Peak Workload – How to Improve Contract Processes and Set Q4 Priorities

Also notice an enormous peak of contracts that need to be signed before the end of the year? This year will be no different. After starting as a lawyer in 2004, I constantly noticed this peak at the end of the year. After asking my fellow lawyers & negotiators, this seems to be a constant for most corporate & commercial contracting professionals. As teams enter the final stretch of Q4, the pressure to improve contract processes grows rapidly. Sales, procurement, legal, partnerships and finance all face a peak contract workload while internal availability drops and deadlines accelerate. This combination often produces stress, bottlenecks and unclear priorities. However, when organizations take a structured approach to Q4 planning and align on meaningful priorities early, they reduce friction and accelerate execution without sacrificing legal quality or commercial accuracy. This article explains how business and legal teams can set the right Q4 priorities, streamline internal coordination and manage contracts intelligently during the busiest period of the year.

With 19 December 2025 expected to be the final practical day for executing agreements, it’s more important than ever to focus on the contracts that drive strategic impact. At the same time, managing dormant deals, clearing roadblocks early and preparing the groundwork for Q1 2026 can significantly reduce last-minute stress and ensure a seamless transition into the new year.

This guide breaks down 9 practical, high-impact actions that will help you align your teams, accelerate deal cycles, and finish the year strong without sacrificing quality or burning out your workforce.

What We Will Cover

- How to set clear, realistic Q4 priorities across sales, procurement, legal, and leadership

- How to improve contract processes during peak contract workload

- How to reduce bottlenecks and eliminate low-value cycles

- How to balance speed with legal and commercial safeguards

- How to prepare for the new year while keeping Q4 delivery on track

Context and Importance of the Topic

Why Q4 Creates Pressure for Commercial and Legal Teams

Peak contract workload typically builds in November and December and slows down the Friday before Christmas. This is because companies push to finalize revenue, secure procurement budgets, and complete partnership renewals before year-end. Sales teams try to close deals to meet quotas, while procurement aims to finalize vendor agreements before budgets expire. Meanwhile, legal teams face a surge in review requests with shorter turnaround expectations, fewer available decision-makers, and a higher volume of non-standard negotiations. This combination magnifies misalignment and exposes the weaknesses of unclear processes.

Practical Challenges When Q4 Is Not Managed Properly

Teams that lack clear priorities face an immediate productivity drop. Sales focuses on high-value customer deals, procurement targets last-minute supplier contracts, and partnerships try to finalize distributor or reseller agreements—yet all three funnel into a single legal team with limited capacity. Without alignment, low-impact work gets equal attention, dormant deals drain time, and review queues grow faster than they shrink. These issues slow contracting cycles, frustrate counterparties, and risk missing revenue or budget deadlines.

Opportunities When Q4 Priority Setting Is Done Well

When organizations define clear Q4 priorities, they improve contract processes across multiple dimensions. Legal gains predictability, commercial teams gain transparency, and leadership gets a clear view of revenue or procurement impact. Prioritized work also reduces rework, shortens negotiations, and channels resources to the contracts that matter most—reducing calendar stress and improving year-end decision-making. As a result, teams close more impactful deals without sacrificing quality or compliance.

How This Fits Into the Broader Contract or Business Framework

Key Documents, Processes, and Phases to Consider

Year-end contracting typically spans three categories: customer-facing sales agreements, procurement/vendor contracts, and partnership arrangements such as distributors, resellers, or strategic alliances. Each flows through a predictable contracting process: intake, triage, drafting, negotiation, approval, and signature. During Q4 peaks, organizations should reassess intake channels, approval chains, fallback positions, signature authority, and final documentation workflows. When these elements are reasonably defined, teams move faster and reduce unnecessary escalations.

Connecting Processes Across Functions

Contracting cannot sit within a single department, especially during Q4. Sales needs structured negotiation paths for pricing, service levels, and timelines. Procurement requires clarity on commercial terms, supplier evaluation, and risk ownership. Partnerships depend on a balanced approach to exclusivity, territories, and performance commitments. Legal sits at the center of all three, translating business intent into enforceable language while protecting the organization. Improving contract processes requires connecting these groups so that information flows freely and issues surface early.

Balancing Flexibility With Risk Management

Speed increases during peak contract workload, but so does risk exposure. To maintain flexibility without losing safeguards, teams can agree on pre-approved fallback clauses, risk thresholds, and decision rules. For example, a customer deal with standard terms may bypass legal review, while a supplier contract above a certain financial threshold requires legal approval. Clear rules reduce cycle time, protect the business, and avoid last-minute escalations to leadership.

Take These Nine Actions to Successfully Close Out the Year

Now, let’s go into the practical examples and specific actions you can take at the end of the year. This will take preparation and buy in from the other teams, so focus on cooperation and communication with other teams. Avoid the top down approach where possible (see our article about this here). The end of the year can be a stressful period so it is all about creating understanding with the other teams and focusing on helping each other where possible to reach the best result. While trying to avoid the top down approach, do ensure that you have champions to reach your results in all layers in the organization. This means involving the leadership and senior management, as well as involving all team members of the commercial team. In our commercial contracting “world” this means Sales, IT, Tech, Procurement and other Commercial Business Teams entering into purchase, vendor and supplier contracts.

1. Align Your Teams on What Matters Most

Before diving into individual contracts, bring your cross-functional teams together including Legal, Sales, Procurement, Operations, and Finance. A lack of alignment is the fastest path to missed opportunities and duplicated effort. See also the article from the leading university MIT ‘3 ways to keep your team together in critical times’ here.

How to do it:

- Hold a short, focused Q4 planning session with key stakeholders.

- Map out each active deal and assign priorities.

- Identify blockers early (approvals, redlines, internal dependencies).

- Consolidate everything into a shared, accessible priority list.

Why does this work? When everyone knows the plan—and their role in it—you replace chaos with coordinated progress.

2. Lock in the Q4 Deals That Really Count

Once priorities are aligned, spotlight the agreements that are critical to your company’s year-end financials or strategic objectives.

Recommended actions:

- Assign dedicated team members to shepherd these deals across the finish line.

- Keep internal and external stakeholders informed with regular updates.

- Use approved tracking tools consistently to avoid miscommunication.

Ask yourself: Which deals materially impact revenue, partnerships, or strategic positioning? Based on your answer to this, it might make it easier to know what to focus on.

3. Give High-Value Deals the Time They Deserve

Large or strategically important agreements often involve more complex negotiations and require input from senior leadership.

Best practices:

- Conduct weekly status syncs with deal teams.

- Flag potential risks early and build backup plans.

- Pre-schedule time with executives for final reviews and approvals.

Why this matters:

These contracts deliver the greatest impact—and often require the most care.

4. Close Smaller Deals Quickly to Build Momentum

Not every deal needs heavy negotiation. Smaller, straightforward agreements can be finalized quickly when approached with intention. As also confirmed in numerous studies and by Harvard University (see this link explaining why celebrating small wins matters).

Your playbook:

- Set a target date in early December to close these low-effort deals.

- Automate workflows (signing, approvals, templates) wherever possible.

The benefit:

Quick wins free your team to focus on more complex negotiations later in the month.

5. Tackle Dormant Deals Before They Drain Time

Dormant contracts—ones you’ve chased without progress—tend to clutter your pipeline.

How to manage them:

- Evaluate whether each deal can realistically close in Q4.

- If not, document the status and move it into your 2026 pipeline.

Pro tip:

Clearing out stalled deals improves focus and removes unnecessary noise.

6. Communicate Proactively With Customers or Vendors

Strong, consistent communication prevents last-minute surprises and keeps deals on track. This sounds so logic that we should not even mention it, but in most companies that we have been involved in, we see that it is very common that people are only waiting for an answer. We understand that this happens as there are hundreds of contracts to be managed, but this waiting game will often lead to last-mite stress and very high peaks just before the start of a holiday period.

What to do:

- Align on closing timelines and expectations.

- Follow up consistently (but respectfully).

- Confirm customer-specific requirements, e.g., signing protocols, timing, legal or compliance approvals.

Why it helps:

Transparency builds trust and keeps your pipeline moving smoothly.

7. Empower Your Team With the Right Tools and Instructions

Your team can only move as fast as your internal systems allow.

Set them up for success by:

- Storing contracts in the correct internal locations for compliance and visibility.

- Tracking negotiation, approval, and signature steps in your official tools.

- Reminding everyone of approval thresholds, escalation paths, and policy requirements.

Outcome:

Streamlined workflows prevent confusion and reduce turnaround times.

8. Review Your Processes—Not Just the Contracts

A successful year-end close isn’t just about finishing agreements. It’s about ensuring your internal process supports fast, compliant execution.

Questions to consider:

- Are approval chains clear and respected?

- Are compliance checks documented?

- Who is available for year-end signatures?

Why it matters:

Even the best-negotiated deal can stall if your internal process is slow or unclear.

9. Only Prepare Q1 2026 Deals When Your Q4 Is Under Control

If your team has extra capacity, now is the perfect time to set up Q1 for success—but only after critical Q4 work is complete.

Suggested early prep:

- Refresh templates and fallback clauses.

- Schedule early-January alignment sessions.

- Resolve known issues that could delay Q1 negotiations.

Key reminder: Year-end focus should stay firmly on finishing 2025 strong.

