Notes purely informational, or do they legally modify the service?

Key takeaways

- Treat the order form as the commercial source of truth.

- Keep the MSA stable; place change in Order Forms and Product Terms.

- Use Release Notes and User Terms to manage product behavior and daily use.

- Define renewal, pricing mechanics, and usage metrics clearly to prevent disputes.

- Add growth through new order forms rather than new MSAs.

Conclusion & call to action

A careful design makes tech and SaaS deals easier to sell, buy, and manage. Mainly, it is all about flexibility and clarity. It gives sales and procurement a clear document to rely on while the MSA protects core legal risk.

Also see the following articles on the importance of Order Forms from Contract Nerds and Ironclad.

If your contracts feel harder than they should, AMST Legal can help you set up this layered structure and train your teams to use it well. To discuss your current setup or a specific deal, book a call here

The term ‘Order Form’ is most commonly used in Tech/SaaS. Other words for Order Form are:

📍Order / Ordering Document

📍Subscription Order / Service Order

📍Work Order (more traditional/industrial)

📍Insertion Order (IO) – common in AdTech/Media buying

📍Statement of Work (SOW) – for project-based professional services

📍Purchase Order (PO) – buyer-issued, especially in procurement-heavy industries (mostly as confirmation of the Order Form)

📍Quote / Quotation – becomes binding when signed/accepted

📍Service Agreement

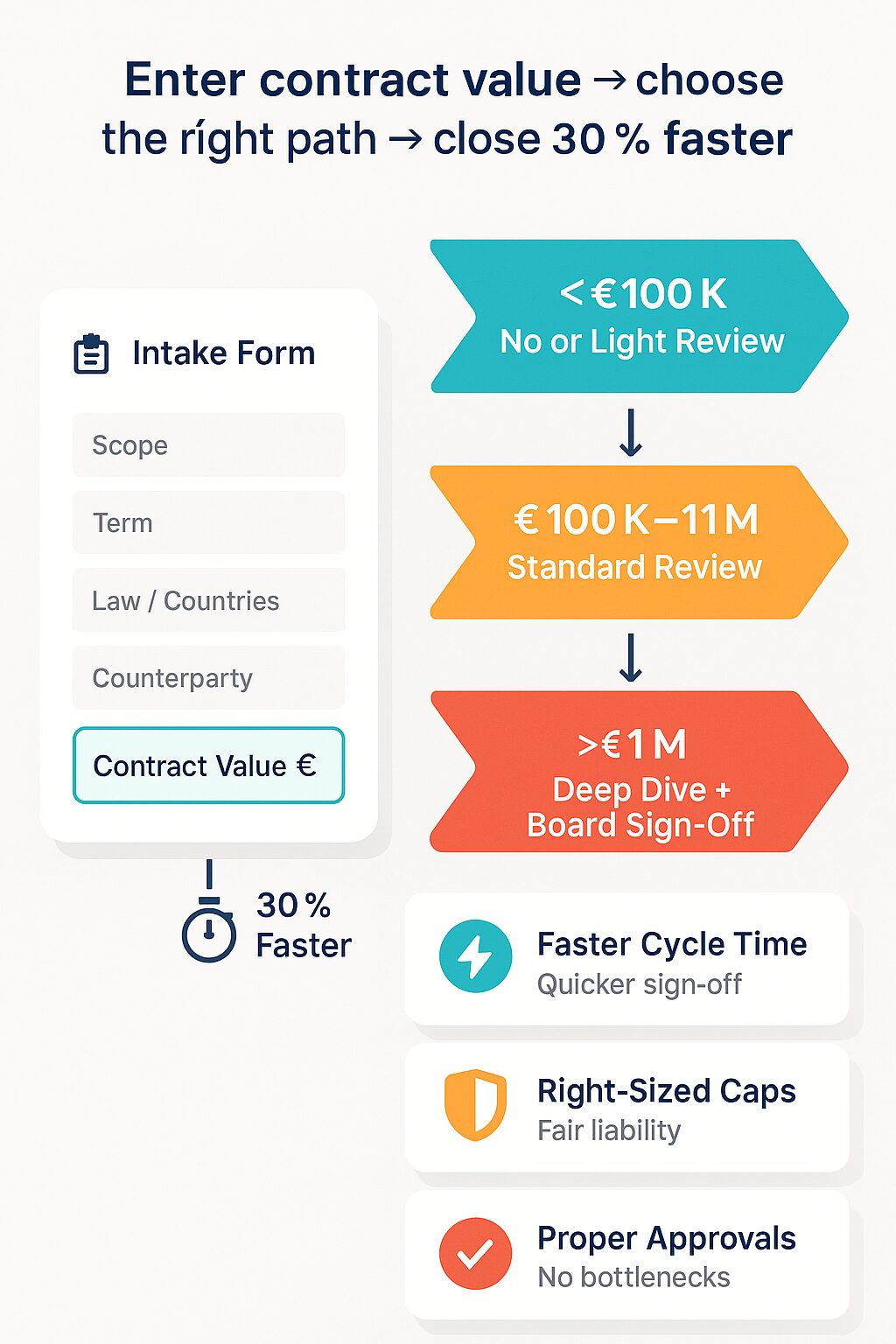

Reduce Contract Review Time 30 % with One Simple Question – Contract Value

Why do all lawyers first need to ask what the contract value is, before reviewing or red-lining a contract? When Legal receives a draft contract, their first task is to gather the facts they need to review, advise and negotiate effectively. That means asking questions – sometimes a lot of them. This is important for the liability limits, risk assessment and signing authority. Most common questions are regarding scope, background, term, governing law, counter-party risk and more. Yet one question towers above the rest:

“What is the total (or yearly) contract value?”