Practical Examples and Use Cases

Example 1 — Supporting a Tech Company Facing End-of-Year Customer Renewals and New Enterprise Deals

When we supported a fast-growing SaaS company preparing for a demanding Q4, their sales and legal teams were overwhelmed by simultaneous enterprise renewals and a pipeline of new mid-market deals. The primary issue was that everything looked urgent, which meant nothing received the right level of attention. We helped the team improve contract processes by creating a structured triage model that classified contracts into three streams: high-value enterprise deals with leadership involvement, medium-tier customer contracts that required legal review, and standard renewals that could move forward through automated templates. By focusing first on high-impact agreements, removing low-value distractions, and coordinating weekly alignment sessions between sales, finance, and legal, the company accelerated closures and reduced unnecessary negotiation cycles during their peak contract workload.

Example 2 — Helping a High-Fashion Brand Fix Procurement Contracts Across IT, Tech, Software, and Professional Services

A luxury fashion house engaged us when their procurement team was struggling to finalize multiple IT, software, and professional services agreements before budgets expired. The issue wasn’t legal complexity—it was a lack of clear priorities and inconsistent intake. Teams were spending time on small tactical contracts while strategic supplier agreements sat idle. We first helped procurement and legal jointly define Q4 priorities, identifying which vendors materially impacted operations or budget planning. Then we aligned internal stakeholders—procurement, IT, security, finance, and legal—through short weekly checkpoints focused exclusively on those priority contracts. We also cleaned up dormant deals and moved non-essential negotiations to Q1. As a result, the company stabilized its supplier pipeline, reduced negotiation drag, and avoided year-end spending pressure.

Example 3 — Training a Fintech Provider to Improve Contract Processes Through Templates, Policies, and Hands-On Guidance

A fintech services company asked us to improve their contracting efficiency during peak contract workload, but the real underlying problem was inconsistent knowledge across teams. Sales, operations, and product all used different contract versions, and only legal understood the approval thresholds and fallback positions. To improve contract processes sustainably, we conducted targeted training sessions on the correct templates, escalation rules, risk thresholds, and standard negotiation positions. We also introduced a “first-level review” checklist so business teams could handle straightforward issues themselves before involving legal. This freed the legal department to focus on high-value negotiations while enabling commercial teams to move faster with low-risk contracts. By year-end, the company saw a measurable reduction in turnaround time and far fewer last-minute escalations.

Benefits of Doing This Well

Business Impact: Speed, Clarity, Efficiency

Improved contract processes reduce cycle time, minimize distractions, and ensure that commercial teams focus on high-value opportunities. Prioritization improves forecasting accuracy and helps leadership plan revenue, cost, and budget decisions more reliably. The organization closes more meaningful contracts with less friction and greater transparency.

Legal Impact: Lower Disputes, Better Scalability

When priorities are clear and workflows are consistent, legal teams experience fewer urgent escalations and less rework. Contracts become more consistent, negotiation positions become clearer, and documentation improves. This reduces future disputes and enables legal teams to scale their support more effectively across the business.

Key Takeaways

- Improve contract processes early to handle peak contract workload confidently

- Set clear Q4 priorities across sales, procurement, legal, partnerships, and finance

- Remove dormant deals and focus resources where the business impact is highest

- Strengthen communication channels to prevent late-stage surprises

- Prepare the early Q1 pipeline only once critical Q4 contracts are secured

Conclusion & Call to Action

As year-end approaches, the difference between a controlled contracting function and a chaotic one often comes down to clarity, preparation, and alignment. Organizations that improve contract processes early manage peak contract workload more effectively and protect both commercial and legal outcomes. If your team needs support with contract prioritization, negotiation, or process improvement, AMST Legal can help you close Q4 efficiently while setting up a strong foundation for the new year.

Visit amstlegal.com to book a consultation with Robby Reggers via our appointment page.

Legal Intern Amsterdam – Contracts, AI & Legal Tech

Ben jij rechtenstudent en nieuwsgierig naar hoe technologie en juridische praktijk elkaar versterken? Bij AMST Legal zoeken we een student-stagiair Amsterdam / legal intern Amsterdam die wil ervaren hoe modern contracteren en legal operations in de praktijk werken. In deze juridische stage werk je direct samen met de oprichter én het bredere team. Daarnaast krijg je de kans om mee te bouwen aan de manier waarop we AI inzetten in ons werk — zowel intern als bij onze cliënten. Lees het artikel “Legal Intern Amsterdam bij AMST Legal – Contracts, AI & Legal Tech in de praktijk” om meer te weten over de stage.

Deze juridische stage is perfect voor iemand die houdt van recht én innovatie. Je leert stap voor stap hoe contracten worden opgebouwd, hoe technologie juridische processen ondersteunt en hoe AI het vak verandert. Hiermee ontwikkel je praktische vaardigheden. De student-stagiair Amsterdam werkt mee aan contracten voor tech- en SaaS-bedrijven en schrijft samen met het team aan juridische artikelen en LinkedIn-posts.

Wat je gaat doen tijdens je stage

Afwisselende taken met echte impact

Je werkzaamheden zijn gevarieerd en altijd gericht op echte impact. Denk bijvoorbeeld aan:

- Opstellen en beoordelen van commerciële contracten voor tech-, SaaS- of servicebedrijven

- Verbeteren van juridische templates en playbooks voor cliënten

- Schrijven van juridische memo’s en samenvattingen in heldere taal

- Ondersteunen bij general-counsel-werk, zoals contractbeheer of interne adviezen

- Onderzoeken hoe AI-tools contractwerk, legal research en workflows kunnen verbeteren

- Meewerken aan blogs, artikelen of LinkedIn-posts over juridische en AI-onderwerpen

Daardoor krijg je inzicht in hoe moderne juridische dienstverlening eruitziet — waar recht, business en technologie samenkomen.

De rol van AI, Tech en Legal Innovatie

Werk mee aan de toekomst van juridische dienstverlening

Bij AMST Legal geloven we dat AI juristen niet vervangt, maar hen juist slimmer laat werken. Als legal intern Amsterdam speel je daarin een actieve rol.

We implementeren momenteel AI-systemen die helpen bij het analyseren, opstellen en beheren van contracten. Bovendien ondersteunen we cliënten die hun juridische processen willen moderniseren. Omdat jij hierbij onmisbaar bent, help je daarbij met onderzoek, testen en het documenteren van resultaten.

Voorbeelden van jouw bijdrage

- Verschillende AI-tools vergelijken en hun sterke en zwakke punten samenvatten

- Meewerken aan richtlijnen voor verantwoord AI-gebruik in de juridische praktijk

- Memos schrijven over juridische risico’s en regelgeving rond AI

Zo krijg je een unieke inkijk in hoe AI daadwerkelijk wordt toegepast in het juridische vak — iets wat nog maar op weinig plekken in Nederland gebeurt.

Wie we zoeken

We zoeken studenten met onderstaande opleiding, vaardigeheden en houding. Het is voor ons vooral van belang dat je een meewerkende houding hebt, met een internationale focus.

Opleiding en vaardigheden

- Je studeert rechten (Bachelor of Master), bij voorkeur met interesse in contract-, IT- of ondernemingsrecht

- Je schrijft uitstekend Engels en Nederlands. Het is een vereiste voor deze stage dat je perfect Nederlands spreekt en schrijft. Sollicitaties van studenten die geen Nederlands spreken worden niet in behandeling genomen.

- Je werkt zorgvuldig en analytisch

- Je hebt affiniteit met technologie, AI of digitalisering

Professionele houding

- Je stelt vragen, zoekt context en wilt begrijpen wat je werk zakelijk betekent

- Je kunt juridische onderwerpen helder en beknopt uitleggen

- Je schrijft graag — zowel memo’s als toegankelijke artikelen

- Je wilt leren en samenwerken in een internationale, dynamische omgeving

Persoonlijke eigenschappen

- Je bent nieuwsgierig naar hoe AI het juridische werk verandert

- Je experimenteert graag met nieuwe tools en leert snel

- Je denkt mee en draagt bij aan verbeteringen in processen

Begeleiding, groei en toekomstperspectief

Tijdens je stage werk je nauw samen met het hele team, inclusief Soma, Henriette, Chantal, Jeroen, Lowa Heimer en Robby Reggers, oprichter van AMST Legal. Robby adviseert internationale cliënten over contractonderhandeling, template-ontwikkeling en juridische innovatie. Daardoor krijg je persoonlijke begeleiding en directe feedback. Bovendien denk je actief mee in lopende projecten en leer je hoe je juridisch advies vertaalt naar duidelijke, bruikbare oplossingen.

Daarnaast maak je kennis met de twee manieren waarop AMST Legal werkt:

- Per contract of project, bijvoorbeeld het opstellen of onderhandelen van commerciële overeenkomsten.

- Op interim-basis, waarbij we als general counsel meedraaien binnen bedrijven en hun juridische processen versterken.

Zo ervaar je zowel de advieskant als de operationele kant van het vak. Daardoor bouw je ervaring op die je uitstekend voorbereidt op een carrière bij een bedrijf, advocatenkantoor of legal-tech organisatie.

Waarom deze juridische stage in Amsterdam bijzonder is

Veel juridische stages blijven beperkt tot onderzoek of ondersteunend werk. Bij AMST Legal is dat anders: je helpt actief bouwen aan de toekomst van het juridische vak.

Je werkt mee aan:

- Nieuwe manieren van contracteren en automatiseren

- Praktische, AI-ready templates voor bedrijven

- Projecten waarin juridisch advies en businessstrategie samenkomen

- Content waarmee we kennis delen over AI, recht en contracten

Daarom leer je niet alleen hoe contracten werken — maar ook hoe je ze slimmer maakt.

Solliciteren op de functie Legal Intern Amsterdam

Klinkt dit als deze juridische stage die bij jou past? WIl je graag student-stagiair worden bij AMST Legal? ✨

Dan horen we graag van je! Bekijk de volledige vacature en solliciteer direct via onze LinkedIn-pagina:

👉 Solliciteer hier op LinkedIn

Vertel in je sollicitatie kort waarom jij enthousiast wordt van contracten, technologie en AI. Daarnaast vinden we het interessant om te horen hoe jij jouw juridische kennis in de praktijk wilt brengen. Tenslotte: wees vooral jezelf. We zoeken geen perfecte student, maar iemand met motivatie, nieuwsgierigheid en lef.

Ten Slotte

Als juridische student stagiair / legal intern Amsterdam bij AMST Legal krijgt de kans om deel uit te maken van een klein, vooruitstrevend team dat juridische expertise combineert met innovatie. Je leert denken als jurist én als probleemoplosser. Bovendien schrijf je contracten, onderzoek je AI-toepassingen en vertaal je complexe materie naar begrijpelijke taal.

Ben jij een gemotiveerde rechtenstudent die wil ontdekken waar de toekomst van het juridische werk naartoe gaat — én daar zelf aan wil bijdragen? Dan is dit jouw kans.

Anthropic’s Claude AI Updates – Impact on Privacy & Confidentiality

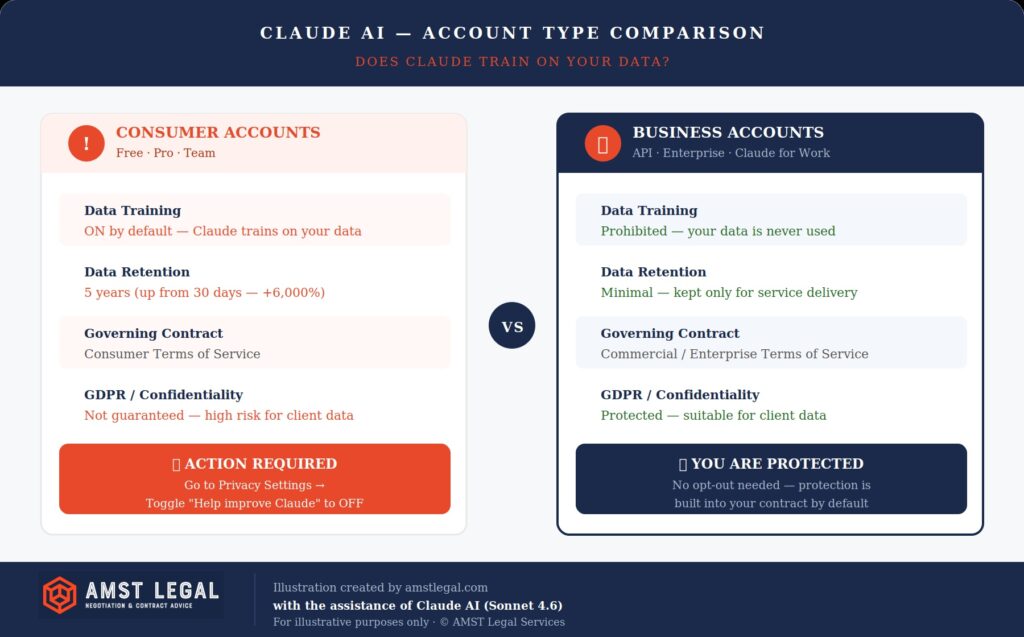

Anthropic will update the Consumer Terms of Service and Privacy Policy of the popular Claude AI model on 28 September. After this update, businesses worldwide will discover a fundamental shift in how their data gets handled when using Claude AI. The changes to these terms of Claude dramatically amend data training consent mechanisms. Thin k how important this is for Claude AI Privacy and Confidentiality of Data when using Claude AI. This is why we wrote this article “Anthropic’s Claude AI Updates – Impact on Privacy & Confidentiality’.

In short, from 28 September, Claude AI will train on all data, except from business accounts. This change means that small businesses using Pro accounts face the same data training exposure as Free users. The biggest question is whether companies realize that they are now training Claude AI with their data?

The critical question “does Claude train on your data” now depends entirely on which account type you use. Most importantly: you can even opt-out of this possibility, but have you done that? Let us also explain how the Terms of Use and Privacy Policy documents work together. They establish legal frameworks that are not clear for most business leaders.

Executive Summary: The TLDR of Claude’s Privacy Shift

Anthropic’s Sept. ’25 update changed data handling for most users. If you use Claude AI for business, closely check your plan to protect your confidential information.

- Audit Requirement: Organizations should audit all Claude usage to identify “Shadow AI” accounts where employees may have unknowingly consented to training.

- The “Pro” Trap: Claude Pro and Team are classified as Consumer accounts. By default, these now train on your data unless you manually opt out.

- 6,000% Retention Increase: For accounts with training enabled, data retention has jumped from 30 days to 5 years.

- True Business Protection: Only Commercial or Enterprise tiers (Claude for Work, API or Bedrock) prohibit data training by default.

- Manual Opt-Out: Free, Pro and Team users must change “Help improve Claude” to OFF in Privacy Settings to prevent data usage for training.

What We Will Cover

- Explanation of the Anthropic’s Claude AI Terms – how do they work?

- The critical distinction between consumer and business accounts that determines whether Claude trains on your data

- Why the new 5-year data retention period and opt-out default represents a 6,000% increase from previous policies

- Practical steps small and medium businesses must take to protect confidential information under the new framework

- Contract negotiation strategies for organizations dealing with AI vendors implementing similar policy changes

- Essential compliance considerations for regulated industries handling sensitive data through AI platforms

Claude AI Terms Explained: What You Need to Know

Anthropic’s terms and policies use a lot of specific terms, and they are not there by accident. Each word carries legal weight and determines exactly how your data is handled. Understanding them is not a technical exercise;. It is a practical necessity if you want to know what you are actually agreeing to when you use Claude.

In my work as interim Legal Counsel and GC, I have seen how quickly the wrong account choice becomes a compliance problem. The terms below will help you follow the rest of this article. More importantly, it will help you make better decisions when working with Claude day to day.

The Claude Privacy & Contract Terminology List

- Consumer Terms of Service: The primary contract for Free, Pro, and Team accounts. This document gives Anthropic the legal right to use your conversations to train their AI models by default.

- Commercial Terms of Service: The business-grade contract used for Claude for Work, Enterprise, and API access. These terms explicitly prohibit data training on your inputs.

- Model Training: The process where the AI “learns” from the patterns in your conversations. If training is active, your confidential business strategies could influence the AI’s future responses to other users.

- Data Training Opt-Out: A specific privacy setting for Consumer accounts. It allows you to manually stop the AI from learning from your data while staying on a lower-tier plan.

- 5-Year Data Retention: The period Anthropic now stores conversation data in training-enabled accounts. This is a massive jump from the previous 30-day policy.

- Shadow AI: This happens when employees use personal Claude accounts for company work. This often leads to sensitive corporate data being governed by weaker consumer rules instead of strict business terms.

Understanding the Claude AI Privacy Policy and Terms

The Complete Document Ecosystem

Anthropic’s September 2025 changes of its terms of service affected multiple interconnected documents. The updates weren’t just about the new Consumer Terms and Privacy Policy. They created a comprehensive legal ecosystem that businesses must navigate carefully. See below our detailed explanation of the Contract setup.

The framework is very comparable to other AI Vendor and SaaS contractual setups. It includes primary contracts, data policies and usage guidelines. Each document serves a specific purpose. Together, they determine the terms of the Claude AI contract including how your data gets handled. Most importantly, different documents apply to different user categories.

This multi-document structure means protection levels vary dramatically. Consumer and business users operate under entirely different rules. Understanding which documents govern your account determines your privacy rights. Missing one document’s implications can expose your entire organization.

What is the difference between Consumer vs Business Use?

Consumer Terms Explained

How do Anthropic Terms of Service work? Consumer users operate under the Consumer Terms of Service. This primary contract establishes the relationship with Anthropic. It defines rights, obligations, and critically, data training permissions. The Consumer Terms apply to Free, Pro, and Team accounts.

The Privacy Policy explains how Anthropic handles data. It details collection methods, usage purposes, and retention periods. Moreover, it contains the crucial opt-out possibility for training. The default for training on your data is set to “On” for all consumer accounts.

The Usage Policy sets acceptable use boundaries. It prohibits harmful content and illegal activities. Violations can trigger human review of conversations. Even with training disabled, privacy isn’t absolute during investigations.

Business Framework Components

Business users receive Commercial or Enterprise Terms of Service (the Commercial Terms of Service) instead. These terms explicitly prohibit data training without exception. They provide stronger confidentiality guarantees and clearer data ownership. Business terms apply to Claude for Work, Enterprise, and API access.

The same Privacy Policy applies but functions differently. Business accounts can’t enable training even if desired. Data retention stays minimal regardless of settings. The Usage Policy remains identical but enforcement differs.

Business users often receive additional documents. Data Processing Agreements provide GDPR compliance. Service Level Agreements guarantee uptime and support. These extra protections justify higher pricing tiers.