Example: A €30 000 software tool slides through with a few light tweaks by legal. A €3 million multi-year rollout for a software tool that involves lots of sensitive data? That triggers data privacy, cyber-insurance review, CFO approval and deeper due diligence. Same inbox, two very different paths – because of a single figure.

That number steers everything from the depth of due diligence to the height of liability caps and the level of internal approvals required. In organizations with mature legal teams and operations, the contract value is part of a triage system. This includes a short intake questionnaire, preferably delivered by legal-tech platforms, web-forms or templated e-mails. Once you have that information, that routes each contract to the right template, reviewer and approval chain within minutes. Sharing the value up front isn’t paperwork for paperwork’s sake; it’s the key that lets the legal team protect the business quickly, proportionately and cost-effectively.

What We Will Cover

- Background & importance—how contract value underpins every part of contract strategy.

- How to calculate contract value. Practical formulas for Sales, Procurement and Partnerships; the difference between total contract value (TCV) and Annual Contract Value (ACV).

- Ten concrete reasons lawyers insist on the figure before they mark up a clause.

- Explanation of terms used like contract value, annual contract value, total contract value and why it is linked to liability caps

- Process tip. How can you make contract value a standard field in your deal-intake form.

- Quick summary & next steps.

Background & Importance: Value Drives Risk

Legal review is risk management in writing. How forcefully you negotiate liability caps, payment security or exit rights depends on impact—financial, operational and reputational. Contract value (sometimes called deal worth) is the fastest, most objective proxy for that impact. Provide it late and every downstream decision is delayed.

Think of contract value as the master input cell at the top of a spreadsheet. Change the figure and every formula beneath—warranties, indemnities, insurance checks, delegated approvals—re-calculates instantly.

How to Calculate Contract Value

Because “value” means different things in Sales, Procurement and Channel Partnerships, align on a common formula before you fill in the intake form.

| Context | What the number should capture | Practical formula |

|---|---|---|

| Sales / Revenue contracts | All cash you expect to receive from the customer—set-up fees, recurring licence, usage charges, committed renewals, minimum guarantees. | Total Contract Value (TCV) = One-off fees + (Recurring fee × Committed term) Annual Contract Value (ACV) = TCV ÷ Term (years) |

| Procurement / Spend contracts | All cash your company will pay the supplier—tooling, minimum orders, variable unit pricing, support fees and committed renewals. | Total Spend = Up-front costs + (Estimated annual spend × Term) |

| Partnership & Reseller deals | The share of revenue or discount margin that will flow between the parties over the commitment period—including tiered rebates or volume incentives. | Channel Value = (Projected end-customer revenue × Margin or Rev-share %) × Term |

Total vs. Annual Contract Value. Why Both Matter

When negotiating contracts it is important to know the total contract value and the annual contract value. Next to signing authority relevance (who can sign until what amount), it is also crucial to know for team involvement & liability discussions. In case of smaller contracts, you only need to involve a smaller team with less specialists, for larger deals more specialists need to be involved. Additionally, the limit of liability can be linked to either the total and/or the annual value of the contract. It is used by legal in commercial contracting discussions to agree on a limit of liability.

- Total contract value (TCV) answers: “What is the maximum euro exposure over the life of the deal?” Lawyers plug this into liability-cap formulas, insurance checks and worst-case damage models.

- Annual Contract Value (ACV) normalises multi-year deals to a single-year figure. Many caps and service-credit schedules reference “one year’s fees,” so ACV keeps negotiations apples-to-apples regardless of term length.

Pro tip: For evergreen (auto-renew) contracts, calculate TCV and ACV on the first committed term.

Calculation Examples

| Scenario | Calculation | Result |

|---|---|---|

| SaaS sale: €20 000 set-up + €5 000 / month, 3-year term | TCV = 20 000 + (5 000 × 36) | €200 000 ACV ≈ €66 667 |

| Procurement: €30 000 tooling + €150 000 / year, 4 years | Total Spend = 30 000 + (150 000 × 4) | €630 000 |

| Reseller: €2 m revenue / year, 15 % margin, 2 years | Channel Value = (2 000 000 × 0.15) × 2 | €600 000 |

Include realistic high-end estimates of usage fees—liability caps track exposure. Exclude VAT/sales tax; legal risk follows net commercial value.

Ten Reasons Lawyers Need Contract Value Up Front

See below a list of 10 reason why lawyers should always ask the contract value of a contract. From lawyers, inhouse legal counsel to paralegals, Legal should always know the spend or potential income of a contract before starting work on a contract. How else is Legal able to advise someone on a contract?

I have made this mistake and started with a deep dive of a contract, providing the sales team with detailed contract advice. I thought they would be satisfied, but because it was only a 20K contract the advice was not fit for purpose.

Therefore, before you start advising as Legal, ask: “What’s the annual contract value of this contract”.

As someone sending a contract to Legal, add: “The estimated annual contract value of this contract is XYZ EUR. Potentially add: We are not sure of this value, but this is the best estimate I can provide you at this moment.”

1 – Level of Legal Review (Scrutiny)

This is one of the most important reasons to know the contract value. How important is the contract for the company?

A €50 000 Master Services Agreement doesn’t need a four-week deep dive; a €20 million strategic partnership does. Contract value tells lawyers how deep to dig, which template to use and how many specialists to involve.

2 – Indemnities & Liability Caps

As one of the most negotiated clauses, this directly ties into the contract value as liability limits / caps are directly linked thereto.