The Critical Account Classification Problem

Why “Pro” Doesn’t Mean Professional

Claude Pro costs $20 monthly but remains a consumer account. The name suggests business-grade protection that doesn’t exist. Similarly, Team accounts at $30 monthly sound enterprise-ready. They’re actually consumer tier with training enabled by default.

This naming confusion creates massive risks. A 50-person law firm using Team accounts seems protected. In reality, their client communications train AI models. Meanwhile, a solo consultant with API access has better protection.

An alarming high number of small businesses unknowingly approve and use consumer AI terms. They assume paid accounts mean business protection. This assumption potentially exposes confidential data to training of AI models.

The Real Business Account Options

True business protection at Claude requires specific account types:

- Claude for Work (custom pricing)

- Claude Enterprise (negotiated contracts)

- Claude API with Commercial Terms

- Claude via Amazon Bedrock

- Claude for Government/Education

These accounts operate under Commercial Terms of Service. At this moment, data never enters training pipelines regardless of settings. Retention periods remain minimal by default. Additional compliance documents provide extra protection.

The September 28 Deadline’s Lasting Impact

The mandatory September 28, 2025 deadline forced immediate decisions. Users have to accept new terms or lose access entirely. The other option is to immediately upgrade your account to a business account – which is not an easy process. As far as we know, this approach did not create a panic among businesses. Many accepted without understanding the implications.

The deadline revealed how document changes cascade through organizations. Individual employees accepted terms independently. They unknowingly bound their organizations to training consent. Corporate data entered pipelines without authorization or oversight.

How Claude’s Privacy Policy and Terms of Service Create a Complex Legal Framework

Understanding Claude’s Document Structure

Claude operates through a multi-document legal framework that differs for consumers and businesses. Here’s how the framework related to Anthropic terms of service works:

For Consumers:

- Consumer Terms of Service (primary contract)

- Privacy Policy (data handling rules)

- Usage Policy (acceptable use guidelines)

- Supporting documents referenced within terms

For Businesses:

- Commercial/Enterprise Terms of Service (primary contract)

- Privacy Policy (data handling rules)

- Usage Policy (acceptable use guidelines)

- Data Processing Agreements (where applicable)

- Supporting documents referenced within terms

This structure creates different protection levels. Consumer Terms allow data training by default. However, Commercial Terms prohibit it entirely. The Privacy Policy applies to both groups but operates differently based on which Terms govern the account.

Consumer Terms of Service: Where Training Rights Begin

The Consumer Terms of Service forms the primary contract for Free, Pro and Max accounts. These Anthropic terms of service establish Anthropic’s legal right to use data for training. Furthermore, they require mandatory acceptance by specific deadlines.

The Terms incorporate other documents by reference. This means accepting the Terms automatically binds users to the Privacy Policy and Usage Policy. Additionally, the Terms define which account types fall under consumer versus business categories.

Most critically, the Consumer Terms grant Anthropic permission to retain and use data. They establish the legal foundation for the 5-year retention period. However, they defer implementation details to the Privacy Policy.

Privacy Policy: How Your Data Gets Used

The Privacy Policy explains exactly how Anthropic collects, uses, stores, and shares data. It contains the actual consent mechanisms users must navigate. Moreover, it introduces the critical “Help improve Claude” toggle.

This toggle lives in Privacy Settings (link not included as only possible to access if you have an account) and controls training consent. When enabled, it allows:

- Model training on conversations

- Safety system improvements

- Product development uses

- 5-year data retention

When disabled, it limits:

- Data retention to 30 days

- Usage to service delivery only

- No model training permitted

The Privacy Policy also explains data sharing with third parties. It details security measures and user rights. Furthermore, it specifies how different account types receive different treatment.

Usage Policy: The Forgotten Third Document

The Usage Policy sets boundaries on acceptable platform use. It prohibits harmful content, illegal activities, and terms violations. Moreover, it affects data handling indirectly.

Violations of the Usage Policy can trigger account reviews. These reviews might involve human examination of conversations. Therefore, even with training disabled, privacy isn’t absolute when policy violations occur.

The Two-Step Consent Trap

Step 1: Accept Terms or Lose Access

Users must accept updated Consumer Terms by deadline dates. Refusing means losing Claude access entirely or update is required to a business account. This creates pressure to accept without careful review.

Step 2: Find and Change Privacy Settings

After accepting Terms, users must locate Privacy Settings separately. The training toggle defaults to “On” for new users. Many miss this second step entirely.

This two-step process disadvantages small businesses. They often lack legal resources to understand both documents. Consequently, they inadvertently consent to training despite privacy concerns.

This is a pattern seen across AI vendors and SaaS companies. Companies use complex document structures to maximize consent rates. Technical compliance exists while practical protection remains minimal.

Critical Claude Privacy Policy Changes Small Businesses Must Navigate

The 5-Year Data Retention

The retention period jumped from 30 days to 5 years for training-enabled accounts. This 6,000% increase affects all consumer accounts by default. Your conversations today could train AI models in 2030.

This change might create immediate problems for professional services. Law firms’ client strategies become training data. Consultants’ competitive insights feed future models. Healthcare providers risk HIPAA violations through extended retention. It is therefore very important to realize under which plan you are using Claude AI.

The retention period exceeds most document destruction policies. Companies typically delete sensitive data after 2-3 years. However, Claude keeps it for five. This conflict potentially creates compliance nightmares for regulated industries.

Why Small Firms Face Disproportionate Claude AI Privacy Risks

Limited Resources Create Vulnerabilities

Small businesses lack dedicated privacy teams. They can’t analyze complex policy changes effectively. Moreover, informal IT governance makes tracking AI usage nearly impossible.

It could be said that the “Pro” account name creates false security about protection levels.

The Professional Account Naming Trap

Claude Pro sounds professional but isn’t. It remains a consumer account with training enabled. Small firms assume “Pro” means business-grade protection. This assumption exposes confidential data to AI training.

Team accounts create similar confusion. They cost $30 per user monthly. Yet they receive consumer privacy treatment. Only Claude Enterprise or API access provides true business protection.

Shadow IT and Compliance Nightmares

The September 28 deadline revealed widespread shadow AI usage. Employees had signed up independently for Claude accounts. They accepted new terms without corporate oversight. Sensitive data potentially entered training pipelines without authorization.

Professional services face particular challenges here. Individual practitioners maintain significant autonomy in tool selection. A tax attorney might use personal Claude Pro for research. Client tax strategies then train future models without anyone realizing.

Healthcare consultants create similar risks. They might process patient information through consumer accounts. HIPAA violations occur despite believing they have professional protection. These violations carry penalties up to $2 million per incident.

Audit Requirements After Policy Changes

It is instrumental that organizations audit all AI tool usage immediately. Document every Claude account across all departments. Identify which accounts are consumer versus business tier. Check whether training toggles are properly configured.

This audit often reveals surprising results. Companies discover dozens of unknown accounts. Shadow IT usage exceeds official deployments significantly. Sensitive data has been processed through consumer tiers for months.

Practical Steps for Protecting Your Organization Under New Terms

Immediate Actions Every Business Must Take

Start with a comprehensive audit of all Claude usage. Document every account type and billing structure. Map usage patterns across departments. This audit reveals your actual exposure level.

Navigate to Claude’s Privacy Settings for all consumer accounts. Ensure the “Help improve Claude” toggle is OFF. This prevents future data from entering training pipelines. However, it doesn’t affect previously submitted information.

Implement strict data classification policies next. Define what information can use different account tiers:

- Public information: Consumer accounts acceptable

- Internal data: Enhanced monitoring required

- Client confidential: Business accounts only

- Regulated data: Enterprise accounts mandatory

Establish monitoring systems to detect policy violations. Flag attempts to input sensitive information into consumer accounts. Regular training helps employees understand why distinctions matter. Their choices directly affect organizational risk.

Contract Strategies for AI Vendor Negotiations

Essential Provisions to Demand

The Claude privacy policy changes teach valuable negotiation lessons. Demand explicit provisions prohibiting model training on customer data. Require data segregation between consumer and enterprise services. Include audit rights to verify compliance.

Hogan Lovells’ AI Contract Framework recommends specific clauses. Add termination rights triggered by adverse privacy changes. Negotiate graduated pricing for mixed account usage. Request transparency reports on data handling practices.

Protecting Against Future Policy Changes

Include change notification requirements with 90-day advance notice. Specify that material adverse changes permit immediate termination. Require grandfathering of existing terms for contract duration. These provisions protect against surprise modifications.

Small businesses need particular protection here. They can’t afford sudden enterprise pricing requirements. Graduated transition periods allow budget planning. Group purchasing through associations reduces individual costs.

Building Competitive Advantage Through Privacy Leadership

Transform Claude AI data privacy compliance into market differentiation. Law firms advertise enterprise AI tool usage in pitches. Consultancies include AI governance descriptions in proposals. This transparency builds trust and justifies premium pricing.

Develop “AI Privacy Pledges” for client communications. Guarantee that client data never enters training datasets. Promise privacy assessments before adopting new AI tools. Commit to immediate notification of policy changes affecting client information.

Professional service providers report significant benefits. They win 35% more proposals when demonstrating privacy leadership. Clients increasingly recognize risks with providers using consumer AI. Privacy commitment becomes a selling point rather than a burden.

Creating Internal AI Governance Frameworks

Establish an AI governance committee with cross-functional representation. Include legal, IT, compliance, and business unit leaders. Meet monthly to review AI tool usage and policy changes.

Document all AI tools in a central registry. Track account types, usage purposes, and data classifications. Review quarterly for compliance and optimization opportunities. This systematic approach prevents shadow IT growth.

Benefits of Proper Claude AI Privacy Management for Small Businesses

Business Impact: Trust, Efficiency, and Growth

Small businesses implementing proper Claude AI data privacy controls experience immediate competitive advantages. Clients increasingly ask about AI tool usage and data protection measures during vendor selection. Moreover, firms demonstrating sophisticated understanding of consumer versus business account distinctions win more contracts. Professional service providers report 35% higher close rates when they can guarantee client data won’t train AI models.

Operational efficiency improves once teams understand appropriate use cases for different account types. Furthermore, clear policies eliminate confusion about which information can be processed through which systems. Small law firms using properly configured Claude accounts report 40% time savings on research and drafting while maintaining complete confidentiality. Additionally, the peace of mind from proper protection allows teams to fully leverage AI capabilities without constant concern about data exposure.

Legal Impact: Compliance, Insurance, and Risk Management

Proper Claude privacy management dramatically reduces legal exposure for small businesses. Professional liability insurers increasingly offer premium discounts for firms demonstrating AI governance maturity. Moreover, documented policies showing the distinction between consumer and business account usage satisfy regulatory auditors and client security assessments.

Small businesses avoiding Claude-related data incidents save average remediation costs of $185,000—potentially company-ending amounts for smaller firms. Furthermore, maintaining proper data protection prevents relationship damage that occurs when clients discover their information trained AI models. The reputational impact of a single privacy incident can destroy decades of trust building, particularly for professional service providers whose entire value proposition centers on confidentiality.

Frequently Asked Questions (FAQ) on Claude AI Privacy

Q: Does Claude train on your data?

It depends entirely on your account type and the Anthropic terms of service that are applicable. By default, Claude Free, Pro, and Team plans (Consumer accounts) do train on your data unless you manually opt out in settings. Claude Enterprise and API accounts (Commercial accounts) never train on your data.

Q: What is the benefit of the Claude Team plan for data privacy?

Despite the name, the Claude Team plan operates under Consumer Terms. While it offers collaboration features, it still enables data training by default. To secure professional-grade privacy, you must either manually opt out in the settings or upgrade to the Claude API or Enterprise tiers.

Q: How do I opt out of Claude AI data training?

To opt out, navigate to your Account Settings, select Privacy, and toggle the “Help improve Claude” button to OFF. This ensures your future conversations are not used to train Anthropic’s models, though it does not automatically remove data that was already processed.

Q: Is Claude safe for law firms and regulated industries?

Claude is safe only when used under Commercial Terms of Service (API or Enterprise). Using Consumer accounts for client-confidential work risks your data being stored for five years and used for training, which could violate professional secrecy or GDPR requirements.

Q: What happens to my data if I use a personal Claude Pro account for work?

Your data is treated as consumer data. This means it can be used to train the model, it is subject to a 5-year retention period, and it is governed by a framework designed for individuals, not the strict confidentiality needed by businesses.

Key Takeaways

- Both Terms of Use and Privacy Policy changed simultaneously, creating a dual-document framework where Terms provide contractual authority while Privacy Policy contains actual consent mechanisms

- The 30-day to 5-year retention increase affects ALL consumer accounts (Free, Pro, Team) with training enabled by default—only true business accounts maintain automatic protection

- Small businesses face greater exposure than enterprises because “Pro” and “Team” accounts sound professional but receive consumer-grade privacy treatment

- Shadow IT discoveries revealed widespread unauthorized AI usage, with employees accepting new terms independently and potentially exposing corporate data

- Immediate action required: Audit all accounts, disable training in privacy settings, implement data classification policies and negotiate protective provisions with AI vendors

Taking Control of Your AI Contract and Data Privacy Strategy

These modifications mentioned above demonstrate how quickly privacy frameworks can shift and why organizations need proactive strategies rather than reactive responses. Therefore, businesses must treat AI privacy as a strategic priority requiring the same attention as cybersecurity or regulatory compliance.

AMST Legal specializes in navigating these complex AI contractual landscapes. We help organizations understand not just what policies say but what they mean for practical operations. We’ve guided numerous businesses through the maze of AI and SaaS Contracts, identifying risks others miss and negotiating protections that actually matter. Additionally, our expertise spans from emergency audits following policy changes to comprehensive AI governance framework development.

Whether you need immediate assistance assessing your Claude account exposure, strategic guidance negotiating with AI vendors, or ongoing support managing evolving privacy requirements, AMST Legal provides flexible engagement models tailored to your needs. Contact us at amstlegal.com to discuss how we can protect your organization’s interests while enabling responsible AI adoption.

To read more on this topic here is the Ultimate Guide how ChatGPT, Perplexity and Claude use Your Data

Here are other articles on this topic Anthropic will start training its AI on your chats unless you opt out. Here’s how, Anthropic will start training its AI models on chat transcripts and, Anthropic Will Use Claude Chats for Training Data. Here’s How to Opt Out.

About AMST Legal

At AMST Legal, we specialize in helping businesses navigate the world of AI and SaaS contracts. We move beyond simple legal reviews to provide strategic advice on data privacy, sales & vendor negotiations and internal governance frameworks. Whether you need an emergency audit following a policy change, help securing enterprise-grade protections from AI vendors, or a fractional General Counsel to oversee your legal operations, we provide the expertise needed to enable responsible AI adoption. Contact us at info@amstlegal.com or book a meeting here to ensure your organization’s data remains a private commercial asset, not a public training set.

Author: Robby Reggers, Founder of AMST Legal (amstlegal.com), recognized by Legal Geek as a LinkedIn Top Voice for contracting, negotiation, and interim GC work. AMST Legal supports clients per contract/project or on an interim basis (set hours/week).

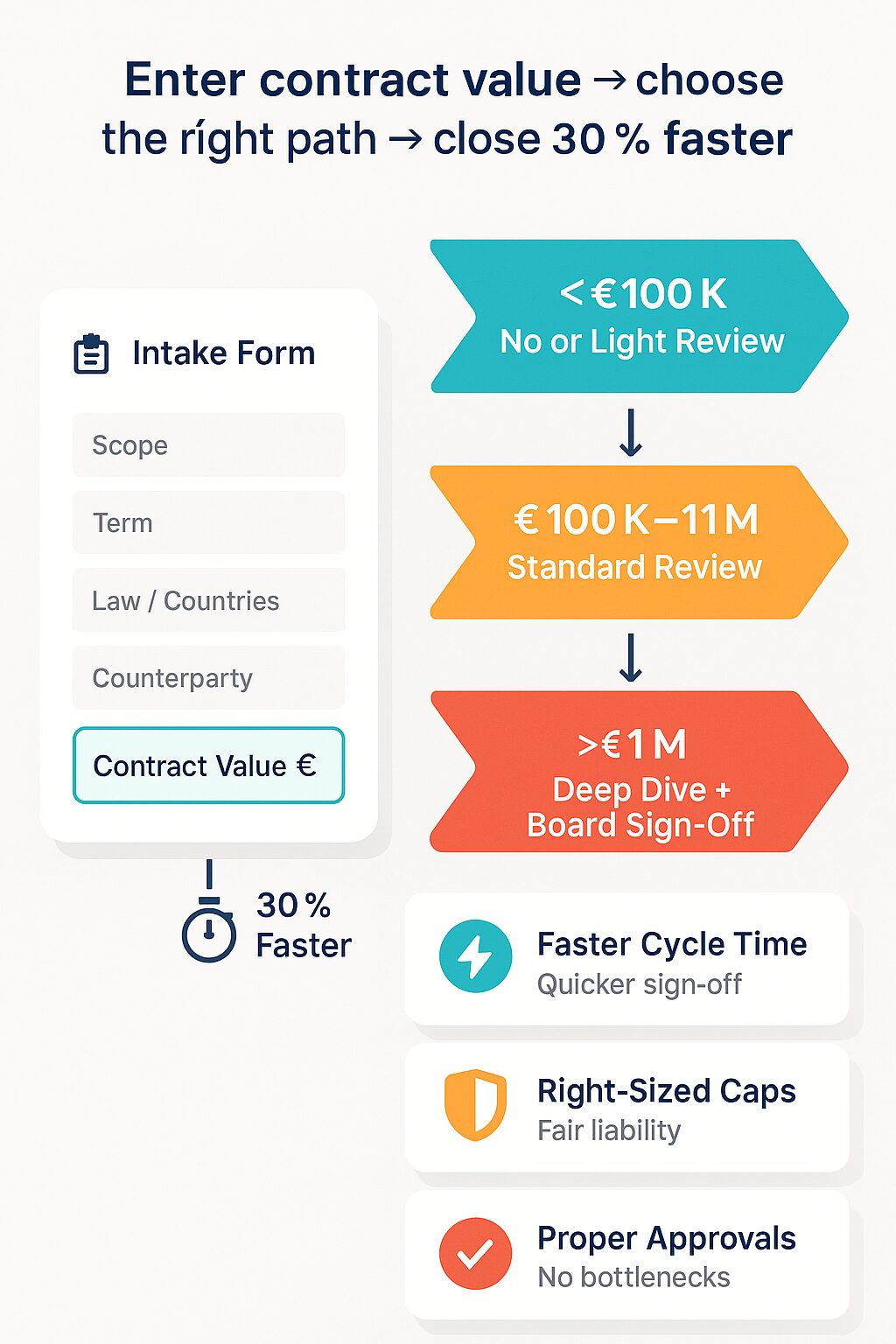

Reduce Contract Review Time 30 % with One Simple Question – Contract Value

Why do all lawyers first need to ask what the contract value is, before reviewing or red-lining a contract? When Legal receives a draft contract, their first task is to gather the facts they need to review, advise and negotiate effectively. That means asking questions – sometimes a lot of them. This is important for the liability limits, risk assessment and signing authority. Most common questions are regarding scope, background, term, governing law, counter-party risk and more. Yet one question towers above the rest:

“What is the total (or yearly) contract value?”

Example: A €30 000 software tool slides through with a few light tweaks by legal. A €3 million multi-year rollout for a software tool that involves lots of sensitive data? That triggers data privacy, cyber-insurance review, CFO approval and deeper due diligence. Same inbox, two very different paths – because of a single figure.

That number steers everything from the depth of due diligence to the height of liability caps and the level of internal approvals required. In organizations with mature legal teams and operations, the contract value is part of a triage system. This includes a short intake questionnaire, preferably delivered by legal-tech platforms, web-forms or templated e-mails. Once you have that information, that routes each contract to the right template, reviewer and approval chain within minutes. Sharing the value up front isn’t paperwork for paperwork’s sake; it’s the key that lets the legal team protect the business quickly, proportionately and cost-effectively.

What We Will Cover

- Background & importance—how contract value underpins every part of contract strategy.

- How to calculate contract value. Practical formulas for Sales, Procurement and Partnerships; the difference between total contract value (TCV) and Annual Contract Value (ACV).

- Ten concrete reasons lawyers insist on the figure before they mark up a clause.

- Explanation of terms used like contract value, annual contract value, total contract value and why it is linked to liability caps

- Process tip. How can you make contract value a standard field in your deal-intake form.

- Quick summary & next steps.

Background & Importance: Value Drives Risk

Legal review is risk management in writing. How forcefully you negotiate liability caps, payment security or exit rights depends on impact—financial, operational and reputational. Contract value (sometimes called deal worth) is the fastest, most objective proxy for that impact. Provide it late and every downstream decision is delayed.

Think of contract value as the master input cell at the top of a spreadsheet. Change the figure and every formula beneath—warranties, indemnities, insurance checks, delegated approvals—re-calculates instantly.

How to Calculate Contract Value

Because “value” means different things in Sales, Procurement and Channel Partnerships, align on a common formula before you fill in the intake form.

| Context | What the number should capture | Practical formula |

|---|---|---|

| Sales / Revenue contracts | All cash you expect to receive from the customer—set-up fees, recurring licence, usage charges, committed renewals, minimum guarantees. | Total Contract Value (TCV) = One-off fees + (Recurring fee × Committed term) Annual Contract Value (ACV) = TCV ÷ Term (years) |

| Procurement / Spend contracts | All cash your company will pay the supplier—tooling, minimum orders, variable unit pricing, support fees and committed renewals. | Total Spend = Up-front costs + (Estimated annual spend × Term) |

| Partnership & Reseller deals | The share of revenue or discount margin that will flow between the parties over the commitment period—including tiered rebates or volume incentives. | Channel Value = (Projected end-customer revenue × Margin or Rev-share %) × Term |

Total vs. Annual Contract Value. Why Both Matter

When negotiating contracts it is important to know the total contract value and the annual contract value. Next to signing authority relevance (who can sign until what amount), it is also crucial to know for team involvement & liability discussions. In case of smaller contracts, you only need to involve a smaller team with less specialists, for larger deals more specialists need to be involved. Additionally, the limit of liability can be linked to either the total and/or the annual value of the contract. It is used by legal in commercial contracting discussions to agree on a limit of liability.

- Total contract value (TCV) answers: “What is the maximum euro exposure over the life of the deal?” Lawyers plug this into liability-cap formulas, insurance checks and worst-case damage models.

- Annual Contract Value (ACV) normalises multi-year deals to a single-year figure. Many caps and service-credit schedules reference “one year’s fees,” so ACV keeps negotiations apples-to-apples regardless of term length.

Pro tip: For evergreen (auto-renew) contracts, calculate TCV and ACV on the first committed term.

Calculation Examples

| Scenario | Calculation | Result |

|---|---|---|

| SaaS sale: €20 000 set-up + €5 000 / month, 3-year term | TCV = 20 000 + (5 000 × 36) | €200 000 ACV ≈ €66 667 |

| Procurement: €30 000 tooling + €150 000 / year, 4 years | Total Spend = 30 000 + (150 000 × 4) | €630 000 |

| Reseller: €2 m revenue / year, 15 % margin, 2 years | Channel Value = (2 000 000 × 0.15) × 2 | €600 000 |

Include realistic high-end estimates of usage fees—liability caps track exposure. Exclude VAT/sales tax; legal risk follows net commercial value.

Ten Reasons Lawyers Need Contract Value Up Front

See below a list of 10 reason why lawyers should always ask the contract value of a contract. From lawyers, inhouse legal counsel to paralegals, Legal should always know the spend or potential income of a contract before starting work on a contract. How else is Legal able to advise someone on a contract?

I have made this mistake and started with a deep dive of a contract, providing the sales team with detailed contract advice. I thought they would be satisfied, but because it was only a 20K contract the advice was not fit for purpose.

Therefore, before you start advising as Legal, ask: “What’s the annual contract value of this contract”.

As someone sending a contract to Legal, add: “The estimated annual contract value of this contract is XYZ EUR. Potentially add: We are not sure of this value, but this is the best estimate I can provide you at this moment.”

1 – Level of Legal Review (Scrutiny)

This is one of the most important reasons to know the contract value. How important is the contract for the company?

A €50 000 Master Services Agreement doesn’t need a four-week deep dive; a €20 million strategic partnership does. Contract value tells lawyers how deep to dig, which template to use and how many specialists to involve.

2 – Indemnities & Liability Caps

As one of the most negotiated clauses, this directly ties into the contract value as liability limits / caps are directly linked thereto.

For example the liability is capped to one year of fees, 2× ACV, or a fixed sum aligned to insurance. Without total contract value, caps are guesswork that stall negotiations or leave catastrophic exposure.

3 – Understand the Risks

Large deals carry reputational and operational weight. Counsel tightens disaster-recovery clauses and escalation paths as contract value climbs. Although not only monetary, the risk is often linked to value – next to data shared, confidentiality, alternatives, etc.

4 – Insurance Cover Check

If worst-case damages exceed policy ceilings, buy a rider, refine the clause or walk away—decisions impossible until you disclose the value.

5 – Guide Flexibility & Concessions

Strategic, high-value deals may warrant bespoke SLAs; low-margin work demands firm standard terms. Value is the compass.

6 – Signal Internal Priority 🚦

Delegated-authority matrices hinge on value. Legal routes the document to a finance manager, CFO or board only when it knows the amount.

7 – Spot Regulatory Thresholds

Public-procurement rules, export licences and merger filings often hinge on deal size. Early flagging preserves timelines.

8 – Secure Payment

Escrow, guarantees, milestone invoicing – each tool costs money. Lawyers select the lightest mechanism that still protects cash flow, guided by contract value.

9 – Termination or Exit Provisions

If a contract feeds 35 % of revenue, sudden termination is existential. Notice periods and break fees scale with value concentration.

10 – Tax & Accounting Impact

Revenue recognition, VAT and transfer pricing ride on deal size. Early disclosure lets finance book correctly and brief auditors – often linked to item 3 above (liability caps).

Make Contract Value a Standard Triage Field

A deal-intake questionnaire that captures both total contract value and ACV should be the first gate in every commercial workflow.

Why do Contract Intake Forms Work?

Feed it to Legal, Finance and Risk and you unlock:

- Faster template selection

- Accurate legal-budget scoping

- Early insurance checks

- Automatic routing to approvers

AMST Legal has rolled out many triage dashboards / questionnaires that cut cycle times by up to 40 %. Next to setting up an internal legal page with all legal resources this is the easiest step to improve contract negotiation speed.

Summary: One Number, Ten Advantages

Quite often, when we ask for the value of the contract, we receive a negative reaction. Why does legal need to know the value, fees incurred or profit of the contract? receive the answe Contract value is not a nosy question. It is the master key that unlocks:

- Right-sized legal review

- Proportionate liability caps & indemnities

- Adequate insurance cover

- Clear view of risks and commercial stakes

- Smart negotiation concessions

- Proper internal approvals

- Timely regulatory filings

- Robust payment security

- Balanced exit rights

- Accurate tax & accounting treatment

Share it on day one and your contracts close faster, safer and with fewer surprises.

Next time your legal advisor asks this question, say “glad you asked”, not “why do you ask?”.

Contract Value, Signing Authority and E-Signature Policy Explained

In commercial contracting, many negotiations slow down because teams use different terminology for the same financial reality. Sales talks about deal size, Finance looks at revenue impact, and Legal asks for TCV, ACV or exposure. Without shared definitions, liability discussions become inconsistent and internal approvals stall.

The terms below create a common commercial language. Understanding them helps you negotiate liability caps more effectively, route contracts correctly under your Signing Authority Matrix, and ensure your e-signature process aligns with internal governance.

What Is Contract Value?

Contract Value is the total monetary consideration payable or receivable under a contract during its committed term, excluding VAT or sales tax.

It represents the financial size of the deal and is the primary input for legal review depth, risk assessment and approval routing.

What Is Total Contract Value (TCV)?

Total Contract Value (TCV) is the aggregate amount payable or receivable over the full committed term of the agreement, including fixed and contractually committed recurring fees.

TCV reflects the maximum agreed commercial exposure during the term and is commonly used to size liability caps and approval thresholds.

What Is Annual Contract Value (ACV)?

Annual Contract Value (ACV) is the yearly portion of the contract value, calculated by dividing TCV by the number of committed years.

ACV is particularly relevant where clauses refer to “one year of fees,” such as in limitation of liability or service credit provisions.

How Contract Value Impacts Liability Caps

A Liability Cap is the agreed contractual limit on one party’s financial liability.

Liability caps are often structured as:

- A multiple of ACV

- A percentage of TCV

- A fixed monetary amount

Without knowing the contract value, it is impossible to assess whether the liability cap is proportionate to the commercial risk.

What Is a Signing Authority Matrix?

A Signing Authority Matrix defines who within an organization is authorized to approve or sign contracts at specific monetary thresholds.

Contract value determines:

- Whether business-level approval is sufficient

- Whether CFO or board sign-off is required

- Whether additional governance steps apply

The matrix ensures that only properly authorized individuals legally bind the organization.

What Is an E-Signature Policy?

An E-Signature Policy sets the rules for how contracts are executed electronically and how digital signatures are validated and stored.

Even when using electronic signatures, signing authority must align with the thresholds defined in the Signing Authority Matrix. An electronic signature does not replace proper delegated authority.

What Is Contract Exposure?

Contract Exposure refers to the maximum financial and legal risk arising from a contract, including liability caps, indemnities, termination payments and potential regulatory penalties.

Exposure may exceed the pure contract price where liabilities are uncapped (for example, in data protection or intellectual property infringement scenarios).

What Is a Materiality Threshold?

A Materiality Threshold is the internal monetary level at which enhanced governance, executive approval or reporting obligations are triggered.

Materiality thresholds are typically linked to contract value and embedded in internal approval workflows.

Next Steps

- Process audit – map your current intake and spot bottlenecks.

- Triage implementation – build a questionnaire that captures contract value, term length and risk flags.

- Template tuning – align clause libraries to value bands so protections scale automatically.

- Training & change management – explain why value matters, boosting adoption across Sales, Procurement and Finance.

Ready to build a smoother bridge between Commercial and Legal? Contact AMST Legal for a free initial consultationand never lose time guessing at contract value again.

Vacature Jurist Amsterdam – AMST Legal

AMST Legal is op zoek naar een Commercial Legal Counsel / Bedrijfsjurist voor ons groeiende juridisch advieskantoor in Amsterdam. In deze hybride rol werk je grotendeels op afstand, met twee vaste kantoordagen per week en af en toe een bezoek aan klantlocaties. Werk voor klanten zoals Booking.com, PVH (Tommy Hilfiger / Calvin Klein), Meatable, ServiceNow, Construsoft, Syndio, Conga en ManyChat.

Als legal counsel (bedrijfsjurist) adviseer je snelgroeiende bedrijven in de tech-, software- (SaaS), openbaar vervoer- en duurzame energiesector. Sectoren waar juridisch advies zakelijk, pragmatisch en scherp moet zijn. Naast de focus op SaaS & Tech zijn we zeer actief betrokken (Juridische Werkgroup OVPay) bij (i) de uitrol van de nieuwe OV-Chipkaart: de OV-pas en (ii) de mogelijkheid om in -en uit te checken met de debit en creditcard in het OV.

Ben jij een juridisch professional die op zoek is naar meer eigenaarschap, afwisseling en de kans om klanten te helpen bij het slimmer inrichten van hun contractprocessen? Werk je graag zowel strategisch als inhoudelijk aan commerciële juridische vraagstukken? Kijk dan vooral verder in deze ‘Vacature Jurist Amsterdam voor AMST Legal’.

Belangrijk voor deze functie: je spreekt vloeiend Nederlands en een afgeronde Nederlandse rechtenstudie is een pré.

Je stapt in een zichtbare, impactvolle rol waarin je je bezighoudt met contractonderhandelingen, corporate housekeeping en het opzetten of verbeteren van interne juridische processen.

Waarom deze rol uniek is

Bij AMST Legal adviseer je scale‑ups en middelgrote ondernemingen in tech, SaaS, openbaar vervoer en duurzame energie. Je combineert strategisch contractmanagement met het bouwen van efficiënte juridische processen – precies waar groeiende bedrijven behoefte aan hebben in een snel digitaliserende markt.

Over AMST Legal

AMST Legal is een juridisch advieskantoor, opgericht door Robby Reggers. Robby is een voormalig advocaat (Hogan Lovells) en Head of Legal/General Counsel.

Wij helpen bedrijven bij het sluiten van betere commerciële contracten en het opbouwen van efficiënte juridische afdelingen. Tot onze klanten behoren start-ups tot grotere bedrijven zoals Booking, Construsoft, Keolis, Qbuzz, EBS, OVPay, Twelve, en meer.

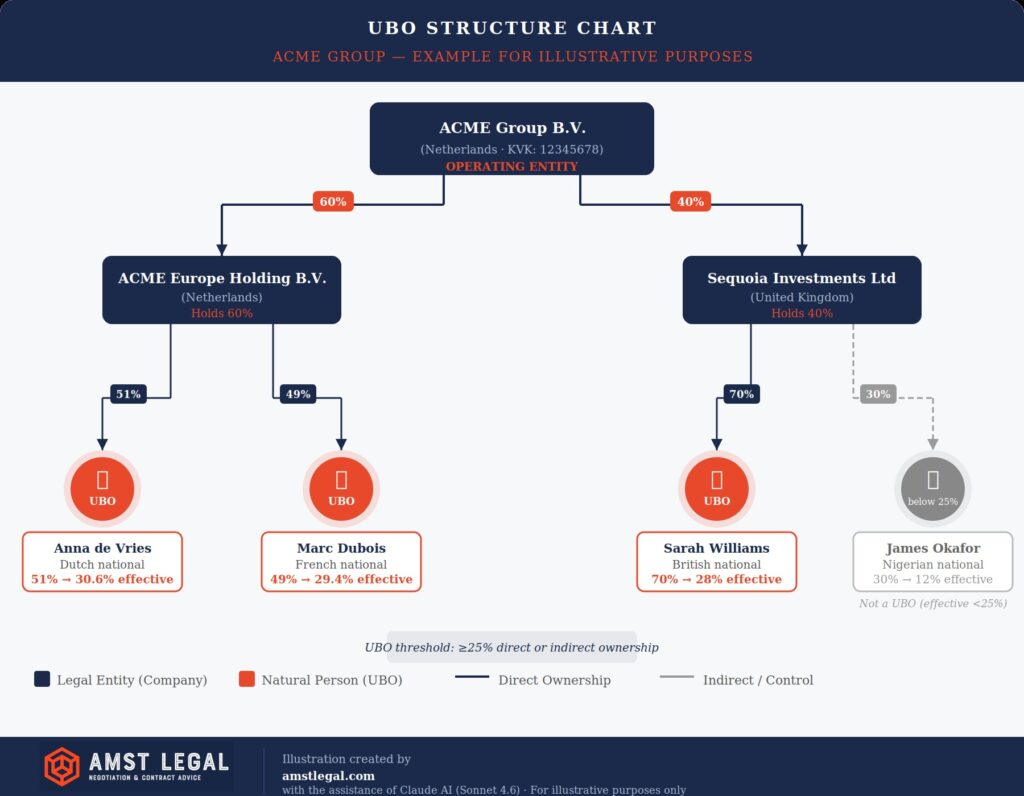

Focus

- Commerciële contracten – zoals verkoopcontracten, reseller- en partnerovereenkomsten, en inkoopcontracten

- Vennootschapsrechtelijke ondersteuning – zoals UBO-registraties, tekenbevoegdheden binnen concerns en corporate housekeeping

- Legal operations – verbeteren van templates, opzetten van contractprocessen, en begeleiding van in-house teams

- Onderhandelingen – onderhandelen over contracten én klanten helpen beter te onderhandelen met trainingen

We treden regelmatig op als extern juridisch adviseur of general counsel voor klanten in Nederland en internationaal (België, VK, Nordics en VS), zowel projectmatig als op langdurige basis.

Wat jij gaat doen

Als Commercial Legal Counsel in Amsterdam ben je nauw betrokken bij zowel klantwerk als interne kennisontwikkeling. Je werkt direct samen met de oprichter, ondersteund door een paralegal en een juridische stagiair, aan uiteenlopende commerciële en vennootschapsrechtelijke zaken.

Werkzaamheden

Je werkzaamheden bestaan onder andere uit:

- Het onderhandelen van commerciële contracten: van SaaS- en licentieovereenkomsten tot inkoop- en distributiecontracten

- Adviseren over structuur en compliance: begeleiden bij tekenbevoegdheden, vennootschapsdossiers en UBO-registraties

- Verbeteren van juridische processen: opstellen van sjablonen, bouwen van clausulebibliotheken, en adviseren over interne goedkeuringsflows

- Intensief samenwerken met klanten: soms op locatie, vaak op afstand, altijd met een pragmatische instelling

- Begeleiden van junior teamleden: bijdragen aan hun ontwikkeling en kennisdeling binnen het team

Je krijgt ruimte om zelfstandig te werken waar je sterk in bent, met ondersteuning waar nodig – in een cultuur die kwaliteit, nieuwsgierigheid en balans waardeert.

Wie we zoeken

Deze rol is ideaal voor iemand met 2–4 jaar ervaring in commerciële contracten of vennootschapsrecht, opgedaan bij een advocatenkantoor of als in-house legal counsel.

Wij zoeken juristen die:

- Enthousiast worden van commerciële contracten (verkoop, partnerships, inkoop)

- Zelfstandig kunnen werken, maar ook goed samenwerken

- Vaardig zijn in het opstellen en onderhandelen van contracten in zowel Nederlands als Engels

- Geïnteresseerd zijn in het verbeteren van juridische processen – niet alleen in de inhoud van contracten, maar ook in hoe je efficiënter werkt met templates, Legal Tech en AI

- Pragmatisch, responsief en communicatief sterk zijn richting zakelijke stakeholders

- Affiniteit hebben met juridische uitdagingen in SaaS, technologie of duurzaamheid (pré, geen vereiste)

Waarom werken bij AMST Legal?

Bij AMST Legal ben je geen een van de velen in een grote hiërarchie. Je maakt deel uit van een klein, deskundig team waarin jouw ideeën tellen en je werk zichtbaar is. We zijn een groeiend kantoor met veel potentieel in de markt voor onze diensten.

Wij bieden jou:

- Een hybride werkstructuur: grotendeels thuiswerken, met twee vaste dagen op kantoor in Amsterdam en af en toe klantbezoek

- Werken aan juridische vraagstukken met impact – voor Nederlandse en internationale klanten

- Persoonlijke begeleiding van een ervaren contractjurist en general counsel

- Vrijheid om je eigen praktijk op te bouwen binnen een ondersteunend team

- Een positieve, internationale en flexibele werkcultuur

- Competitieve vergoeding passend bij je ervaring en vaardigheden

Interesse?

Neem contact op met ons

Klinkt dit als jouw volgende stap? Stuur een bericht naar lowa@amstlegal.com om je interesse kenbaar te maken of vragen te stellen

(onderwerp: “Commercial Legal Counsel AMST Legal – [jouw naam]”).

Of solliciteer direct via LinkedIn.

Laten we samen de toekomst van commerciële contractpraktijk verbeteren.

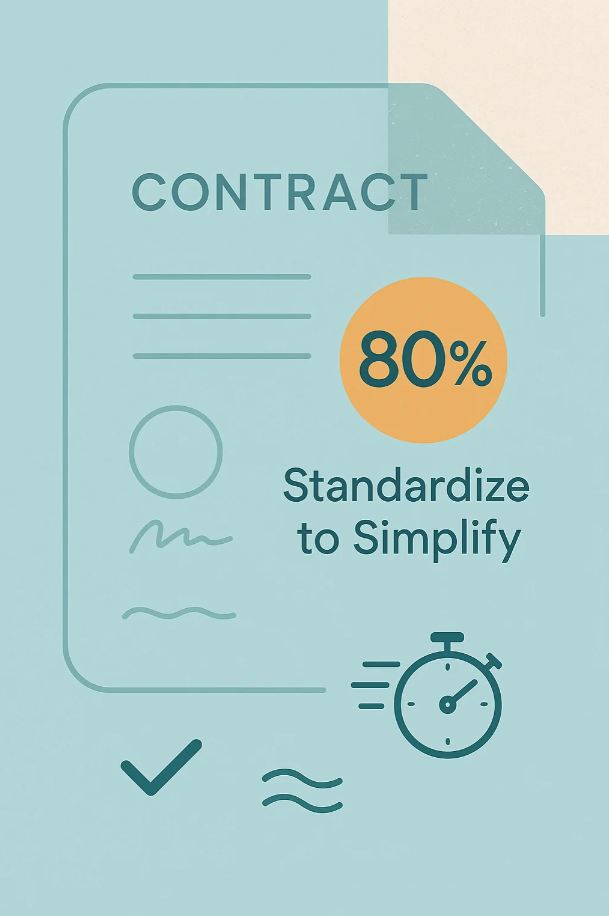

Why You Need Better Terms & Conditions – 80 % Template Rule

Contract Templates and Terms & Conditions (T&Cs) are more than a legal formality. As we always say: “Don’t underestimate the importance of contracts – including Terms and Conditions”. Contracts are the basis of all business you do with your customers and suppliers. They set the foundation for how you operate, protect your business from disputes and build trust with clients. Yet many companies struggle to streamline their contracts and end up juggling a mess of documents. One way to simplify—and speed up—your contract workflow is by adopting the 80% Template Rule. This means that you should aim for having contract standards (contract templates) of at least 80% of the contracts you sign.

This principle states that around 80% of your agreements can rely on standardized templates, while 20% remain flexible for high-value or complex deals. In this article ‘Why You Need Better Terms & Conditions – 80 % Template Rule’, we’ll explore how this approach strikes the perfect balance between efficiency and adaptability, saving you time and money without compromising on legal safeguards. It is part of our 9 practical solutions to solve Contract Standards that Fail, see our article on this here and our Linkedin post on this subject.

What We Will Cover

- Understanding the 80/20 Template Ratio Rule

- Deviations from the 80/20 Rule: When Standardization Needs Adjusting

- Strategic Advantages of Contract Template Standardization

- How Terms & Conditions Fit into the 80% Model

- Suggested Set-Up for Standard Templates

- Examples of the 80/20 Rule in Action

- Applying the 80% Rule Beyond Sales & Procurement

- Conclusion: Finding the Ideal Contract Balance

1. Understanding the 80/20 Template Ratio Rule

Defining the 80/20 Balance

The 80/20 Template Rule suggests that about 80% of your contracts—often NDAs, routine purchase orders, and standard service agreements—can be effectively managed using pre-approved templates. These documents share consistent language, key legal protections, and known risk parameters.

The remaining 20% represents more complex or strategic agreements requiring extra customization. This might include multi-year government contracts with compliance mandates or large-scale software licenses where intellectual property rights need special attention.

Why 80%? Most deals share similar terms and risk profiles, so standardizing them eliminates tedious drafting, ensures legal consistency, and accelerates negotiations.

Our Recommendation

We advise clients – especially in tech and service-focused industries – to create shorter T&Cs for everyday deals (the 80%), while reserving longer, more detailed contracts for enterprise-level customers or specialized projects (the 20%).

It is no surprise that major companies like Microsoft, AWS, Booking.com, Salesforce, and ServiceNow follow a similar playbook. Their user agreements are concise and straightforward, but when a large corporation with unique needs comes along, they switch to a more comprehensive legal framework.

In this article we focus on Sales & Procurement Contracts, but we also recommend to improve your templates of other contracts or legal documentation, like:

- Confidentiality Agreement (NDAs)

- Employment Contracts and Consultancy / Contractor Agreements.

- Corporate Documents like Board and Shareholders Resolutions.

Training Sales and Procurement Teams

It is imperative to train your Sales and Procurement teams to use your own templates as much as possible. While it might feel easier to cave in and work off a counterparty’s contract, that typically leads to inconsistent terms, lengthier negotiations, and higher legal risks. Teaching your teams good negotiation skills and emphasizing the benefits of sticking to your standardized documents will:

- Preserve the efficiency gains from the 80/20 approach

- Reinforce consistent legal protections across deals

- Minimize back-and-forth revisions that slow down transactions

Admittedly, this isn’t always easy. But the payoff in faster deal cycles and fewer legal snags more than justifies the effort spent on training.

2. Deviations from the 80/20 Rule: When Standardization Needs Adjusting

Industry-Specific Variations

- Tech & SaaS Companies:

Subscription-based models often push standardization above 80%. Many SaaS agreements share the same billing cycles, uptime commitments, and data protection clauses. - Bespoke or Regulated Sectors:

Construction, healthcare, and government-related projects can require detailed specifications and stringent compliance checks. Consequently, more contracts need unique clauses, tipping the balance closer to 70/30 or 60/40.

Finding Your Ideal Ratio

Each business has its own risk tolerance, product complexity, and regulatory pressures. Some firms can standardize a higher percentage of deals, while others need more customization. Staying alert to market changes and evolving client needs will guide you on when to adjust your ratio.

3. Strategic Advantages of Contract Template Standardization

Cost Efficiency & Risk Mitigation

- Lower Legal Costs: Less time drafting unique clauses for every contract.

- Unified Risk Controls: A single vetted template helps avoid oversights like missing indemnity or outdated compliance provisions.

Example: A mid-sized tech firm standardized all routine SaaS contracts. They cut legal spending by 30% and reduced negotiation timelines, thanks to well-vetted core terms.

Strengthening Business Relationships

- Transparency & Trust: Straightforward T&Cs reassure clients there are no hidden pitfalls.

- Faster Onboarding: Routine deals finalize more swiftly, giving your team more time to foster the client relationship itself.

Example: An e-commerce retailer merged shipping, returns, and warranty policies into one Terms & Conditions document. Customers found it simpler to review, boosting repeat purchases.

Resource Optimization

- Reduced Bottlenecks: Standard approvals mean fewer contracts clogging Legal’s inbox.

- Empowered Teams: Sales and procurement can self-manage standard deals without waiting on constant legal oversight.

Example: A global logistics company unified its supply-chain terms. Roughly 80% of vendor contracts sailed through automatically, letting the legal team focus on high-stakes negotiations.

Competitive Edge for High-Value Negotiations